Amid a heated climate of conservative pressure, Ford Motor has undertaken a bold move to reshape its Diversity, Equity, and Inclusion (DEI) initiatives. Led by the fervor of figures like Robby Starbuck, these initiatives have been restructured to address workplace disparities. In an unexpected twist, this announcement saw a surge in Ford’s stock, with a commendable 5% gain experienced during the extended trading session.

The heart of Ford’s transformation lies in opening up its employee resource groups to all staff members, irrespective of their background. Furthermore, Ford will be stepping away from the Human Rights Campaign’s Corporate Equality Index, a significant ranking system that evaluates LGBTQ+ workplace equality.

The Backlash Against DEI Rollbacks Amid Conservative Influences

Amidst a remarkable wave of conservative pressure and legal confrontations, Ford’s strategic pivot echoes a larger trend in the corporate landscape. Notable entities such as Lowe’s, Home Depot, Harley-Davidson, Tractor Supply, and John Deere have all recently realigned their DEI strategies in response to similar pressures.

Noteworthy activists, including Robby Starbuck, are utilizing social platforms as battlegrounds to drive changes in corporate DEI policies. Their reverberating campaigns tap into themes surrounding affirmative action, race, gender, and familial principles.

The burgeoning pressure on corporates to reconsider their DEI commitments carries implications that could reverberate across their reputation, brand perception, and allure for premium talent.

Opportunity Knocks: Is Ford’s Stock a Compelling Investment?

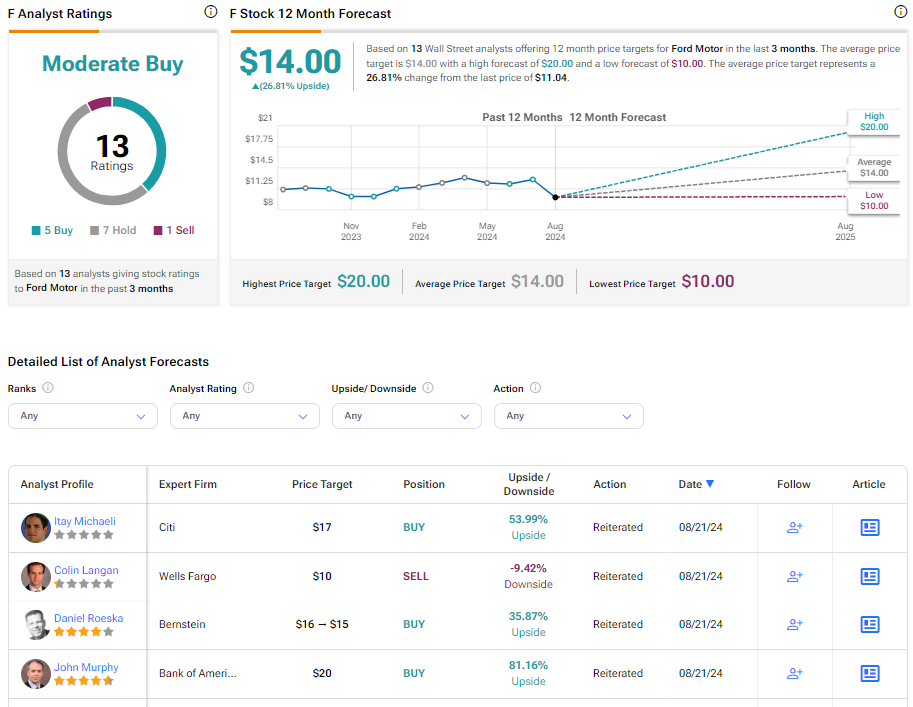

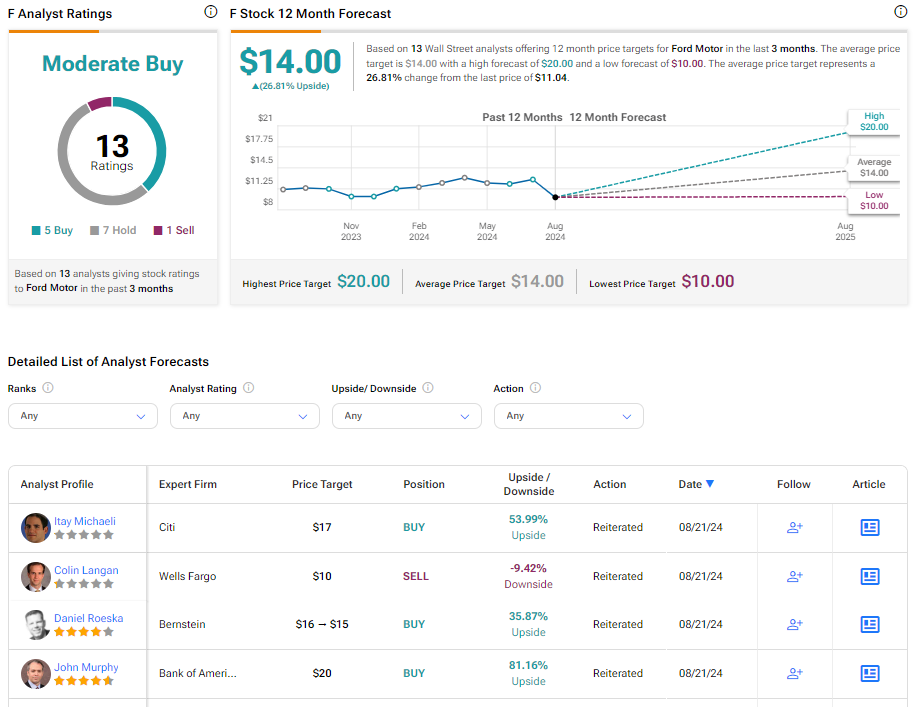

Within the realm of TipRanks, Ford’s stock boasts a Moderate Buy consensus, supported by a spectrum of five Buy ratings, seven Hold recommendations, and a singular Sell rating. The average price target of $14 projected by analysts heralds a potential upside of 26.81%, signaling optimism amidst a backdrop where Ford shares have witnessed an 8.8% dip over the past six months.

For further insights on F analyst ratings, click here.