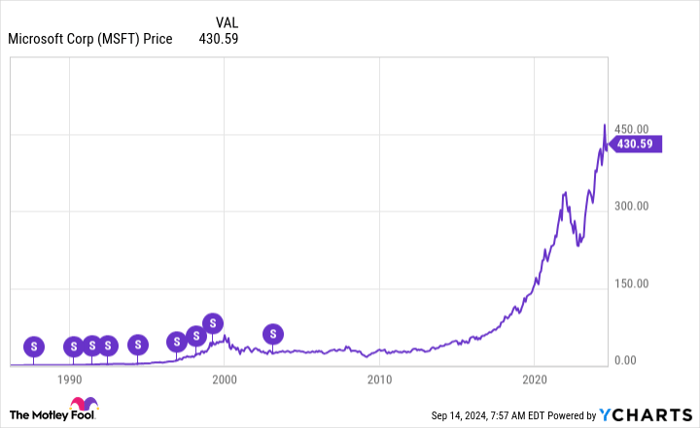

Stock splits serve as a fundamental aspect of the stock market landscape, although they bear no impact on a company’s intrinsic value. Picture a company’s market capitalization akin to a freshly baked pie or a delectable pizza – splitting merely creates more slices without altering the total sum. Yet, these splits play an essential role, especially for the non-billionaire crowd. Case in point: Microsoft (NASDAQ: MSFT), having undergone nine splits to date, with the most recent in 2003. A single share today would demand a hefty $123,800 sans the historical splits – a price far beyond the reach of many investors. Peering below, one will notice the soaring stock price yet again.

Stock splits also signify a company’s robust growth, indicative of a substantial surge in share price. Unlike Microsoft, ServiceNow (NYSE: NOW) is yet to experience a split; however, with shares priced at $879, a split may loom on the horizon.

The Microsoft Marvel

The feverish AI race shifted into high gear with the advent of the generative AI chatbot, ChatGPT, propelling AI to the forefront of societal and investor consciousness. Microsoft’s multibillion-dollar investment in its brainchild, OpenAI, ignited a race among tech firms to catch up. ChatGPT seamlessly integrates with Microsoft Bing, potentially enabling Bing to gnaw at market share held by Alphabet‘s formidable Google Search, boasting a staggering $95 billion revenue in the first half of 2024. Even minor inroads by Bing could translate into billions in revenue.

Another AI gem in Microsoft’s arsenal is Copilot, which seamlessly integrates into various products, offering answers, text generation, image creation, coding, and data analysis. Remarkably, an estimated 60% of the Fortune 500 cohort leverages Copilot, a phenomenal statistic given the technology’s relative novelty. These groundbreaking innovations steered sales growth to a commendable 16% in fiscal 2024, clocking in at $245 billion. Operating income soared by 24% to hit $109 billion, spelling a remarkable 45% margin.

Trading at 36 times earnings, Microsoft’s stock commands a premium compared to its three and five-year averages of 33. However, the forward price-to-earnings (P/E) ratio stands at a more palatable 33. Given the lofty valuation, investors shouldn’t anticipate an overnight stock price surge. Nevertheless, the Wall Street fraternity can rationalize the present valuation based on Microsoft’s flourishing AI prospects.

ServiceNow’s Spectacle

ServiceNow and Microsoft have forged longstanding partnerships across diverse technology ventures. Their latest collaboration intertwines ServiceNow’s AI jewel, Now Assist, with Microsoft Copilot. To spare you the intricate technical minutiae, Now Assist catalyzes productivity leaps in domains like human resources, IT support, and customer service, among others. For instance, Now Assist streamlines customer service agents’ tasks by summarizing recent interactions with clients, thereby eliminating the need to delve through extensive transcripts, enabling rapid database searches for prompt solutions, and much more. Such surges in efficiency are priceless in a fiercely competitive business environment.

Around 85% of the Fortune 500 top brass harness ServiceNow’s offerings. The graph below portrays the exponential growth in ServiceNow’s clienteles. Each year a customer adopts ServiceNow is portrayed by a distinct hue, underscoring the escalating revenue from these clients over time.

ServiceNow

ServiceNow presently steers a higher growth trajectory than Microsoft ($2.6 billion in sales, a 22% uptick last quarter), with revenues better reflecting its valuation than the bottom-line earnings. The prevailing price-to-sales ratio stands at 18, in sync with its five-year average. Looking ahead, the company anticipates 2024 subscription sales reaching $10.5 billion, scaling up to $15 billion by 2026. This projection hints that the stock price might potentially surge almost 50% by 2026 while maintaining the current valuation.

With Microsoft and ServiceNow spearheading monumental strides in AI and witnessing stock price escalations, stock splits might very well be on the cards.

Should You Consider Investing in Microsoft?

Prior to delving into Microsoft stocks, ponder this:

The Motley Fool Stock Advisor analyst troupe recently pinpointed the top 10 stocks primed for investment… and Microsoft didn’t clinch a spot on their list. The selected 10 stocks are envisioned to potentially deliver substantial returns in the upcoming years.

Reflect back to April 15, 2005, when Nvidia secured a spot on this list… a $1,000 investment then would have swelled to $729,857!*

Stock Advisor furnishes investors with a user-friendly roadmap for prosperity, encompassing guidance on portfolio construction, regular analyst updates, and two fresh stock picks each month. The Stock Advisor service has quadrupled the S&P 500 return since 2002*.

Explore the 10 recommended stocks »

*Stock Advisor returns as of September 16, 2024