A Surge of Optimism

China’s recent economic stimulus is akin to a lightning bolt, electrifying global markets. The People’s Bank of China (PBoC) has orchestrated a symphony of actions, slashing the reserve requirement ratio (RRR) for banks and trimming key repo rates. This maneuver is set to flood the financial system with liquidity — a tidal wave of approximately $140 billion aimed at supercharging the economy and fostering increased lending to spur growth.

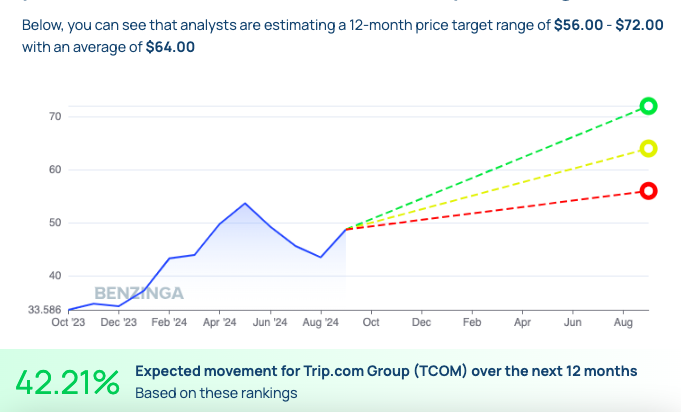

The Jewel in the Crown: Trip.com Group

Leading the pack is the shining star, Trip.com Group, China’s mammoth online travel agency. Like a phoenix rising, the stock has ascended over 43% in the past year, flaunting a dazzling 44% gain year-to-date. Analysts, with their crystal ball in hand, foresee Trip.com riding the wave of China’s travel resurgence, especially with passport usage still in its infancy stages. As international travel makes a triumphant return, Trip.com is poised to revel in a feast of high-margin growth opportunities.

JD.com: The E-Commerce Behemoth

Next up on the illustrious list is JD.com, a titan in China’s e-commerce realm. Its crown jewels are its expansive logistics and fulfillment network, propelling it to a 22% gain thus far this year. Analysts don their forecasting hats, predicting a price spectrum from $28 to $47, with an average target resting at the regal sum of $37.50. This prophecy suggests a potential 36.97% uptick over the coming year — solidifying JD.com’s spot as a commanding player in the kingdom.

Alibaba Group: A Multifaceted Imperium

Completing the triumvirate is Alibaba Group, a juggernaut in the global e-commerce domain. While Alibaba may have weathered storms in recent times, its diverse repertoire — spanning online marketplaces to cloud computing — continues to captivate analysts. With a 21% rise in the year thus far, analysts pencil a 12-month price band stretching from $85 to $130, averaging to a princely sum of $107.50. This projection hints at a 29.78% elevation, crafting Alibaba as a reliable long-term venture.

As the economic juggernaut of China kicks into overdrive with its latest fiscal boost, the trio of Trip.com, JD.com, and Alibaba stand ready to harness the country’s resurgence and development.