Canadian Pacific Kansas City’s CP operations are experiencing a surge propelled by impeccable operational efficiency and strategic cost-cutting strategies. Embracing shareholder-friendly actions are proving to be a boon for the company, albeit overshadowed by challenges like soaring fuel costs and liquidity concerns.

Strengths Driving CP Forward

Canadian Pacific has undoubtedly elevated operational prowess, evident in its remarkable performance during the second quarter of 2024. Witness the average terminal dwell time shrink by 9%, a testament to improved processing and handling. The network’s fluidity shines through a 6% boost in average train speed. Moreover, locomotive productivity escalated by 10%, and fuel efficiency witnessed a 2% uplift, showcasing CP’s profound dedication to operational excellence and sustainability.

The company’s proactive cost-saving maneuvers are bearing fruit. Labor costs, representing 26.2% of overall operating expenses, dropped by 7% year over year in the second quarter of 2024, amounting to $612 million.

CP’s commitment to rewarding its shareholders amidst uncertainties speaks volumes about its financial confidence. With dividend distributions surging from C$507 million in 2021 to C$707 million in 2022 and 2023, the company’s financial robustness and proactive shareholder approach are on full display. In the second quarter of 2024, CP disbursed a quarterly dividend of 19 cents per share to its stakeholders.

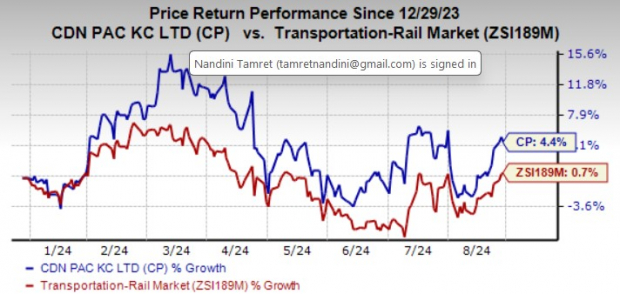

Notably, Canadian Pacific’s stock has soared by 4.4% year-to-date, outperforming the industry’s modest growth of 0.7% within the same period.

Image Source: Zacks Investment Research

Potential Pitfalls for CP

The surging fuel costs pose a significant worry, with a 17% year-over-year increase recorded in the second quarter of 2024.

By the conclusion of the June quarter, Canadian Pacific held $557 million in cash and cash equivalents, juxtaposed against a current debt load amounting to $3.67 billion. This glaring dissonance indicates that the company may fall short on cash to meet its immediate obligations.

CP’s current ratio, standing at 0.51 by the end of the second quarter of 2024, raises concerns about liquidity. A ratio below 1 implies probable struggles in meeting short-term financial obligations.

CP’s Zacks Rank Evaluation

Presently, Canadian Pacific bears a Zacks Rank #3 (Hold).

Other Stocks for Deliberation

Amidst the sea of options, some noteworthy stocks within the Zacks Transportation sector include C.H. Robinson Worldwide and Westinghouse Air Brake Technologies.

C.H. Robinson Worldwide proudly holds a Zacks Rank #1 (Strong Buy). The company boasts an anticipated earnings growth rate of 25.2% for the current fiscal year.

Having displayed a commendable earnings surprise streak, CHRW outperformed the Zacks Consensus Estimate in three of the last four quarters, with an average surprise of 7.3%. Over the past year, CHRW shares have soared by 9.9%.

On the flip side, Westinghouse Air Brake Technologies secures a Zacks Rank #2 (Buy) currently, accompanied by an expected earnings growth rate of 26% for the ongoing fiscal year.

WAB’s track record in surpassing earnings expectations is noteworthy, having outshined the Zacks Consensus Estimate in each of the preceding four quarters, garnering an impressive average beat of 11.8%. WAB shares have witnessed an impressive surge of 46.2% in the past year.