Nvidia’s Consistent Gross Margins Signal Potential Growth

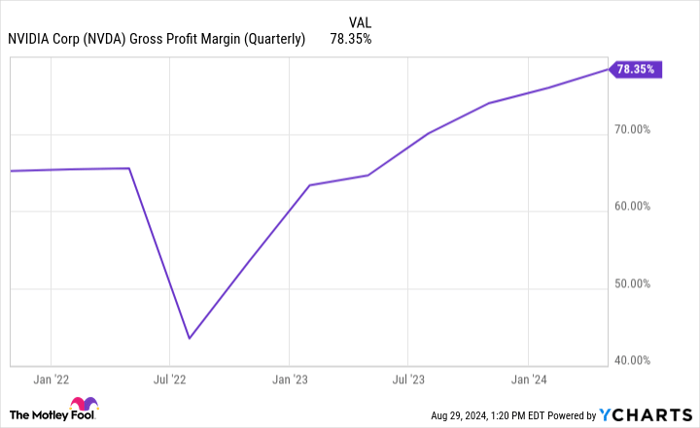

Despite the recent fluctuations in Nvidia’s stock price, driven by a blockbuster Q2 report, the company’s financial performance continues to impress. Posting a gross margin of 75.1% in Q2 and guiding for 74.4% in fiscal Q3, Nvidia’s prospects are looking up. With an expectation of mid-70s gross margin percentage for the full year, the AI giant’s pricing power remains strong.

Strong demand for advanced processors is bolstering Nvidia’s gross margins. Amidst declining prices for its GPUs in the data center segment, the company’s forthcoming release of the Blackwell chips signifies a leap in GPU technology. The impending rollout of the new processors hints at sustained growth potential for Nvidia.

Exploring the Investment Potential in Nvidia

Before diving into Nvidia stock, considering historical trends can provide valuable insights. While Nvidia wasn’t among the 10 best stocks identified by the Motley Fool Stock Advisor team, looking back at the company’s performance in 2005 reveals a striking narrative. A $1,000 investment in Nvidia back then would have burgeoned into $731,449 today. The Stock Advisor service has significantly outperformed the S&P 500 since 2002.

With Nvidia positioned at the forefront of AI technology, the company’s resilience in pricing power and forthcoming product launches strengthen the bullish case for potential investors. As the market dynamics evolve, Nvidia’s consistent performance and innovation propel it as a promising choice for those eyeing long-term growth opportunities.

Investigate the 10 recommended stocks to broaden your investment horizon and substantiate your financial goals. Historical data showcases the undeniable potential for substantial returns, underlining the appeal of investing in companies demonstrating consistent growth and innovation.

*Stock Advisor returns as of August 26, 2024