PDD Facing Macro Headwinds

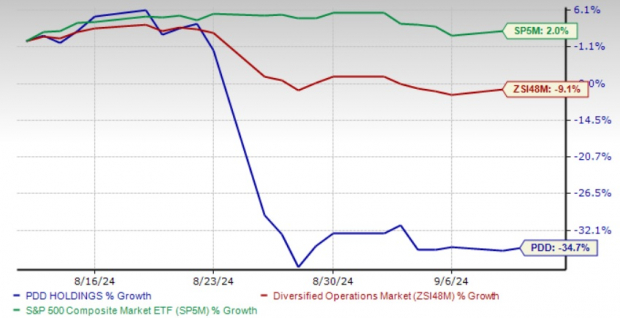

PDD Holdings, ticker symbol PDD, has encountered turbulent times with its stock plummeting by 34.7% in the past month, primarily due to escalating macroeconomic uncertainties. The global environment, evolving consumption trends, fears of recession, market fluctuations, and the intricate economic landscape in China have collectively cast a shadow over PDD’s stock performance.

This decline starkly contrasts with the industry’s downturn of 9.1% and the S&P 500 index’s rise of 2% during the same period.

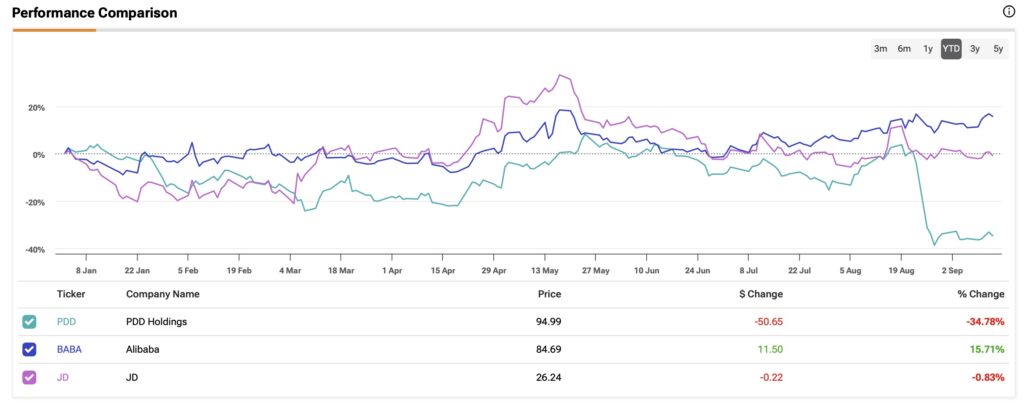

Furthermore, intense competition within the domestic and international e-commerce sectors, particularly from giants like Amazon, JD.com, and Alibaba, has added additional pressure on PDD Holdings.

Understanding PDD’s Long-Term Prospects

Despite the prevailing macro concerns, PDD’s robust e-commerce model centered around the Pinduoduo platform remains a standout feature. The company’s foothold in the agricultural sector is another asset, leveraging the Pinduoduo platform to foster digital inclusion among smallholder farmers.

The amalgamation of risks and rewards prompts investors to ponder their strategic stance – whether to buy, hold, or sell PDD shares.

Diving into PDD’s Growth Drivers

PDD continues to exhibit solid momentum, particularly in its Pinduoduo platform, offering a wide array of products ranging from agricultural goods to household items. In the second quarter of 2024, the company witnessed a remarkable 86% year-over-year revenue surge, reaching RMB 97.06 billion.

Efforts to enhance fulfillment solutions across various markets, streamline supply chain operations, and bolster the Temu platform indicate positive growth prospects for PDD.

Assessing PDD’s Valuation and Market Positioning

PDD Holdings currently trades at an appealing discount, boasting a forward 12-month Price/Earnings ratio of 7.12X compared to the industry average of 14.66X and a median of 18.37X. This favorable valuation coupled with an A-rated Value Score and Growth Score signifies an attractive investment opportunity.

Analyzing Macro Challenges and Future Outlook

New challenges such as evolving consumer demands and diversified preferences are emerging as hurdles for PDD. To combat these shifts, the company is intensifying investments and collaborating with renowned brands to tailor customized offerings, potentially impacting profitability.

In addition, geopolitical tensions between the United States and China pose a looming threat, further complicating the landscape for companies like PDD.

Despite these obstacles, the company’s strong fundamentals and growth trajectory remain intact. Hence, holding onto PDD stock amidst the ongoing market fluctuations and uncertainties is advisable.

Analysis of Explosive Growth Potential in the Market

As the financial markets continue to ebb and flow, one company stands out among the pack for its potential explosive growth in the months ahead. From a selection of five contenders, Director of Research Sheraz Mian singles out a promising candidate with remarkable upside.

Diving into the Details

This company has its sights set on capturing the millennial and Gen Z audiences, raking in a whopping $1 billion in revenue in the last quarter alone. Despite a recent retreat in its stock price, the current moment presents a golden opportunity to seize a position in this budding prospect.

Although not all top picks hit the mark, this particular selection has the potential to far exceed the gains of earlier Zacks’ “Stocks Set to Double” like Nano-X Imaging, which surged by an impressive +129.6% in just over 9 months.

Setting the Stage

Looking back at market history, instances of such meteoric rises are indeed rare but not unprecedented. Companies like Amazon, Apple, and Google have all witnessed explosive growth periods that have reshaped the financial landscape.

Market Dynamics

The recent market pullback and macroeconomic concerns have created an environment ripe for potential outperformance by forward-looking firms that align with shifting consumer trends.

Opportunities in the Making

This juncture offers investors a chance to capitalize on the next big wave in e-commerce and technology sectors, where innovative disruptors can navigate changing market tides and emerge as industry leaders.

To unlock the full potential of this exciting opportunity, it’s essential for investors to keep a keen eye on emerging trends and respond swiftly to market forces, always staying one step ahead of the curve.

With proper analysis and a long-term bullish outlook, investors can position themselves to ride the wave of growth that these visionary companies are poised to deliver.