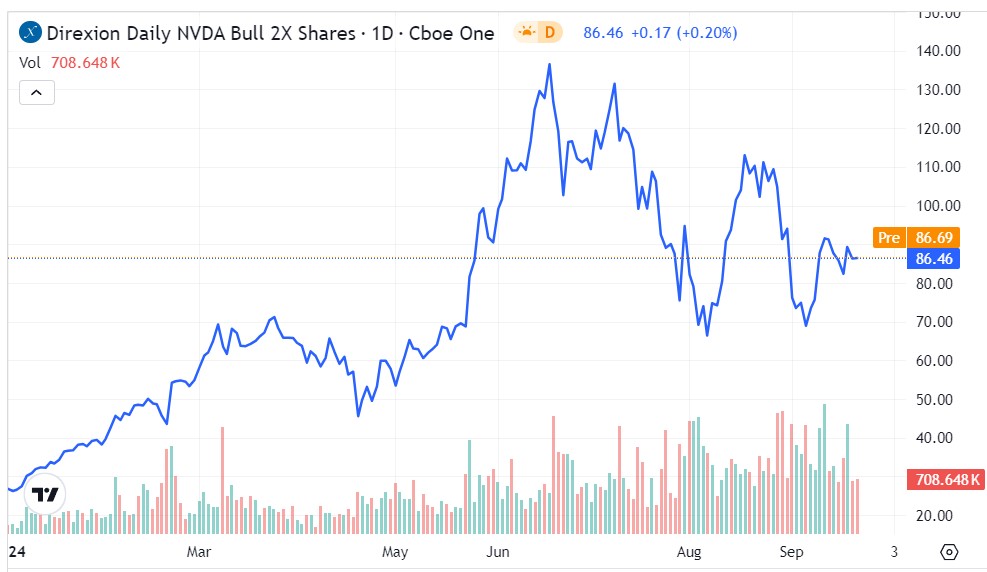

Shares of Nvidia (NASDAQ: NVDA) were on the move due to several key factors, notably a surprising drop in inflation rates, a successful presentation at a Goldman Sachs conference, and potential chip export opportunities to Saudi Arabia by the US government. As a result, the stock witnessed an 8% surge by market close.

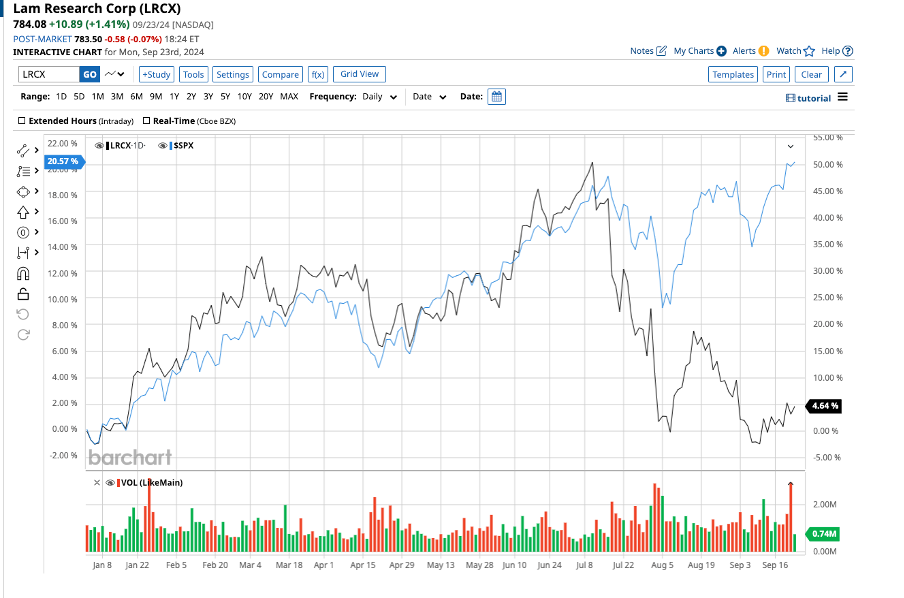

Chip stocks across the board also experienced a boost following the inflation report, with the iShares Semiconductor ETF up 4.6% and the Nasdaq Composite rising by 2.2%.

Image source: Nvidia.

The Impact of Falling Interest Rates

Investors initially wavered on the CPI report indicating a mere 2.5% year-over-year inflation increase in August, but as the day progressed, the Nasdaq surged forward, with Nvidia leading the charge.

The Federal Reserve is poised to lower interest rates in the upcoming week, raising uncertainty over a 25 or 50 basis point cut. Ideally, a scenario where rates decrease while the economy flourishes can greatly benefit Nvidia. Lower rates enhance the value of growth stocks, fostering investment in technologies like artificial intelligence (AI) infrastructure, thereby driving demand for Nvidia’s components.

During his presentation at the Goldman Sachs’ Communacopia conference, Nvidia CEO Jensen Huang championed the company’s technology prowess, especially in generative AI. He emphasized Nvidia’s strengths, including software libraries for applications like autonomous driving and climate tech. Huang remarked, “Demand is so great that delivery of our components, our technology, infrastructure, and software is really emotional for people because it directly affects their revenue. It directly affects their competitiveness.”

Additionally, reports from Semafor suggest that the US government is contemplating permitting Nvidia to export advanced chips to Saudi Arabia for training advanced AI models. While Saudi Arabia may not be a major market, relaxing export regulations could open doors for Nvidia in other regions.

Future Projections for Nvidia

Current tailwinds appear to favor Nvidia as declining interest rates support investments and bolster its valuation. The imminent release of the Blackwell platform in Q4, combined with endorsements from major clients like Microsoft, Meta Platforms, and Alphabet, who prioritize AI infrastructure investments, signal a positive trajectory for Nvidia.

Despite the recent uptick, Nvidia’s stock remains 17% below its peak in June, indicating further potential for growth. Even after a significant surge over the past two years, the stock continues to hold promise for investors aiming for substantial returns.

Investing in Nvidia: A Wise Decision?

Before considering Nvidia for investment, contemplate this:

The Motley Fool Stock Advisor analysts highlighted the 10 best stocks to purchase presently, with Nvidia not making the cut. The selected 10 stocks are anticipated to yield impressive returns in the upcoming years.

Reflect on when Nvidia first made this list on April 15, 2005 – an investment of $1,000 at that time would have grown to a staggering $662,392 today!*

The Stock Advisor provides investors with a clear roadmap to success, offering portfolio building guidance, analyst updates, and two new stock picks every month. Since 2002, the Stock Advisor service has yielded returns that surpass the S&P 500’s by more than fourfold*.

Explore the 10 recommended stocks »

*Stock Advisor returns as of September 9, 2024