The Federal Reserve’s recent aggressive interest rate adjustment signals a potential boon for investors in artificial intelligence (AI) technology giants like NVIDIA Corporation, Microsoft Corporation, and Micron Technology, Inc. As the Fed slashes rates, borrowing costs for these tech players decrease, amplifying profit margins and sustaining cash flows required for growth endeavors.

Amidst the relentless wave of the AI revolution, NVIDIA, Microsoft, and Micron stand positioned for substantial market upticks. NVIDIA’s unmatched supremacy in the GPU space, Microsoft’s Azure growth momentum, and Micron’s optimism surrounding HBM chips narrate an enticing growth story against the backdrop of AI’s promising trajectory.

The AI industry’s anticipated expansion to over $184 billion in 2024, set to culminate at $826 billion in 2030, bodes well for investors navigating the tech space (source: Statista). Let’s delve into the underlying forces propelling the rise of NVIDIA, Microsoft, and Micron’s stocks.

The Dominance of NVIDIA in the GPU Sphere

As data flow increasingly gravitates towards graphic processing units (GPU) from central processing units, NVIDIA’s commendable stake in the GPU market positions it for substantial gains. The GPU market is foreseen to balloon to $1,414.39 billion by 2034, growing at a commendable CAGR of 13.8%, unleashing a trove of opportunities for NVIDIA.

Microsoft’s Azure Ascension

Microsoft’s Azure and cloud services segment is gaining traction, with revenues surging 29% year over year in the latest fiscal quarter. The Azure cloud infrastructure arm is expanding at a pace surpassing Amazon Web Services (AWS), signaling a potential shift in the cloud computing landscape. Microsoft’s Azure is on a trajectory to potentially outstrip AWS, underpinning a robust growth narrative.

Micron’s Bright Prospects with HBM Chips

Micron’s ascendancy in the high-bandwidth memory chips (HBM) domain paints a promising outlook, with burgeoning demand driving full production capacity utilization. Forecasts predict a surge in HBM market revenues to $86 billion by 2030 from a modest $1.8 billion last year, underscoring Micron’s growth projections and contribution to the AI ecosystem.

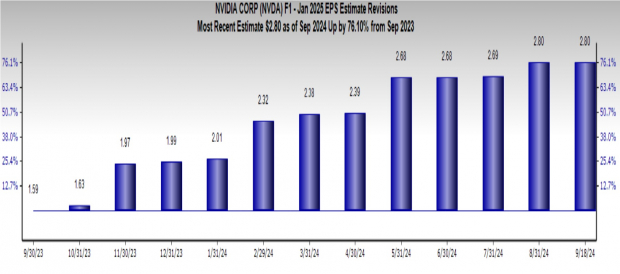

Exuberant Price Targets for NVDA, MSFT, MU

Industry analysts have pegged substantial upside potential for NVIDIA, Microsoft, and Micron, evident in their soaring price targets. Notably, NVDA’s average short-term price target has been lifted by 28.8%, with an alluring upside projection of 73%. MSFT follows suit with a 14.8% appreciation in average short-term price target and a 37.9% upside prospect, while MU’s target reflects a remarkable 74.4% hike and a staggering 153.6% growth potential.

In the past year, NVIDIA’s shares have skyrocketed by 168.4%, with Microsoft and Micron experiencing notable ascents of 34.3% and 25.4%, respectively. The convergence of lower interest rates and the AI landscape herald profound opportunities for shrewd investors anchoring their portfolios on the transformative tech wave.

The Resilience of Stocks in the Ever-changing Market

Seven Top Stock Picks for the Upcoming Month

Recently unveiled are the seven cream-of-the-crop stocks meticulously plucked from the pool of 220 Zacks Rank #1 Strong Buys. These select tickers have been deemed as possessing the greatest potential for swift price surges.

Going back to 1988, this compilation has consistently outperformed the market, boasting an impressive average annual gain surpassing double that of the market at +23.7%. It’s evident these chosen seven are deserving of your immediate and undivided attention.

Should one wish to access the latest recommendations put forth by Zacks Investment Research, there is an enticing offer to download a report on ‘5 Stocks Set to Double’. Being a partaker in such a profitable venture might bring fruitful results.

Amongst the names gaining traction in the market analysis sphere, Advanced Micro Devices, Inc. (AMD), Microsoft Corporation (MSFT), Micron Technology, Inc. (MU), and NVIDIA Corporation (NVDA) have been identified as part of a group of three artificial intelligence stocks poised for growth attributed to the plummeting interest rates. The artificial intelligence domain could potentially be likened to a lush, ever-blooming garden of financial opportunities. For those interested, an added incentive could be to read a detailed industry report available on Zacks.com.