Amazon (AMZN) recently grabbed investors’ attention as one of the most searched stocks on Zacks.com. Exploring the critical factors that can impact its performance in the near future is imperative for savvy investors.

Over the past month, this online retail giant’s shares surged by +7.8%, surpassing the Zacks S&P 500 composite’s +2.1% change. Within the Zacks Internet – Commerce industry, where Amazon operates, a notable gain of 6.3% was observed during this period. The burning question remains – what trajectory will the stock take in the foreseeable future?

While media hype or market rumors tend to momentarily spice up a company’s stock value, the bedrock of long-term investment decisions revolves around fundamental market realities.

Assessing Earnings Projections

Zacks chiefly prioritizes analyzing shifts in Amazon’s earnings estimate rather than other aspects. The rationale is simple – a stock’s fair value is contingent on the estimated stream of future earnings.

By keeping a close eye on how sell-side analysts are updating their earnings projections to mirror the prevailing business trends, we can gauge a stock’s prospective value. When earnings estimates surge for a company, its stock’s fair value increases. This upsurge in value beyond the current market price arouses investor interest, consequently pushing the stock price up. Studies reveal a robust correlation between earnings estimate alterations and immediate stock price movements.

Amazon is anticipated to report earnings of $1.14 per share for the current quarter, reflecting a +34.1% change from the prior-year quarter. The consensus estimate has shifted -0.1% over the last 30 days.

The consensus earnings estimate of $4.74 for the current fiscal year signals a year-over-year uptick of +63.5%, with a slight +0.5% shift over the last month.

Further ahead, the consensus estimate of $5.84 for the next fiscal year forecasts a +23.2% change from the previous year, with a recent +0.3% adjustment.

Founded on a robust externally audited track record, the Zacks Rank, our signature stock rating tool, offers a conclusive snapshot of Amazon’s future price direction. Amazon currently boasts a Zacks Rank #3 (Hold) due to sizeable changes in consensus estimates alongside three other critical factors tied to earnings projections.

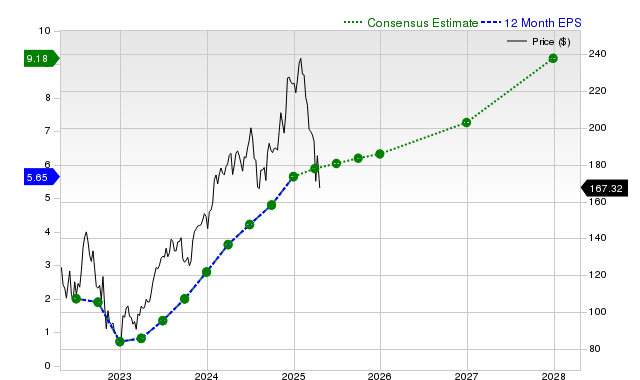

Analysis of the company’s forward 12-month consensus EPS estimate is depicted below:

12 Month EPS Forecast

Predicting Revenue Growth

While earnings growth signifies a company’s financial well-being, it is the revenue surge that acts as a linchpin. Sustainable earnings growth hinges on continuous revenue escalation. Therefore, an extensive understanding of a company’s revenue growth potential holds paramount significance.

Amazon’s current quarter’s consensus sales estimate of $157.05 billion indicates a +9.8% year-over-year rise. Projections for the current and next fiscal years stand at $634.49 billion and $702.77 billion, signaling +10.4% and +10.8% changes, respectively.

Recent Performance and Earnings Surprises

In the last reported quarter, Amazon registered revenues of $147.98 billion, suggesting a +10.1% year-over-year uptick. The EPS for the same period stood at $1.23, compared to $0.63 a year earlier.

Relative to the Zacks Consensus Estimate of $148.63 billion, the reported revenues exhibited a slight -0.44% miss. However, the EPS surprise was a robust +17.14%.

Amazon surpassed consensus EPS forecasts in all four trailing quarters and exceeded revenue estimates three times during the same span.

Valuation Analysis

Delving into a company’s valuation is imperative for making informed investment choices. Assessing whether the stock’s current price accurately mirrors the intrinsic value of its business and growth outlook is key to predicting its future price performance.

Comparing a company’s current valuation metrics like price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) against its historical values unveils whether the stock is fairly priced, overvalued, or undervalued. A peer-to-peer evaluation based on these metrics provides insights into the stock’s reasonableness in terms of pricing.

Amazon scores a grade B on the Zacks Value Style Score, which insinuates that it is trading at a discount compared to its peers. Detailed insights into the valuation metrics driving this grade can be found here.

Final Assessment

Scrutinizing the intricacies discussed here, alongside additional data on Zacks.com, can offer clarity on whether Amazon’s market buzz warrants attention. Nonetheless, its Zacks Rank #3 hints that it may align with the broader market’s performance in the foreseeable future.