Intel Corporation INTC shareholders endured a tumultuous journey this year as the company grappled with challenges in its foundry business. Despite setbacks, a strategic move to spin off its foundry, a notable partnership with Amazon.com, Inc. AMZN, and the possibility of a QUALCOMM Incorporated takeover contributed to a remarkable upsurge in its stock prices last week.

Is this resurgence indicative of a sustained trajectory for INTC stock, or does it merely signify a transitory spike? Is now the time to consider acquiring INTC shares, or would it be prudent to await a more favorable entry point? Let’s delve into the details –

Intel Stock Regains Footing

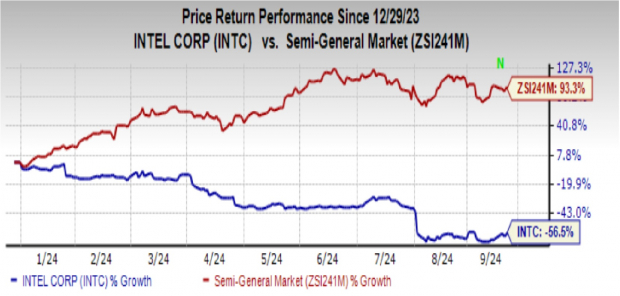

This year has been a challenging one for Intel, with its shares plummeting by 57%, a stark contrast to the Semiconductor – General industry’s robust 93.3% surge. Intel faced financial strains due to costly technological advancements, prompting concerns about cash flow and leading to dividends suspension and job cuts.

Image Source: Zacks Investment Research

Intel’s failure to capitalize on the burgeoning artificial intelligence era compounded its woes. However, a convergence of events invigorated Intel’s stock performance last week, with shares soaring over 11%, marking its most robust weekly gain since November.

Factors Fueling the Upward Surge in Intel Share Prices

According to a Wall Street Journal report, Qualcomm’s potential move to acquire Intel holds promise for both entities. With Intel specializing in personal computers and server chips and Qualcomm excelling in mobile products, a strategic alliance could leverage each other’s strengths and enhance market competitiveness.

Furthermore, Intel’s in-house manufacturing prowess stands to benefit Qualcomm, allowing the latter to gain a dedicated manufacturing facility, reduce outsourcing costs, and bolster profit margins.

The recent collaboration announcement with Amazon is another positive development for Intel, with Amazon Web Service (AWS) embracing Intel’s customized chip designs. This partnership emerged in response to NVIDIA Corporation’s elevated pricing for Amazon, positioning Intel to recapture market share from NVIDIA, a dominant force in AI technologies.

Additionally, Intel’s decision to transition its foundry business into a subsidiary signifies a significant stride for the company. Concerns over sharing chip designs with industry competitors prompted this structural change, with the spin-off expected to inject vitality into the struggling foundry division, which faced stiff competition and reported operating losses in the initial half of 2024.

Separation of the foundry business is anticipated to enhance Intel’s capital efficiency, especially as the company aims to ramp up investments to incentivize U.S. chipmakers to favor local manufacturers over foreign rivals like TSMC.

Assessing the Investment Landscape for Intel

CEO Patrick Gelsinger’s strategic outlook on tech collaborations and the restructuring of the foundry business aims to bolster profitability and propel share prices upwards. Major brokers have raised the average short-term price target for INTC by 36.1% from its latest close of $21.14, with analysts envisioning a high price target of $66, reflecting a remarkable 212.2% upside potential.

Image Source: Zacks Investment Research

Despite these encouraging signs, Intel faces stiff competition and a premium valuation. The dominance of Arm Holdings plc in Intel’s server and networking segments, alongside Advanced Micro Devices, Inc.’s advances in high-performance processors, poses substantial challenges.

Intel’s current high valuation—trading at 81.3X forward earnings compared to the industry average of 47.7X—raises caution flags for prospective investors.

Image Source: Zacks Investment Research

Consequently, investors are urged to tread carefully before considering investments in INTC, given the inherent risks associated with the stock. Existing shareholders, on the other hand, may find merit in maintaining their positions, banking on Intel’s prospects to transform into a U.S. counterpart of TSMC and reap the benefits of recent strategic alliances.

The stock currently holds a Zacks Rank #3 (Hold).

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.