Unleashing Untapped Potential

Amid record-high trading levels on Wall Street, identifying lucrative investment avenues poses a delightful yet demanding challenge. The stock market’s dynamism signifies a plethora of opportunities awaiting discerning investors, even amidst seemingly overvalued equities.

Following diligent scrutiny, three tech companies – SentinelOne (NYSE: S), Netflix (NASDAQ: NFLX), and Sea Limited (NYSE: SE) – have emerged as top contenders in the eyes of astute market analysts. These titans promise substantial market-beating potential for the forthcoming year.

SentinelOne: The Cybersecurity Maestro

Amidst the enigmatic dance of the market in 2024, SentinelOne shines as a beacon of success that shows no signs of slowing down. Combining the formidable forces of cybersecurity and artificial intelligence (AI), SentinelOne’s autonomous security platform represents the vanguard of defense against cyber threats – a critical need in today’s digital landscape.

Boasting a remarkable 33% year-over-year revenue surge in its recent fiscal quarter, SentinelOne is also on a steadfast march towards profitability. The company’s strategic collaboration with industry giants like Lenovo heralds a promising era of growth, potentially catapulting its revenue projections to the billion-dollar milestone.

Despite its meteoric ascent, SentinelOne’s valuation remains relatively subdued, offering an enticing proposition for investors eyeing substantial returns in the tech sector. The party initiated by SentinelOne in 2024 seems poised to transcend into a jubilant celebration in the coming year.

Netflix: A Streaming Sensation

Within the tumultuous landscape of streaming wars, Netflix stands tall as a veritable victor, poised for even greater triumphs in the year ahead. Amidst a soaring 45% year-to-date surge in its stock price, Netflix’s dominance in the streaming arena is undisputed.

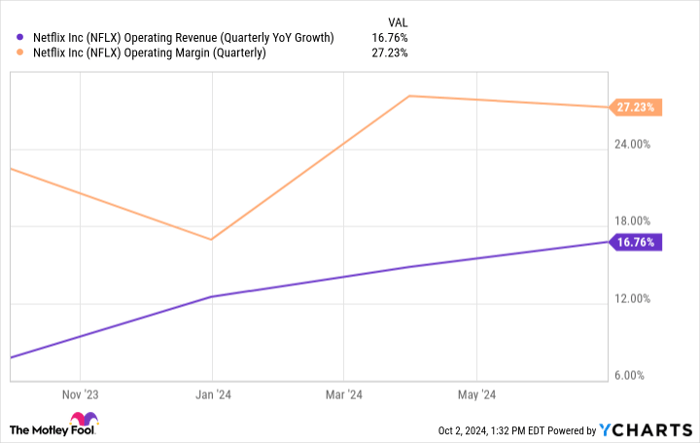

Recent data from Nielsen underscores Netflix’s unrivaled position in streaming, capturing a substantial chunk of the market share. With its sound fundamentals accentuated by robust revenue growth and an impressive operating margin, Netflix continues to outshine its competitors.

2025 holds the promise of further glory for Netflix as it forays into new avenues, including the expansion of its ad-tier business. The streaming giant’s resilience in weathering challenges has not only fortified its standing but also primed it for expanded success in the upcoming year.