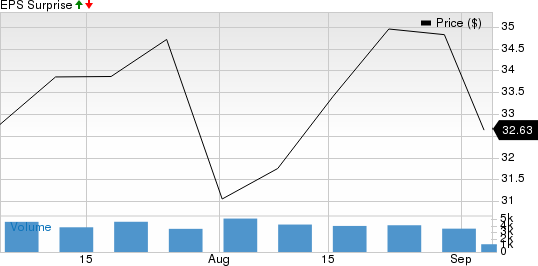

Rubrik RBRK is gearing up to unveil its second-quarter fiscal 2025 results on Sept. 9.

The company anticipates revenues between $195 million and $197 million for the quarter.

Analysts forecast second-quarter revenues to hit approximately $195.58 million.

The consensus estimate for earnings in this quarter is a loss of 49 cents per share, a figure that has remained steady over the past month.

Factors Impacting Rubrik’s Performance

Rubrik’s upcoming earnings announcement is poised to reflect the company’s expanding customer base and the heightened demand for its data security offerings.

Fresh off a robust fiscal first quarter, where subscription revenues skyrocketed by 59% year over year to $172.2 million, Rubrik is expected to maintain its growth trajectory due to a solid partner network and the growing adoption of its solutions.

The company’s expanding clientele, inclusive of industry giants like Crowdstrike CRWD, Kyndryl, and Alphabet’s cloud division, Google Cloud, likely bolstered growth in the recent quarter.

In the first quarter of fiscal 2025, Rubrik inked a key partnership with CrowdStrike to ramp up data security by integrating Rubrik Security Cloud with CrowdStrike’s Falcon XDR platform, improving threat detection and data protection capabilities. The benefits of this collaboration should manifest in the upcoming quarter’s outcomes.

Rubrik also unveiled a strategic global alliance with Kyndryl to co-launch Kyndryl Incident Recovery with Rubrik, a comprehensive managed solution for data protection, cyber incident recovery, and disaster recovery across cloud and on-premises workloads. This collaboration is set to enhance Rubrik’s market presence and attract new clients in the forthcoming quarter.

In August, the company announced a partnership with Mandiant, a Google Cloud entity, integrating threat intelligence and incident response to fortify cyber recovery and resilience. Leveraging Google Cloud’s expertise is expected to drive further growth for Rubrik and cement its standing as a premier data security solutions provider.

Despite its successes, Rubrik faces fierce competition from data management and protection rivals like Cohesity, Commvault, Veeam, IBM, and Dell EMC, which may have put pressure on revenue growth for the period under review.

Currently, Rubrik holds a Zacks Rank #3 (Hold).