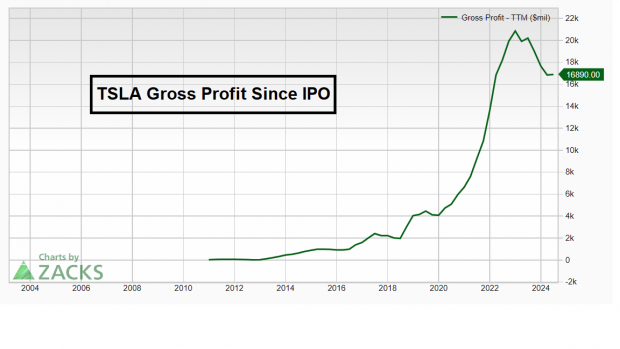

Since its IPO roadshow over a decade ago, Tesla has been a rollercoaster ride of controversy, drama, and volatility on Wall Street. Jim Cramer, the financial TV icon, had expressed doubts about the then-unprofitable electric vehicle (EV) company. Yet, defying all odds, Tesla has surged over 17,000% gained since its inception, becoming the market cap leader among auto behemoths like Toyota, Ferrari, General Motors, and Ford.

Despite this, Tesla’s stock has seen a significant retreat from its all-time high, leading many to ponder its future. Are the best days of Tesla behind it, or does the recent correction signal an opportunity?

To assess Tesla’s trajectory, we must scrutinize the key catalysts and data driving its potential:

The Case for Tesla’s Valuation

A prevailing bear argument against Tesla is its valuation. Critics question why Tesla, with a relatively lower revenue, commands the highest market cap? Two factors support this premium:

1. TSLA’s Exceptional Growth and Profitability: Investors are willing to pay a premium for a company showing rapid growth. Tesla’s ability to expand swiftly and gain market share has been remarkable, rivalling long-established competitors.

2. Tesla’s Diversified Business Model: Many overlook Tesla’s ventures beyond cars, including solar, clean energy, EV charging, and its Full-Self-Driving (FSD) technology. Such tech-inclusive prospects often command higher valuations, an arena where Tesla excels.

Robotaxi and FSD: The Deciding Factors

Critics of Tesla point to Elon Musk’s bold claims as mere hype, yet history proves otherwise. Musk’s innovations, like the Model S and Model 3, have driven substantial shareholder value. While his timelines may vary, the upcoming Robotaxi event at Warner Brothers signifies another milestone.

How transformative is Tesla’s Full-Self Driving (FSD) Robotaxi? Musk’s $5 trillion valuation target by 2030 hinges on this technology. Robotaxis could revolutionize transportation, turning Tesla cars into autonomous ridesharing platforms, competing with Uber and Waymo. Studies also affirm Tesla’s FSD technology’s superiority in safety over conventional vehicles.

Interest Rates Impact on Tesla

Elon Musk’s criticism of the Federal Reserve’s interest rate policy finds merit as lower rates encourage consumer spending. Cheaper financing for high-ticket items like EVs could benefit Tesla, amplifying sales and market presence.

Into Production: The Cybertruck Saga

The Electrifying Rise of Tesla: A Road to Recovery and Success

The Electrifying Rise of Tesla

The Cybertruck Phenomenon

In a scene likened to a sci-fi movie, Tesla’s Cybertruck has started making its way to customers in North America, with sightings becoming a common occurrence. As production efficiency improves, the Cybertruck is poised to dominate streets across the continent. Plans for a Cybertruck tour in Asia indicate Tesla’s intention to expand its market reach.

Tesla’s Sales Surge in China

China, known as the epicenter of the electric vehicle market, has been a battleground for Tesla, facing fierce competition and economic challenges. Despite hurdles, Tesla’s recent sales figures in August signal a potential turnaround. Exceeding 60,000 units sold, August marked a 37% increase over July and stands as Tesla’s strongest month in 2024.

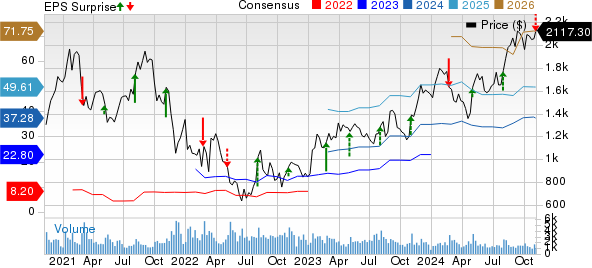

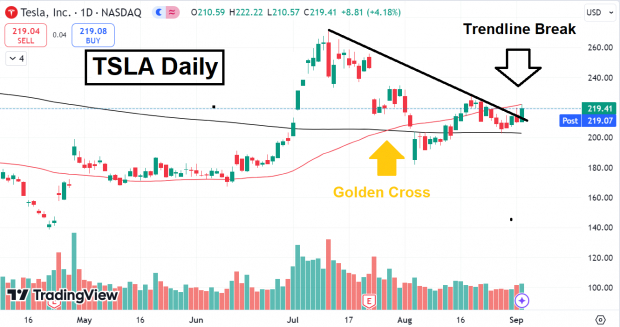

Analyzing Tesla’s Technical Signals

Tesla’s stock (TSLA) has recently displayed strong bullish signals. Breaking through a downtrend line dating back to July and with the 50-day moving average crossing above the 200-day moving average, triggering a “Golden Cross,” heralding positive momentum for the company.

Image Source: TradingView

The Road Ahead for Tesla

Since its IPO, Tesla, under the visionary leadership of Elon Musk, has continuously defied expectations. Emerging from recent challenges, signs point to Tesla’s potential as a top performer well into 2025.