Alphabet Inc’s Recent Momentum

Alphabet Inc, the tech giant behind Google, has been blazing a trail in the market, witnessing a remarkable 5% rise in the last month. The heightened enthusiasm can be linked to the escalating interest in artificial intelligence.

Exciting Developments at Alphabet

Benigna Neuro recently highlighted Sir Demis Hassabis taking the lead in the company’s Google AI arm to develop a research-assistance AI model. This initiative aims to foster collaborations across disciplines, enhancing productivity in scientific endeavors.

Waymo’s Innovation

Waymo, Alphabet’s autonomous driving division, unveiled its sixth-generation hardware, portraying a step towards cost reduction and superior performance, especially in challenging weather conditions like winter. Notably, experts projected autonomous vehicles sales in the U.S. to hit 230,000 units by 2034.

Trading Activity Surges

The options market for Alphabet’s stock, as inferred from implied volatility (IV), has seen a surge in trading. The IV rank escalated from 28% to nearly 75%, indicating a spike in market expectations of price fluctuations.

High IV implies inflated option premiums due to increased demand stemming from the anticipation of significant price movements.

The uphill trading could be linked to Alphabet’s upcoming Q3 earnings report scheduled for October 22nd. While many trades are optimistic, there are contrary bearish sentiments expressed by market whales.

The Role of Direxion’s ETFs

The clash surrounding Alphabet presents a fertile ground for Direxion, a financial services firm. Direxion’s leveraged and inverse exchange-traded funds revolving around GOOGL provide traders with avenues to swiftly take directional positions on the tech powerhouse.

For the bulls, Direxion Daily GOOGL Bull 2X Shares (GGLL) targets 200% of GOOGL stock performance daily. Conversely, Direxion Daily GOOGL Bear 1X Shares (GGLS) seeks 100% inverse performance of Alphabet’s Class A shares.

It’s crucial for traders in both GGLL and GGLS to avoid prolonged exposure due to the compounding effect of volatility eroding fund values over time.

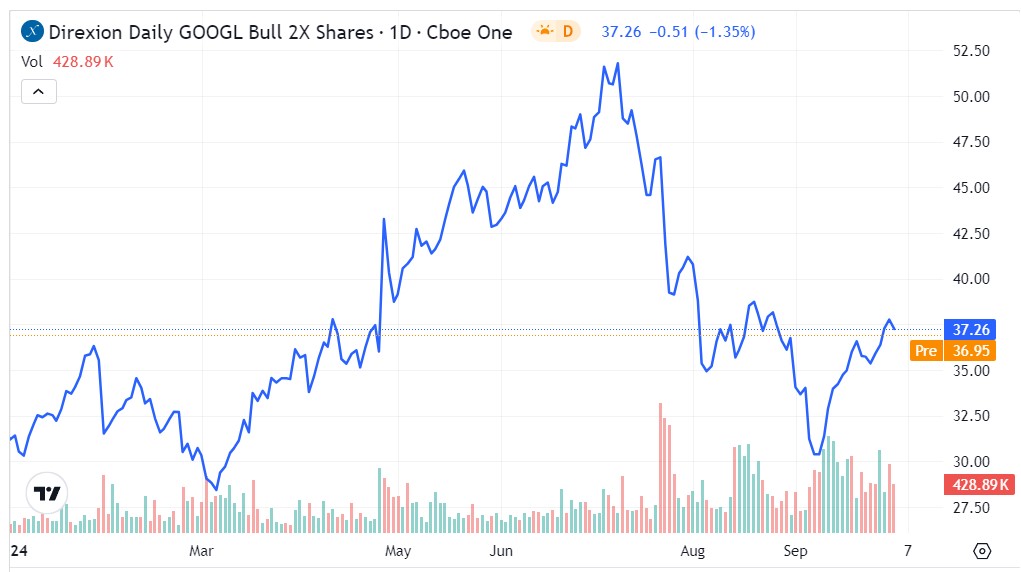

The GGLL ETF Performance

- GGLL has yielded over 19% since the start of the year and demonstrated a robust 23% increase by September 10th.

- Heightened volume levels ahead of the anticipated Q3 disclosures provide encouragement to bullish traders.

- To attract potential speculators, GGLL needs to breach the $38 resistance level.

Perspective on the GGLS ETF

The Direxion’s bear fund, GGLS, has suffered a 19% year-to-date drop, indicating challenges for pessimistic traders in the tech sector.

- GGLS currently trades below its 50-day and 200-day moving averages, signifying significant capitulation.

- Struggling to maintain the $14 support line, GGLS faces hurdles.

- Despite the setbacks, a bounce from the year’s low and bearish options activity might align in favor of the naysayers.