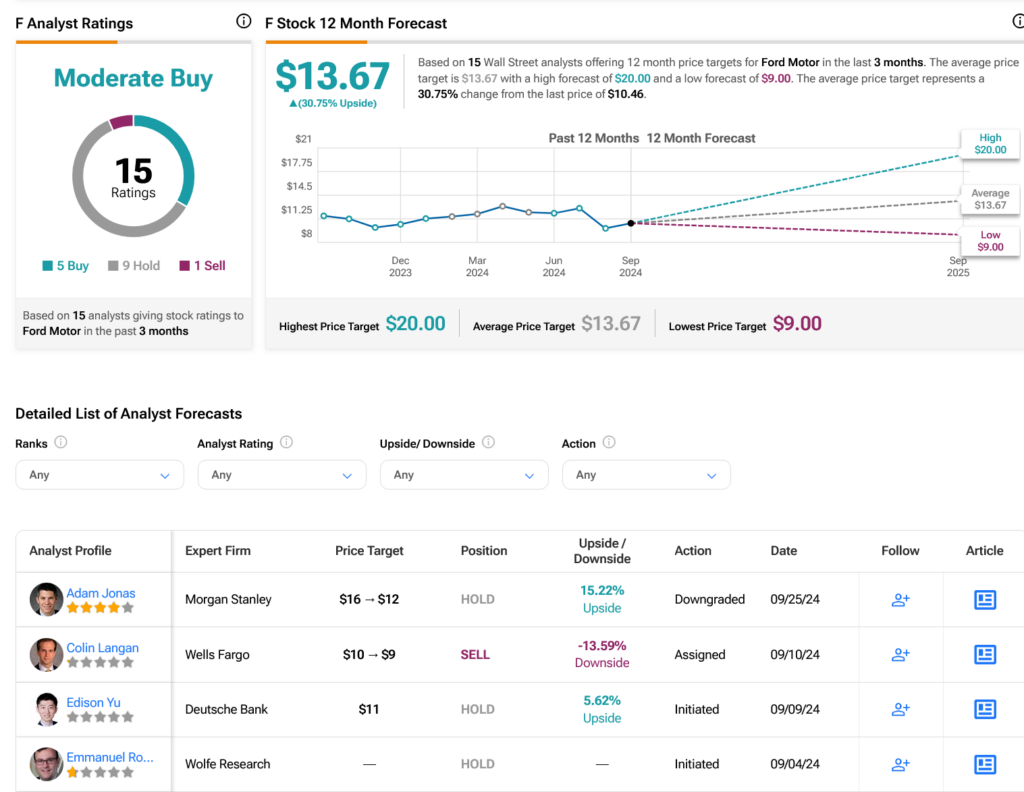

Established automaker Ford has stood the test of time, attracting investors with its enduring presence in the market. However, a recent downgrade from Morgan Stanley has dealt a heavy blow to the company, causing Ford’s shares to plummet by nearly 4% during Wednesday’s trading session.

Morgan Stanley analyst Adam Jonas not only downgraded Ford’s rating from Overweight to Equal Weight but also slashed the price target on its shares from $16 to $12. The root of the problem lies in China, where Ford produces its Territory compact SUV.

With China facing an excess production of nine million cars compared to its domestic demand, the country aims to tap into the export market. While not all surplus vehicles may reach the U.S., Ford’s pursuit of alternative markets in Europe, Africa, and Asia is likely to result in a loss of market share and profitability, as noted by Jonas. Additionally, escalating regulations in the electric vehicle sector pose further challenges for the company.

Potential Resilience Amidst Challenges

Despite these setbacks, Ford boasts some potential game-changers in its arsenal. Recent images of the 2024 Mustang Dark Horse, unveiled on AutoBlog, showcase a stunning vehicle that is bound to capture market attention, even in economically downtrodden times.

Furthermore, Ford has commenced production of the electric Capri in Cologne, Germany. This marks the second electric vehicle production for Ford in Germany, with the Capri resembling the Explorer, albeit with a sleeker roofline. Initially available in large battery models, the Capri is expected to introduce smaller battery variants by year-end.

Assessing the Investment Landscape

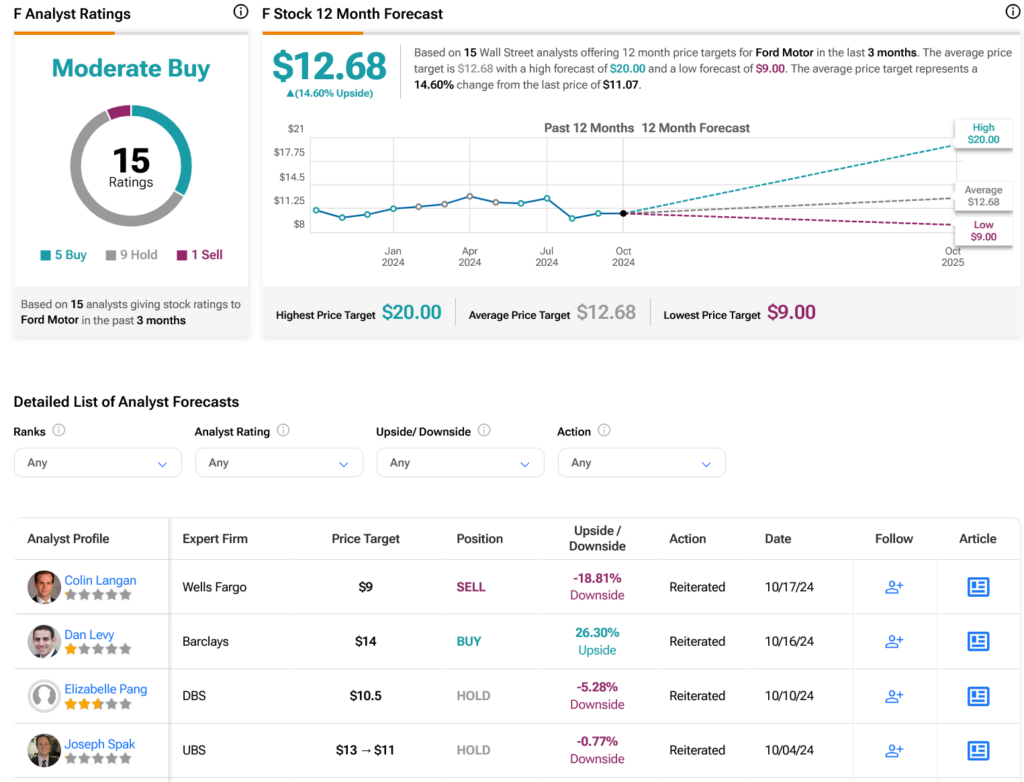

A glance at Wall Street reveals a Moderate Buy consensus rating on F stock, supported by five Buy, nine Hold, and one Sell recommendations over the past three months. Despite a 10.14% decline in its share price over the last year, Ford’s average price target of $13.67 per share suggests a potential 30.75% upside for investors.