This year has not been kind to Intel (NASDAQ: INTC) investors. The chipmaker’s shares have tumbled by a staggering 60% in 2024, with the latest blow coming from its second-quarter results. Released on August 1st, these results triggered a brutal 26% single-day plunge following a notable bottom-line miss, bleak guidance, dividend suspension, and announced layoffs.

With a median 12-month price target of $25 per share from 45 analysts, suggesting a 25% upside potential, investors are left wondering – can Intel stage a comeback in the coming year?

Intel’s Stumbling Blocks in Key Markets

Comparing Intel’s Q2 results with rival Advanced Micro Devices (NASDAQ: AMD) reveals a stark reality – Intel is failing to tap into significant growth opportunities. While Intel’s client computing group (CCG) revenue in Q2 saw a modest 9% increase to $7.4 billion, AMD’s client segment revenue soared by 49% to $1.5 billion. This underperformance is particularly concerning given the PC market’s resurgence driven by the rise of AI-enabled computers.

AMD’s market share gains over Intel in desktop and notebook CPUs further highlight Intel’s plight. While Intel aims to ship 40 million AI PCs by year-end and recently introduced AI-focused CPUs, its revenue guidance for the current quarter indicates challenges ahead. Intel forecasts an 8.5% revenue decline to $13 billion, with CCG accounting for 58% of its revenue, pointing to troubled waters.

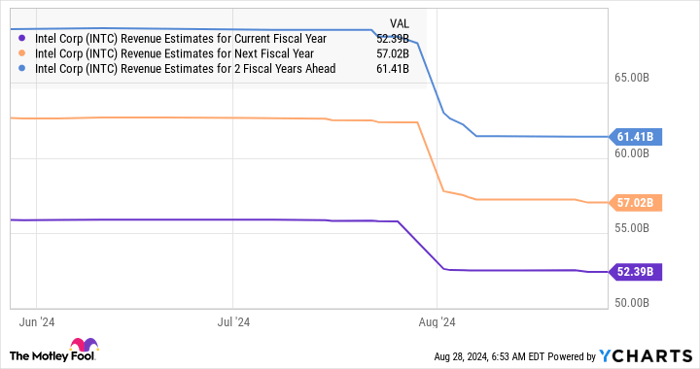

Valuation Woes and Bleak Outlook

Intel’s stock trades at a lofty 87 times trailing earnings and 79 times forward earnings, significantly above the tech sector average P/E ratio of 46. The company’s poor recent performance, with adjusted earnings plummeting, and an anticipated loss in Q3 moving further from profitability, cast shadows over its ability to justify these high multiples.

Given these challenges and expensive valuations, the likelihood of Intel reaching its 12-month price target seems dim. Rather, a slide towards the Street-low target of $17, a 15% drop, appears more plausible. As such, investors are advised to steer clear of Intel and explore more promising opportunities in the semiconductor landscape.

Final Verdict

With Intel facing headwinds in key markets, declining revenue, and inflated valuations, the road ahead looks rough. The once-powerful chipmaker seems to have lost its edge, making a recovery in the near term uncertain. As the tech industry evolves rapidly, Intel’s struggle to keep pace could see its stock continue its downward trajectory. Ultimately, caution is urged for those eyeing Intel as an investment, with better prospects available elsewhere in the semiconductor domain.

Intel’s Exclusion from Top Stock Picks Unveiled by Analysts

Contrary to the high-flying trajectory often associated with top stock picks, Intel found itself on the outside looking in on the recent list of the 10 best stocks highlighted by the Motley Fool Stock Advisor analyst team. While the excluded ten stocks are earmarked for potentially colossal returns, Intel did not clinch a spot.

The Omission:

Nvidia serves as a poignant case study. The tech giant had its moment in the sun when it was a part of a similar list back in April 15, 2005. If you had channeled $1,000 into Nvidia following the Fool’s recommendation, your investment would have ballooned to a staggering $731,449 – a jaw-dropping feat!*

Stock Advisor’s Winning Streak:

Stock Advisor doesn’t just toss around vague investment advice; it provides a coherent roadmap for success. Offering insights on portfolio construction, routine analyst updates, and two fresh stock picks monthly, the service has outshined the S&P 500 by a remarkable margin, boasting a return that has more than quadrupled since its inception in 2002.*

View the full list of 10 stocks

*Stock Advisor returns as of August 26, 2024