In March 2022, the Federal Reserve embarked on a vigorous rate-tightening cycle. Since then, markets have been jolted by various false hopes surrounding an anticipated policy pivot towards rate cuts. However, despite the Fed halting its rate-hike spree and maintaining its benchmark for a year, a rate cut has remained elusive.

Nevertheless, at the annual Jackson Hole Symposium, Fed Chair Jerome Powell virtually set the stage for a rate cut at the upcoming September meeting by indicating that “The time has come for policy to adjust.” This statement hints at a likely rate cut at the next Federal Open Market Committee (FOMC) meeting.

Stocks to Consider in a Falling Interest Rate Environment

The expected decline in U.S. rates, followed by global monetary policy easing, bodes well for several stocks. Growth names are expected to benefit from lower interest rates, making their future cash flows more valuable. Additionally, rate-sensitive sectors like real estate and automotive are likely to see increased demand for high-value goods such as homes and cars purchased on loans.

Moreover, as interest rates decrease from peaks, dividend stocks may regain appeal for investors seeking regular income amidst declining fixed-income yields.

Ford’s Attractive Dividend Yield

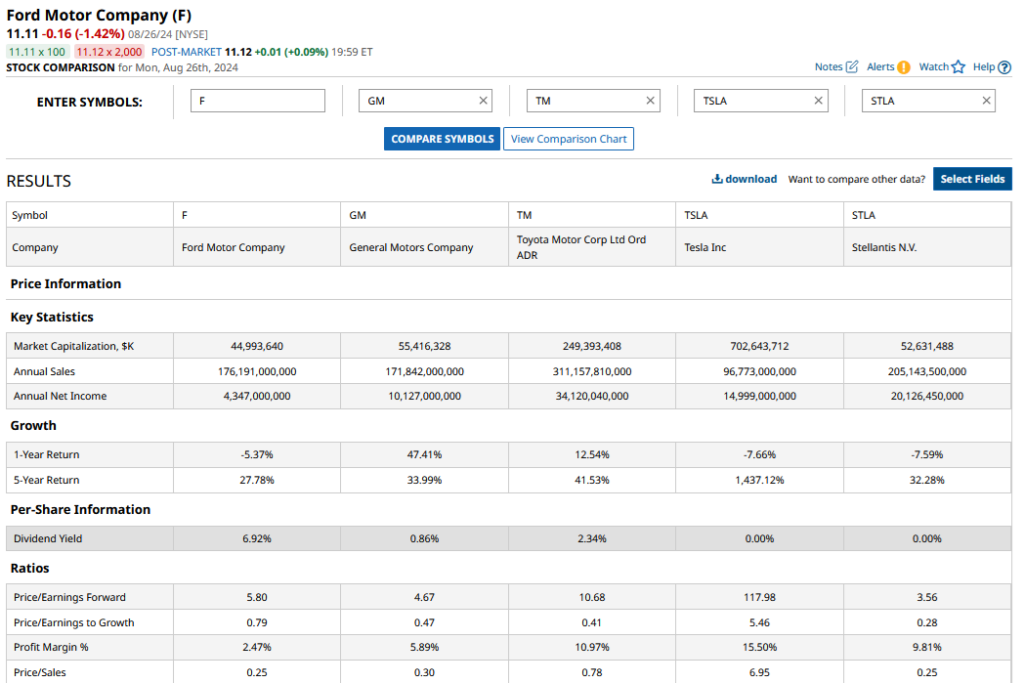

Detroit giant Ford (F) boasts a dividend yield of 5.4%, significantly higher than the average S&P 500 constituent. While both Ford and General Motors (GM) are generating healthy cash flows, Ford stands out with its robust capital allocation policies.

Ford plans to return a substantial portion of its free cash flows to shareholders, maintaining a strong dividend payout. In addition to regular dividends, the company has supplemented its distributions with special dividends, showcasing its commitment to shareholders.

On the other hand, General Motors has a lower dividend yield and has focused on aggressive share buybacks, significantly impacting its market capitalization.

Ford’s Strong Dividend Strategy

Ford has emerged as a dividend powerhouse since reinstating its dividend in late 2021. The company’s robust free cash flows and positive outlook for future cash generation support its dividend sustainability and the potential for future special dividends.

Despite Ford’s tepid valuations, the company’s dividend payments remain secure, hinting at possible shareholder rewards in the form of special dividends moving forward.

Assessing Ford’s Stock Performance and Value

Ford’s stock is currently trading at remarkably low valuation multiples, presenting an attractive investment opportunity. Despite concerns regarding its internal combustion engine (ICE) business and losses in the EV segment, Ford’s strategic adjustments reflect a commitment to future profitability.

With a redesigned product strategy focusing on hybrids and cost-efficient EV models, Ford aims to achieve pre-tax profitability on new models promptly. While facing legacy issues and operational challenges, Ford’s turnaround under CEO Jim Farley’s leadership shows promise for future growth.

Considering an Investment in Ford

In conclusion, despite Ford’s ongoing challenges, its undervalued stock presents a compelling opportunity. The company’s strategic alignment with current market demands, coupled with its attractive dividend yield, positions it as an appealing investment option amidst the anticipated monetary policy easing.