Big tech giants like Microsoft, Meta, and Alphabet are sprinting ahead in the artificial intelligence (AI) race with monumental launches of large language models (LLMs) including ChatGPT, Gemini, and Llama. Despite this, the burgeoning AI market remains a fertile ground for smaller entities to sow the seeds of potential and harness the momentum of secular tailwinds.

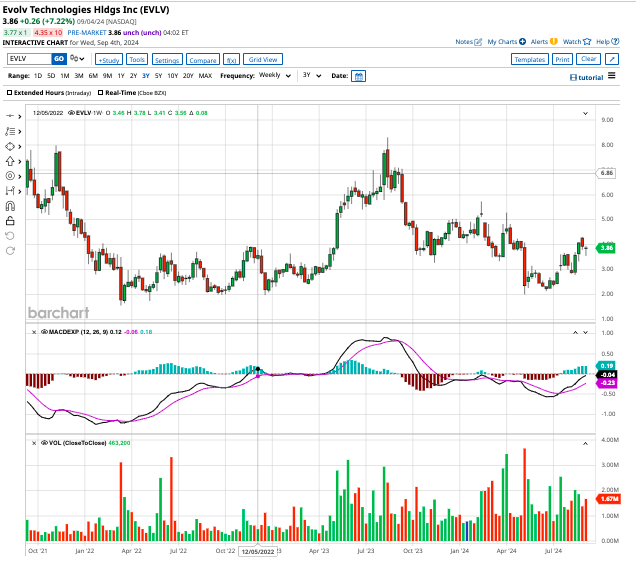

Diving into the realm of AI penny stocks, Evolv Technologies emerges as a noteworthy contender. With a market cap standing at $602.49 million, this small-cap penny stock, which hit the public market four years ago, currently resides at a trading price 71% below its peak.

The Rise of Evolv Technologies: An Overview

Evolv Technologies specializes in AI-based touchless security screening systems, offering a suite of products including Evolv Express designed to detect weapons, Evolv Insights for visitor insights, and Evolv Edge for non-metallic explosive detection. With a mission to supplant traditional security tools such as metal detectors, Evolv boasts an impressive operational capacity of screening up to 4,000 individuals per hour using cutting-edge technology.

Having catered to 750 clients across various sectors like education, healthcare, and sports, Evolv’s reach extends with over 4,000 units deployed, successfully detecting more than 1,000 weapons on a daily basis.

An Evaluation of Evolv Technologies’ Q2 Performance in 2024

The recent dip in Evolv’s stock price owes largely to a deceleration in revenue growth. While the company witnessed robust financial gains in the previous years, sales figures took a hit in the last 12 months, signaling a 17.7% increase year-over-year, with a reported revenue of $89.2 million.

In Q2 of 2024, Evolv bounced back with a revenue surge to $25.5 million, marking a 29% hike compared to the previous year. This uptick was fueled by an influx of new clients, swelling the total customer count to over 800 across 10 key sectors. Notably, the company concluded Q2 with an annual recurring revenue (ARR) of $89 million, showing a remarkable 64% spike in comparison to the preceding year.

Charting the Course: Target Price Analysis for EVLV Stock

Although Evolv Technologies shines bright with its innovative product lineup and an expanding clientele, the shadow of competition looms large, with rivals like Athena Security posing a challenge to pricing and profit margins.

With analysts casting a bullish outlook, four out of five recommend a “strong buy” for EVLV stock, while the remaining advocate a “hold.” The average target price stands at $5.35, signaling a promising 43% upside potential from the stock’s current valuation.