Times are changing in the automotive world. After experiencing a surge in sales for electric vehicles (EVs) for years, the market is now witnessing a slowdown. Just a year ago, new EV sales were growing at a rate of 51% annually. However, in the first quarter of 2024, that growth rate plummeted to zero, indicating stagnant EV sales in the United States.

Stepping in to fill the gap are plug-in hybrids. With a growth rate exceeding 50% year over year, these vehicles are driving most of the expansion in the automotive sector in 2024. In response to this trend, Ford (NYSE: F) has decided to forego an all-electric SUV in favor of developing a plug-in hybrid model.

What implications does this strategic shift hold for companies like Rivian Automotive (NASDAQ: RIVN), focused on all-electric pickup trucks and SUVs? Let’s delve deeper into the matter.

Evolution of Ford’s Product Strategy

A few years back, Ford made significant investments in battery technology and EVs. The company introduced models like the Mustang Mach-E and F-150 Lightning. In 2021, Ford announced an $11.4 billion investment in new American factories dedicated to producing electric vehicles and batteries. Now, Ford is reshaping its approach.

Instead of pursuing an entirely electric vehicle, Ford’s upcoming SUV lineup will feature plug-in hybrids. Despite this shift, Ford’s substantial investment in batteries remains relevant, albeit on a smaller scale. These plug-in hybrids, while not fully electric, still require significant lithium-ion batteries. The pivot is driven by consumer demand for the flexibility that plug-in hybrids offer. Contrary to the stagnation in full EV sales, plug-in hybrid sales surged by 59% in the first quarter of 2024.

Rivian’s Dilemma

On one hand, some investors argue that Rivian is aligning with the environmentally conscious direction of the market. Specializing in all-electric SUVs and trucks, Rivian appears to cater to the growing preference for eco-friendly vehicles, predicting the eventual decline of traditional gas-powered cars.

However, Rivian’s focus solely on all-electric models has its downside. The company has bypassed the plug-in hybrid segment, currently the primary driver of growth in the market. This trend reflects in Rivian’s production and delivery metrics, which have remained stagnant, hovering around 60,000 vehicles annually. While deliveries have seen a slight uptick, it is primarily due to inventory clearance from late 2023. The recent delivery rate has only just matched the production rate.

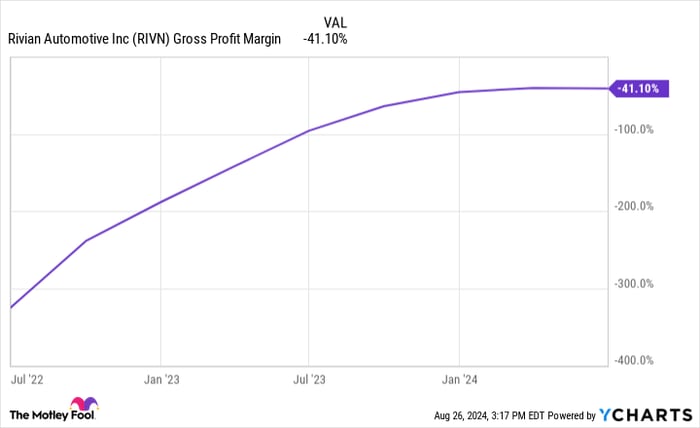

The cost burdens associated with larger battery sizes for SUVs and trucks pose a challenge for Rivian, leading to a startling negative 41% gross margin despite the pickup truck’s $75,000 base price.

Assessing Rivian Stock

The market’s shift towards plug-in hybrids spells trouble for Rivian. The company requires a customer base willing to invest in premium EVs and scale up production to turn its negative gross margins positive, akin to Tesla’s turnaround with the Model 3 ramp-up.

Introducing a new car model entails substantial costs, involving design, supply chain mobilization, and manufacturing plant investments. Rivian is currently burning through $5 billion annually with under $8 billion in cash reserves. Without additional financing, the company may struggle to venture into the plug-in hybrid segment.

Rivian must address its stagnant production and negative margins as the market favors plug-in hybrids. Investors are advised to exercise caution before investing in this risky and unprofitable stock in the prevailing scenario.

Is Investing in Rivian Automotive Advisable?

Prior to considering Rivian Automotive stock, it’s essential to ponder on the following:

Motley Fool Stock Advisor analysts have identified the top 10 stocks poised for significant growth, with Rivian Automotive missing out on the list. These selected stocks are anticipated to yield impressive returns in the foreseeable future.

Reflect on the impactful inclusion of Nvidia in a similar list dated April 15, 2005. A $1,000 investment based on the recommendation back then would have ballooned to $769,685!*

Stock Advisor offers investors a comprehensive roadmap to success, featuring portfolio building tips, analyst insights, and bi-monthly stock picks. The service has outperformed the S&P 500 index by more than fourfold since 2002*.

*Stock Advisor returns as of August 26, 2024