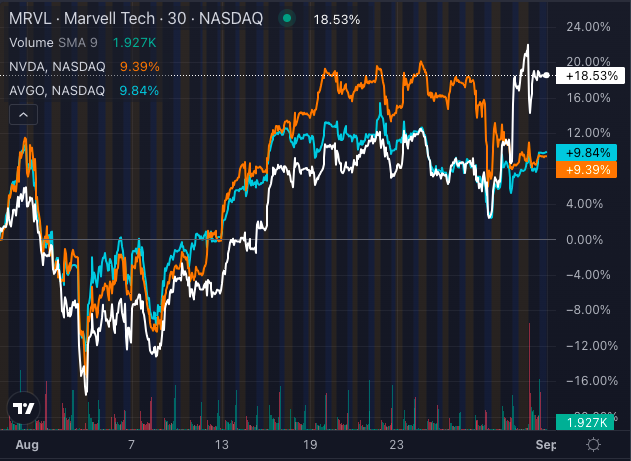

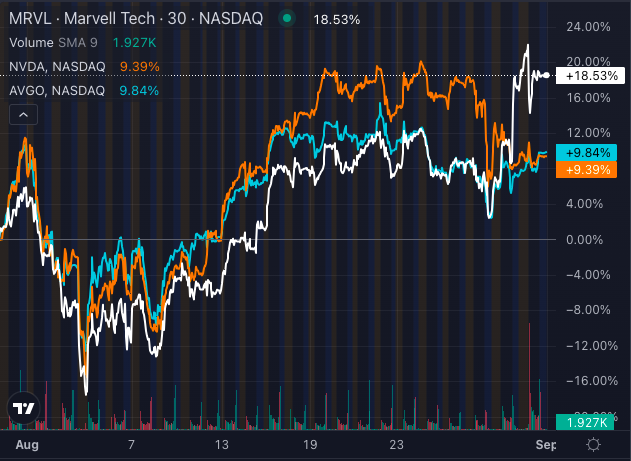

Marvell Technology Inc. MRVL has emerged as a standout performer in the semiconductor sector, outpacing heavyweight rivals Nvidia Corp. NVDA and Broadcom Inc. AVGO throughout Aug. 2024.

While Marvell stock surged an impressive 18.53% last month, Broadcom and Nvidia followed with gains of 9.84% and 9.39%, respectively. This outperformance has caught the attention of investors looking to capitalize on growth opportunities within the semiconductor industry.

Marvell’s Dominance

Marvell’s strategic focus as a fabless chip designer with a significant presence in wired networking has propelled its success. Ranking second in market share within this sector, Marvell caters to a wide range of industries, including data centers, automotive, and consumer electronics, with its array of processors, switches, and storage controllers.

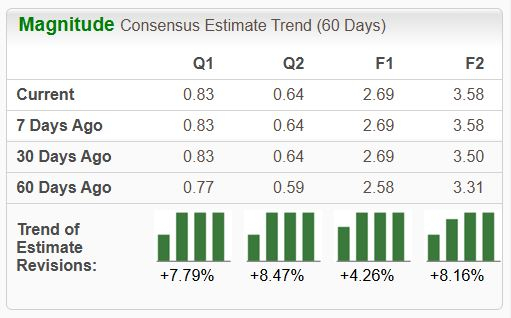

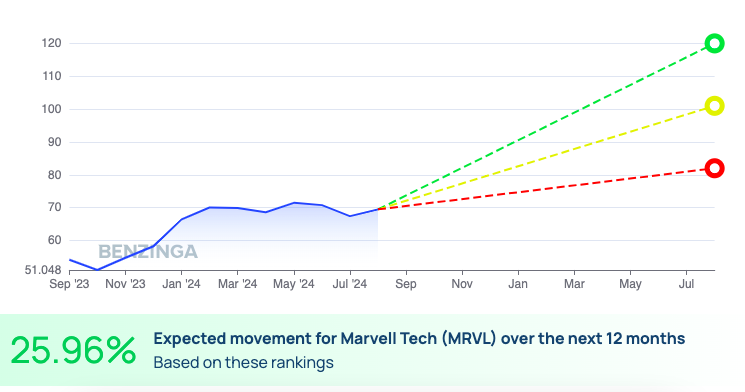

Analysts maintain a bullish outlook on Marvell, with a price target range of $82.00 to $120.00 and an average target of $101.00, indicating an expected upside of 25.96% in the next year.

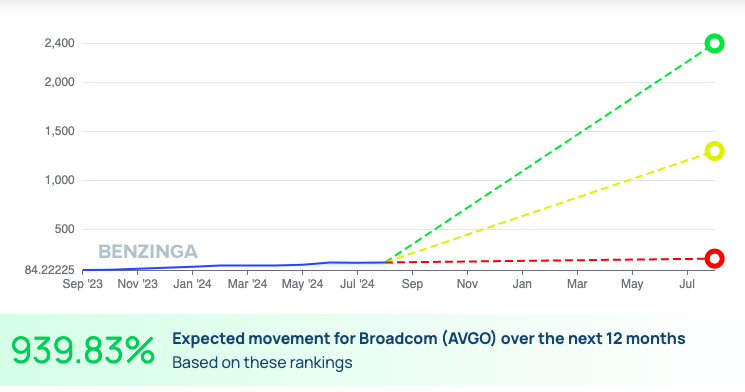

Broadcom’s Strategy

Despite Broadcom’s expansion into software and its broad product range, including wireless, networking, and storage solutions, its growth in Aug. lagged behind Marvell. The company’s 12-month price target range falls between $200.00 and $2,400.00, with an average target of $1,300.00, suggesting a potential upside of 939.83%.

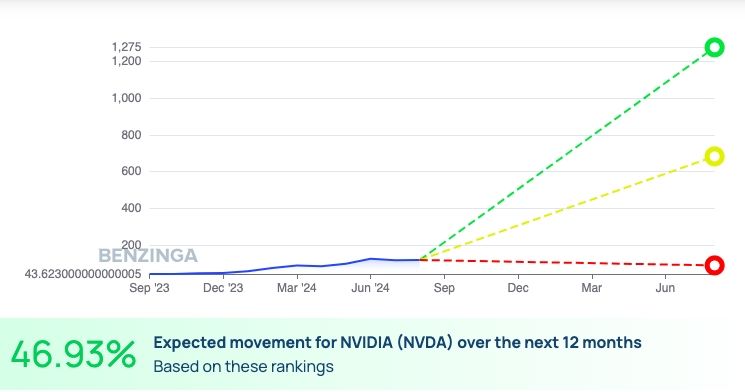

Nvidia’s Focus on AI

Nvidia’s stronghold in the GPU market and its foray into AI and data center networking have positioned it as a key player. While Nvidia performed well in Aug., its gains trailed those of Marvell. Analysts predict a 46.93% upside over the next year, with a 12-month price target range of $90.00 to $1,275.00.

For semiconductor investors, Marvell’s recent outperformance signals the allure of stocks with focused market strategies and high growth potential. While Broadcom and Nvidia maintain their competitive positions, Marvell’s agility and market dominance make it an appealing choice for those eyeing short-term gains in the semiconductor industry.