When stocks in the materials sector appear oversold, it’s like discovering a hidden gem in a sea of stones – a rare opportunity to seize value in undervalued companies.

One way to gauge this oversold condition is through the Relative Strength Index (RSI), a momentum indicator that compares a stock’s strength on up days versus down days. A stock is deemed oversold when its RSI falls below 30, providing traders with insight into possible short-term performance.

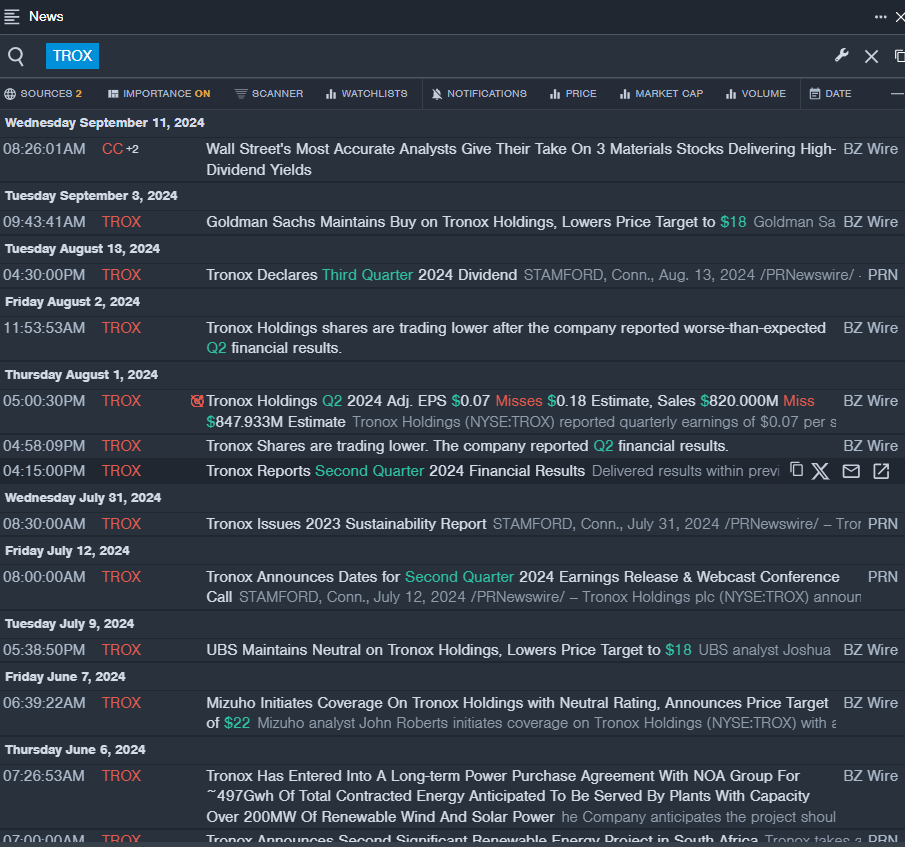

Tronox Holdings PLC: Reviving from the DepthsTROX

- Tronox Holdings suffered a blow with worse-than-expected Q2 financial results, causing its stock to plummet approximately 7% over five days, hitting a 52-week low of $10.08.

- RSI Value: 27.54

- TROX Price Action: The stock price dipped by 0.3% to close at $11.71 on Thursday.

Clearwater Paper Corp: Weathering the StormCLW

- Clearwater Paper faced hurdles with quarterly losses of $1.55 per share. Despite this, they remain optimistic, especially after completing the acquisition of the Augusta facility. The stock, however, dropped by around 11% over the last month to a 52-week low of $27.69.

- RSI Value: 28.09

- CLW Price Action: Showing resilience, Clearwater Paper saw a 2.8% rise, closing at $28.81 on Thursday.

Ascent Industries Co: Climbing the Uphill BattleACNT

- Ascent Industries grappled with quarterly losses of 2 cents per share but showed remarkable sales of $50.189 million. Despite facing headwinds, the company’s concerted efforts in cost reduction and strategic optimization are paying off. The stock slid by about 8% in the last five days, reaching a 52-week low of $7.27.

- RSI Value: 29.92

- ACNT Price Action: Ascent Industries dipped by 3.1% to close at $9.25 on Thursday.