Weighing the Sentiment of Big Players

Large investors, often likened to whales due to their considerable capital, have revealed a starkly pessimistic view regarding Intuit.

When observing the options history of Intuit (INTU) closely, it’s evident that 11 trades were executed.

Diving into the minutiae of each trade, it emerges that only 18% of these transactions were initiated with optimistic expectations, while 27% exhibited a bearish outlook.

Among the trades identified, there were 2 puts amounting to $55,200 and 9 calls totaling $258,250.

Foreseen Stock Price Fluctuations

Scrutinizing the Volume and Open Interest trends in these trades suggests that major stakeholders have been eyeing a price range of $590.0 to $640.0 for Intuit over the last quarter.

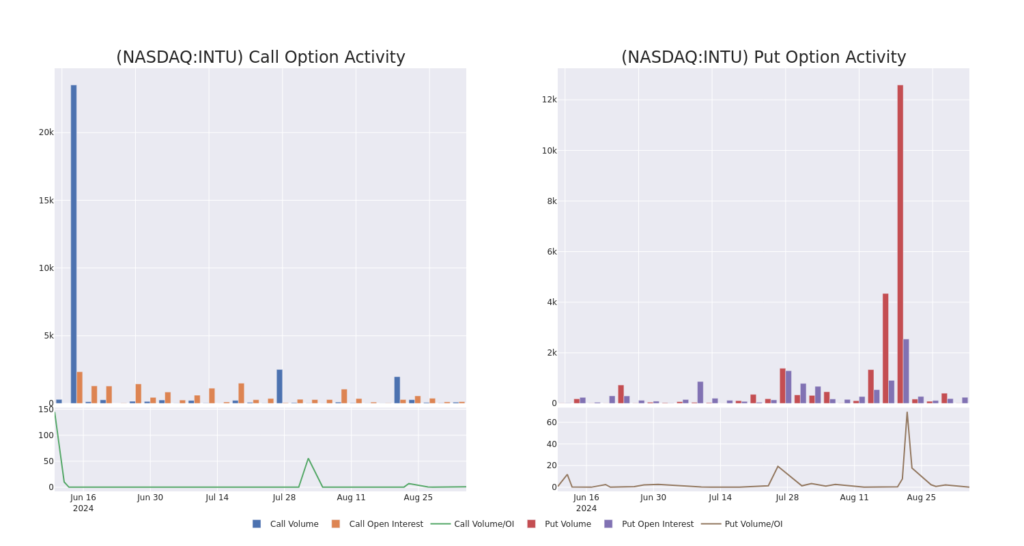

Trend in Volume & Open Interest

Examining the volume and open interest is a pivotal step in the realm of options trading. These metrics provide valuable insights into the liquidity and investor enthusiasm for Intuit’s options at designated strike prices. The upcoming data delineates the ebb and flow in volume and open interest for both calls and puts linked to notable trades involving Intuit, spanning a strike price corridor from $590.0 to $640.0 over the preceding month.

Insight into Recent Options Trading for Intuit

Significant Options Activity Overview:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $68.4 | $65.4 | $66.7 | $640.00 | $33.3K | 852 | 28 |

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $69.7 | $63.2 | $66.2 | $640.00 | $33.1K | 852 | 5 |

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $68.3 | $63.6 | $65.6 | $640.00 | $32.8K | 852 | 43 |

| INTU | PUT | TRADE | NEUTRAL | 12/20/24 | $30.6 | $29.4 | $30.0 | $600.00 | $30.0K | 204 | 11 |

| INTU | CALL | TRADE | NEUTRAL | 06/20/25 | $68.9 | $65.3 | $66.9 | $640.00 | $26.7K | 852 | 23 |

Insight into Intuit’s Background

Intuit is a company synonymous with small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). In the domain since the mid-1980s, Intuit commands a lion’s share of the US market for small-business accounting and do-it-yourself tax-filing software.

Gazing into Intuit’s options trading patterns prompts a shift in focus towards the company itself, allowing for a deep dive into its existing market positioning and performance.

Current Market Position of Intuit

- Trading at a volume of 980,452 shares, INTU’s price has dipped by -0.99%, now resting at $615.33.

- Indications from RSI readings suggest the stock currently straddles a neutral zone between overbought and oversold territories.

- The eagerly awaited earnings disclosure is anticipated in 81 days.

Insights from Financial Analysts on Intuit

During the previous month, 5 industry experts have imparted their perspectives on this equity, envisioning an average target price of $734.4.

- An analyst from Barclays has chosen to uphold their Overweight rating on Intuit with a price target of $740.

- An analyst from JP Morgan has elected to retain their Neutral rating on Intuit, setting a price target at $600.

- An analyst from Susquehanna is unwavering in their Positive rating on Intuit, with a price target of $757.

- Consistent in their stance, an analyst from Stifel persists with a Buy rating for Intuit, targeting a price of $795.

- Unwavering in their evaluations, an analyst from B of A Securities maintains a Buy rating on Intuit, aiming for a target price of $780.

Options trading offers the allure of higher returns intertwined with elevated risks. Discerning traders mitigate these risks through ongoing education, adaptive strategies, vigilant monitoring of multiple indicators, and astute observation of market dynamics. Stay abreast of the latest Intuit options trades through real-time alerts from Benzinga Pro.