Alibaba Group (NYSE: BABA) has weathered tumultuous times, seeing its stock plummet by fifty percent in the last five years. The company grappled with prolonged COVID restrictions, a sluggish Chinese economy post-lockdowns, and fierce competition in the e-commerce realm.

New Era of Open-source AI Models

Alibaba’s cloud computing arm faced challenges amidst escalating competition in the last half-decade, but strategic shifts have bolstered its standing. Shedding low-margin contracts, Alibaba pivoted towards more lucrative public cloud deployments, magnifying segment profits. Notably, in Q2, cloud revenue climbed by 6% to $3.7 billion, accompanied by a staggering 155% surge in adjusted EBITA to $322 million.

Recently, Alibaba debuted over 100 novel open-source AI models, varying in precision across language, audio, vision, coding, and mathematics. These models, rooted in the latest LLM iteration “Qwen 2.5,” boast enhanced AI capabilities. To amplify its AI prowess, Alibaba also unveiled advanced text-to-video and vision language models to stimulate video creation and comprehension.

Moreover, Alibaba ramped up investments in AI infrastructure services including data center architecture, data management, and model training to cater to a global clientele.

Alibaba’s Potential Amidst Tech Giants

Despite trailing behind U.S. counterparts in cutting-edge hardware, Alibaba’s AI ambitions may encounter global headwinds, especially from Western firms wary of leveraging Chinese technology solutions. However, within China and Asia at large, Alibaba finds ample room for expansion, having already secured clientele like Ford Motor Company for cloud services.

Alibaba’s AI advancements intertwined with an uptick in core e-commerce operations, exemplified by double-digit order escalations on Taobao and Tmall, alongside substantial GMV growth, position the company for heightened revenue and profit streams.

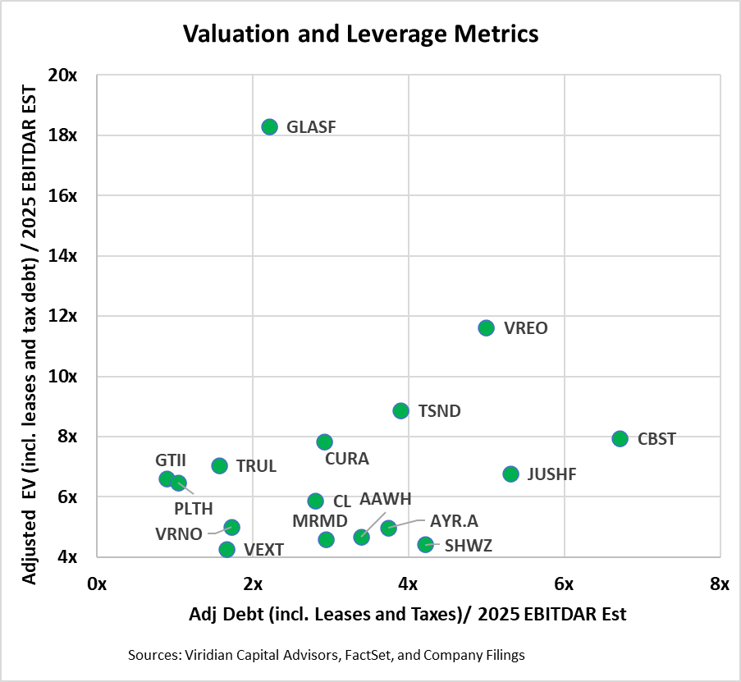

Trading at a forward P/E ratio of approximately 10 based on 2024 analyst forecasts and an enticing EBITDA multiple of 7, Alibaba’s stock valuation appears compelling. With e-commerce stability, burgeoning AI prospects, and flourishing cloud computing endeavors, Alibaba beckons investors to seize the moment before these merits reflect in financial performance.

Invest Wisely for Future Returns

Considering Alibaba’s evolving narrative, potential investors should assess its trajectory critically. While Alibaba did not make the cut in the latest 10 best stock recommendations, its past performance underscores tangible growth possibilities. Empowered by insights from the Motley Fool’s Stock Advisor service and historical success stories like Nvidia, Alibaba’s growth trajectory remains promising.

Investors eyeing Alibaba amid its AI drive and recalibrated business strategy should cautiously weigh risks and rewards to capitalize on the company’s future potential.

*Stock Advisor returns as of September 23, 2024