New Opportunities Unfold

Today marks the inception of trading for Alibaba Group Holding Ltd’s January 2027 options. With 851 days until expiration, these new contracts offer an intriguing prospect for both put and call sellers. The allure lies in the time value, potentially enabling sellers to fetch a superior premium compared to nearer-expiry contracts.

Optimistic Scenario for Put Sellers

At a $80.00 strike price, the put contract currently commands a bid of $12.10. By selling-to-open this contract, an investor commits to buy the stock at $80.00, effectively lowering their cost basis to $67.90 (pre-broker commissions). This strategy presents a compelling alternative for investors eyeing BABA shares, providing a buffer that could mitigate risks at today’s $83.58/share price.

Visualizing Risk and Reward

The $80.00 strike offers a 4% discount from the prevailing stock price, labeling it out-of-the-money by that margin. While there’s a 67% chance the put will expire worthless, a potential 15.12% return on the cash committed awaits investors, offering a 6.49% annualized return – aptly dubbed by Stock Options Channel as the “YieldBoost.”

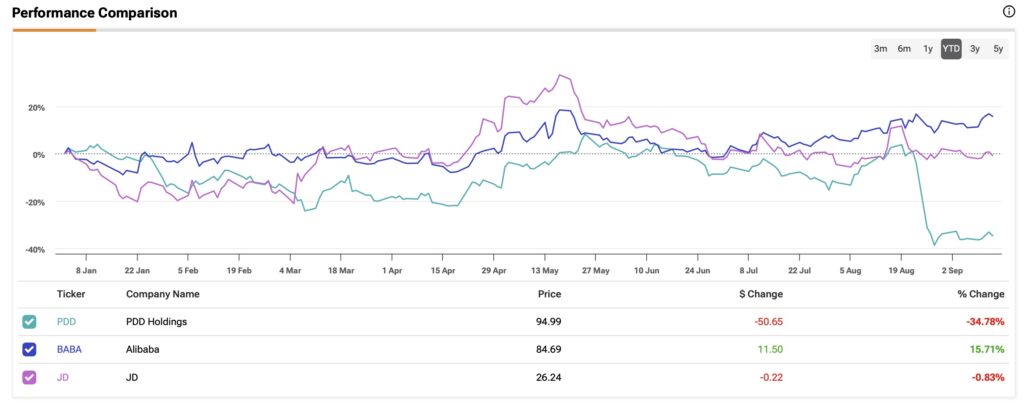

Below, a chart illustrates Alibaba Group Holding Ltd’s twelve-month trading history, pinpointing the $80.00 strike amidst past performance.

Call Opportunities on the Horizon

On the call side, the $90.00 strike contract boasts a $15.75 bid. A “covered call” strategy entails buying BABA shares at $83.58/share and selling-to-open the call, committing to sell at $90.00. This move could yield a 26.53% total return if the stock gets called away at the January 2027 expiration, excluding dividends.

Considering an approximate 8% premium to the current stock price, the $90.00 strike remains out-of-the-money by that margin. Though there’s a 40% chance the call may expire worthless, investors stand to gain an 18.84% extra return, or 8.08% annually – labeled the “YieldBoost” by Stock Options Channel.

Peek into the implied volatilities: put contract at 35% and call contract at 39%. The actual trailing twelve-month volatility calculates at 33%. For further options contract insights, StockOptionsChannel.com beckons your visit.