The Rise of AI in Stock Market

The stock market has witnessed significant growth due to the emergence of artificial intelligence (AI) systems. Particularly, the Nasdaq-100 Technology Sector index has outpaced the S&P 500 index, showing a 75% increase in the past two years compared to 54%. Investing in AI stocks for the long term is gaining traction as the technology continues to evolve.

1. Nvidia: Driving the AI Revolution

Nvidia has been at the forefront of the AI trend, supplying a significant portion of AI chips to various sectors. With a revenue surge of 122% in the second quarter of fiscal 2025, reaching a record $30 billion, Nvidia’s dominance in the AI chip market is evident. Analysts predict exponential growth for Nvidia, with revenue projections reaching $200 billion in calendar 2027, a substantial leap from $61 billion in fiscal 2024.

Expanding Market Presence

Mizuho analyst Vijay Rakesh highlighted Nvidia’s strong demand for Hopper chips and the impending launch of Blackwell processors as key drivers for the company’s data center business growth. Nvidia’s strategic move into the enterprise AI software market also shows promise, with an expected $2 billion annual revenue run rate by the end of the current fiscal year.

2. Palantir Technologies: Leveraging AI Software

Palantir Technologies offers software platforms tailored for commercial and government clients, harnessing generative AI in its operations. The company’s focus on integrating AI into business processes has resulted in accelerated growth, marked by significant deals and customer acquisitions.

Operational Innovation

Palantir’s emphasis on AI innovation is showcased through company-specific boot camps, demonstrating the practical applications of generative AI for operational efficiency. The success of these initiatives is evident in the company’s growth trajectory, reflecting a robust uptake of its AI platform among clients.

Investing in the AI landscape with companies like Nvidia and Palantir Technologies reflects a strategic move towards long-term growth potential. As these firms continue to innovate and expand their market footprint, investors stand to benefit from the burgeoning AI market’s evolution.

Unlocking the Growth Potential of Palantir: A Closer Look at Revenue Surge and Investor Prospects

Potential of Boot Camps: Fueling Revenue Growth

Palantir, the software company renowned for its data analytics prowess, recently reaped the fruits of a strategic move. Just 16 days post a boot camp, the technology titan joined hands with a major wholesale insurance brokerage firm for an automated policy review use case. This alliance underscores the effectiveness of Palantir’s boot camps in driving tangible business outcomes.

Revving Up Revenue Growth

In the second quarter of this fiscal year, Palantir’s revenue witnessed a significant acceleration of 27%, surging to $678 million. This boost marked a substantial upswing from the 21% growth rate witnessed in the previous quarter. The company’s commercial revenue also experienced a robust 33% uptick, clocking in at $307 million, while government revenue saw a commendable 23% increase, reaching $371 million.

Expanding Customer Base and Deal Activity

Palantir’s customer count surged by an impressive 41% year-over-year in the last quarter, reaching a tally of 593 clients. This expansion in the customer base was coupled with a rise in customer spending. The company sealed a notable 96 deals valued at a minimum of $1 million, marking a substantial increase from the 66 deals made in the corresponding period the previous year. Furthermore, the number of deals exceeding $10 million surged by 50% year-over-year, reaching a total of 27.

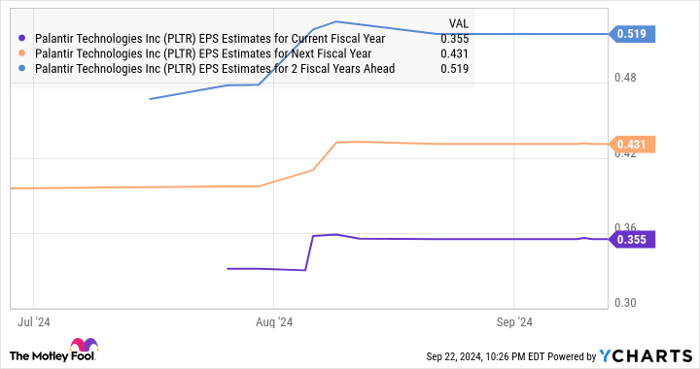

Riding High on Analyst Expectations

The stellar performance in terms of customer growth and deal activity has led industry analysts to revise their growth projections for Palantir. Forecasts for the year 2024 and beyond have been kicked up a notch, setting a positive tone for the company’s future trajectory.

Market Expectations and Investor Prospects

Palantir’s potential can be gauged from market expectations, with forecasts indicating revenue estimates close to $4 billion by 2026. The surge in the company’s total remaining deal value by 26% year-over-year in the second quarter to $4.3 billion further cements its growth prospects. This metric, reflecting the total value of contracts yet to be fulfilled by Palantir, positions the company favorably to maintain robust growth levels, potentially outpacing analyst predictions.

A Promising Investment Opportunity

Forecasts suggest that Palantir is on track to achieve an impressive annualized earnings growth rate of 85% over the next five years. With the stock soaring over 100% in 2024 alone, turning a $3,000 investment into $6,500, Palantir shows promise in delivering substantial returns for investors. Given its vast potential within the AI software market, Palantir’s growth trajectory seems poised for a stellar performance in the long run.