It appeared like a gripping plot straight out of a Netflix original series…

The year was 2022, and gunfire erupted in the streaming battlegrounds. The underdog, Netflix (NFLX), faced heavy artillery from Disney+ and other streaming services launched by the veteran Hollywood moguls.

Co-founder Reed Hastings spearheaded a series of strategic maneuvers to fend off the onslaught from competitors. Initiatives included curbing password-sharing among customers and even contemplating advertising, a move the company had shunned in the past.

Despite these efforts, Netflix’s stock took a nosedive. Critics from the traditional Hollywood studios gloated, proclaiming, “We told you so,” as the prophesied downfall unfolded before their eyes.

However, a dramatic twist in the tale upended expectations. The moment marked the inception of a paradigm shift that not only fortified Netflix’s position but also widened the gap between the streaming giant and its struggling counterparts still grappling to turn a profit despite pouring billions into streaming ventures.

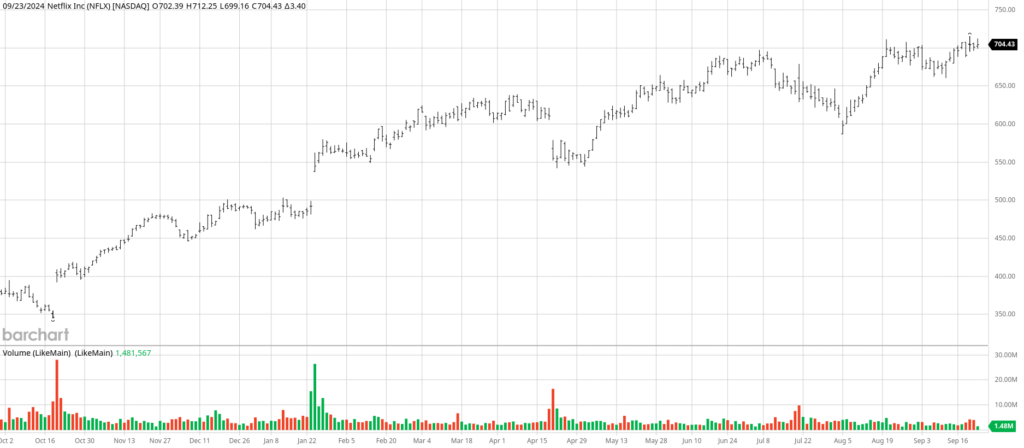

The repercussions were manifest in the stock market’s performance. Over the last year, Netflix’s stock ascended by a remarkable 85.7%. In stark contrast, Warner Bros Discovery (WBD) plummeted by 26.5%, Paramount Global (PARA) by 17.8%, Comcast (CMCSA) by 10%, and Walt Disney (DIS) managed a modest 14.4% increase.

Netflix’s Triumph

Netflix’s triumph is vividly reflected in its financial results.

The Wall Street skeptics cast doubt on the password crackdown, initiated through controlled trials in markets like Chile, Costa Rica, and Peru in early 2022.

Contrary to expectations, the crackdown fueled Netflix’s growth for over a year, propelling its total subscribers to 277.6 million in the latest quarter, marking a 16.5% surge from the prior year.

Since implementing the password crackdown domestically in May 2023, Netflix has amassed a staggering 45 million paying subscribers. This surge catapulted its share price by over 114%, recently achieving record highs.

Five years post the debut of Disney+, the inauguration of the streaming wars, Netflix remains the unrivaled leader in subscriber count and viewer engagement. In July, the platform commanded 8.4% of U.S. screen time, eclipsing DIS, which secured 4.8% amalgamated between Disney+ and Hulu.

Competitors from Hollywood’s other studios – Warner Bros Discovery’s Max, Comcast’s Peacock, and Paramount+ – lagged behind, capturing less than 2% of viewing hours.

Netflix’s Future Endeavors

Reflect on Netflix’s string of successful transformations since 2022. The company pioneered an ads business, invested in its budding video games division, broadened live experiences around hit shows like Bridgerton, Squid Game, and Stranger Things, and even dipped into the realm of live sports.

As the impetus from the password-sharing crackdown starts to wane, Netflix’s next growth spurt might emanate from its other major initiative – advertising.

However, reaping substantial benefits from advertising will entail time. Partnering with Microsoft (MSFT) for digital ad delivery systems and unveiling a roster of top 10 shows for advertisers, Netflix encounters a competitive landscape, with Amazon (AMZN) emerging as a formidable adversary through its Prime Video service.

In response, Netflix redirected course, opting to develop an in-house advertising platform instead of relying on Microsoft. Anticipating advertising to be a “primary driver” of revenue growth from 2026 onwards.

Besides advertising, Netflix is strategically venturing into live event streaming. Recent ventures include broadcasting NFL games on Christmas Day and securing a $5 billion, decade-long deal for World Wrestling Entertainment’s Raw program. This foray could lay the groundwork for Netflix’s potential collaboration with a professional sports league.

Netflix’s incremental strides into live sports programming promise to bolster its advertising revenue, as live events hold greater allure for advertisers compared to scripted content. The NFL, with its preeminent position in the U.S. sports broadcast market, further embellishes the appeal of Netflix’s move.

Predictably, as the undisputed leader in video streaming, Netflix appears poised to drive mid-teen revenue growth alongside expanding operating margins.

Purchase NFLX stock below $717, ideally below $700 during a market downturn. Ride the streaming wave with Netflix as it navigates its strategic evolution.