Upon toiling over Wall Street analysts’ recommendations, investors face a frenzy when deciding to Buy, Sell, or Hold. The sway of media reports that trumpet rating shifts by brokerage-affiliated analysts often stirs ripples in a stock’s price. But do these endorsements wield real power?

Lets embark on a journey into Advanced Micro Devices (AMD) as sanctified by the demi-gods of Wall Street. But before we unpack that enigma, let’s dissect the essence of brokerage recommendations and decipher strategies on how to leverage them to one’s benefit.

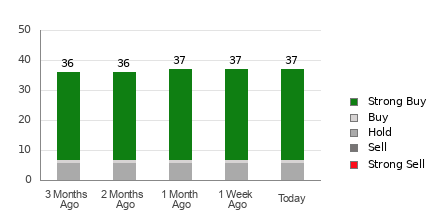

Currently adorned with an average brokerage recommendation (ABR) of 1.35, Advanced Micro stands center stage. This numerical badge, perched on a scale of 1 to 5 that ranges from Strong Buy to Strong Sell, is a cumulation of opinions from 37 brokerage houses. A 1.35 ABR hovers ambiguously between Strong Buy and Buy.

The recommended composite, crafted from the 37 counselings steering this current ABR, unveils 30 Strong Buy accolades alongside a solitary Buy whisper. This Strong Buy and Buy cocktail adorns 81.1% and 2.7% of all recommendations, flickering like stars in a Wall Street galaxy.

Deciphering the Evolution of Brokerage Recommendations for AMD

In a tantalizing twist, the ABR beckons us to embrace Advanced Micro. Yet, laying all chips solely on this statistic could be a risky gamble. Studies unveil the feeble influence of brokerage recommendations in handpicking stocks with the zenith potential for price ascension.

Baffled? Dive into the crucible caused by brokerage firms’ vested interest in a stock they analyze. This dalliance often skews their analysts towards gushing optimism while rating. As our research unravels, for every “Strong Sell” caution, these firms lavish the market with five times the “Strong Buy” exhortations.

It’s akin to a puppet show – their interests rarely shadow that of retail investors, offering as much foresight into a stock’s price trajectory as gazing into a crystal ball. Probably, this intel could be your Sherpa, escorting you as you navigate the cliffs of your personal stock research or tow you towards an indicator that mirrors a better track record in predicting stock price movements.

Behold the Zacks Rank, our proprietary oracle for stock evaluation boasting an audited track record. Division of stocks into five factions – coursing from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) – unveils a cipher to decipher a stock’s impeding price prance. Thus, corroborating the ABR with the Zacks Rank could be the magic wand you seek for enlightened investment choices.

Distinguishing ABR from Zacks Rank: Peeling Away the Layers

Beneath a facade of uniformity in their numerical apparel, ABR and Zacks Rank wield distinctive armors.

Where ABR flirts with brokerage recommendations in sculpting its identity, Zacks Rank dons a garb fashioned from earnings estimate revisions, a measurable metric that leaps from just 1 to 5.

An engrossing saga unfurls – while brokerage analysts sway towards unbridled optimism in their recommendations, Zacks Rank anchors its roots in the earth of earnings estimate revisions. This allegiance often broadcasts a melodic resonance between the trails of estimate revisions and the pirouettes in stock prices.

Adding to the flair, the Zacks Rank unfurls its canopy unbiasedly over all stocks beckoned by brokerage analysts. Thus, this prism maintains a chromatic equilibrium among the five ranks it bestows.

For the zest of freshness, the ABR might lack. Yet, it’s the breath of life injected by brokerage analysts who spruce up their earnings estimates, trailblazing the shifting winds in company fortunes. Hence, the Zacks Rank, akin to a mythical messenger, remains ever-timely in heralding future price dances.

Unveiling the Shroud: Is AMD a Diamond in the Rough?

Sifting through the sands of earnings estimate revisions for Advanced Micro, the Zacks Consensus Estimate for the ongoing year remains riveted at $3.36 in the past moon’s cycle.

The placid waters in analysts’ foresight concerning the company’s earning escapade – showcased by an unflinching consensus estimate – could steer the stock in parallel with the broader marketplace in the near horizon.

This puzzle, entwined with the recent meanderings in the consensus estimate, alongside other factors tethered to earning speculations, has ordained a Zacks Rank #3 (Hold) for Advanced Micro. Dip into the pool of today’s darlings at Zacks Rank #1 (Strong Buy) here >>>>

Thus, maybe, just maybe, a tinge of caution might be the cloak you wear with the Buy-equivalent ABR for Advanced Micro.

Down the Rabbit Hole: The Quest for the “Single Best Pick to Double”

Peer through the lens of wisdom as 5 Zacks wizards cast their lots, earmarking their chosen pegasus to blaze a trail and soar by +100% or more in the moons ahead. Among these five maestros, Director of Research Sheraz Mian plucks the ripest fruit from the tree.

This company serenades millennial and Gen Z cohorts, orchestrating a symphony that amassed close to $1 billion in the rearview quarter. A recent lull in fortunes sets the stage for a serendipitous entry. While not all stars shine, this gem might outshine past Zacks’ luminaries like Nano-X Imaging, basking in a +129.6% spectacle in a mere celestial wink of 9 months.

Free: Unveil Our Gem and 4 Noble Steeds

Unveil the Mysteries of Advanced Micro Devices, Inc. (AMD): A Stock Odyssey