Today’s installment of Full Court Finance at Zacks delves into the recent September selloff in the stock market and provides insight into the potential trajectory of the market in the upcoming period. In addition, the episode focuses on three Zacks Rank #1 (Strong Buy) technology stocks—Taiwan Semiconductor, Spotify, and AppLovin—that may present opportune investment options for investors seeking long-term gains.

Taiwan Semiconductor: Pioneering the Technological Landscape

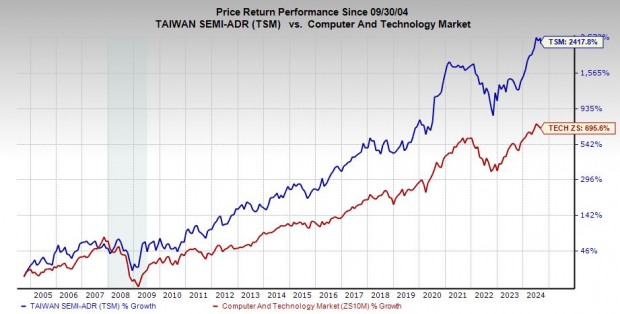

Taiwan Semiconductor Manufacturing Company (TSM) constructs the most intricate and cutting-edge components that underpin global economy and technological advancements. With a reported 61% market share in semiconductor foundry in Q4 2023, TSM is leagues ahead of its closest competitor.

Image Source: Zacks Investment Research

Taiwan Semi’s diverse client base, including tech behemoths like Nvidia and Apple, positions TSM as a significant player in various high-growth sectors. With a Zacks Rank #1, TSM is forecasted to expand its earnings by 25% in 2024 and 28% in 2025, bolstered by 24% revenue growth in both years.

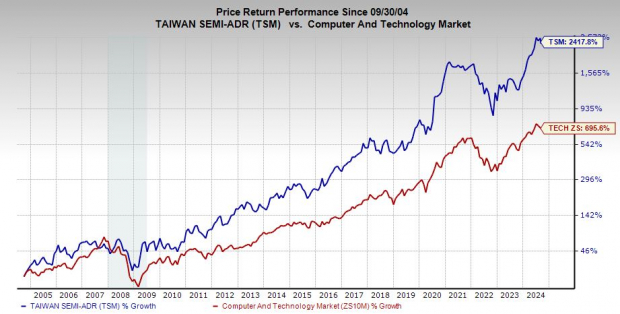

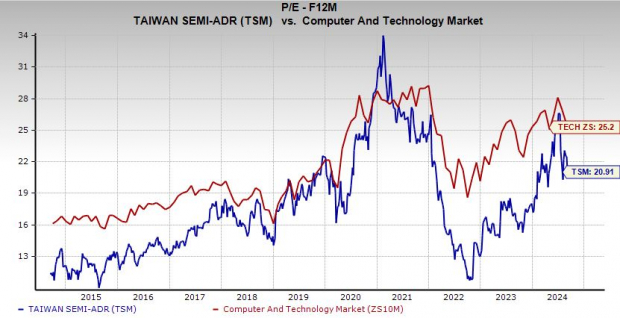

Image Source: Zacks Investment Research

Despite a 60% YTD surge, TSM stock remains undervalued, trading below its highs. Currently, Taiwan Semi trades at a substantial discount compared to historical multiples and sector averages.

Spotify Technology: Innovating the Music Industry

Spotify Technology S.A. (SPOT) revolutionized the music industry with its paid streaming services. Holding a commanding 32% share of the global streaming music market in 2023, Spotify outperformed its competitors by a significant margin.

Image Source: Zacks Investment Research

Efficiency enhancements and strategic pricing adjustments have propelled Spotify to a profitable stance, prompting a surge in EPS estimates. Expected to deliver significant growth in earnings and revenue in the coming years, Spotify is on a trajectory towards becoming a strong investment option.

Image Source: Zacks Investment Research

With a remarkable surge in stock value, Spotify is poised for continued growth, offering investors an opportunity to capitalize on its potential at a reasonable valuation.

AppLovin: The Hidden Gem of Tech Stocks

AppLovin Corporation (APP) plays a pivotal role in assisting companies and application developers in driving innovation and success.