U.S. legacy automaker General Motors held its Investor Day yesterday, unveiling insights into its ongoing transformation and future outlook. While GM is venturing into electric vehicle (EV) technology and striving for cost efficiency, it faces short-term challenges like slower EV adoption and rising costs. This leaves investors pondering over their stance on GM stock. Before delving into the stock’s scenario, let’s analyze the significant highlights from GM’s Investor Day.

Insights From GM Investor Day

Farewell to the “Ultium” Branding: A Strategic Departure

An unexpected move during Investor Day was GM’s abandonment of the “Ultium” branding for its EV batteries and associated technology. GM, under the leadership of CEO Mary Barra, reiterated that although the name change is in effect, the foundational technology and battery advancements will remain pivotal for GM’s future endeavors.

This shift signifies GM’s altered approach towards its EV strategy, directing its focus towards product performance and cost efficiency over flamboyant branding.

Setting up a Battery Cell Development Center: A Future-Forward Bet on EVs

GM announced plans to establish a battery cell development center at its Global Technical Center in Warren, MI, showcasing its long-term commitment to cementing its dominance in battery technology as part of its EV roadmap. This initiative aims to play a pivotal role in GM’s quest to drive down battery costs, a critical step towards enhancing the affordability and profitability of EVs. GM’s executives highlighted the positive trajectory in battery cost reductions, especially with the enhanced production scale at its Ultium Cells plants.

EV Profitability: A Glimmer of Hope?

GM hinted at a potential peak in its EV losses, foreseeing a $2 billion to $4 billion reduction in EV losses by 2025, primarily propelled by enhancements in battery production efficiency and economies of scale. GM’s target includes achieving a positive variable profit on its EVs by the end of 2024, excluding fixed costs—a significant milestone for the automotive giant.

Despite positive trends, GM exercised caution in discussing its long-term profitability goals for EVs, including its previous target of mid-single-digit EV margins by 2025, urging investors to track the company’s progress while acknowledging the challenges in attaining profitability across its broader EV portfolio.

Varied EV Production Targets and a Gradual Ramp-Up

GM revised its EV production projections downward from prior estimates, aligning its North American EV production objective for 2023 to a range of 200,000 to 250,000 units from the earlier 300,000 unit target. Despite maintaining progress towards the lower end of the range, this adjustment underscores the sluggish consumer adoption pace of EVs. The delayed reopening of GM’s Orion Assembly plant until mid-2026 further underscores the prevalent challenges in the EV market, mirrored by several automakers facing subdued demand, affordability constraints, and heightened competition, notably from Chinese automakers.

Robust Performance in Internal Combustion Engine Vehicles

GM continues to excel in its traditional gas- and diesel-powered vehicle segments, with plans to introduce eight new or revamped gasoline-powered SUVs in North America within the upcoming year. These vehicles play a critical role in GM’s strategy, ensuring consistent cash flow as the company transitions towards EVs.

With U.S. consumers heavily favoring gasoline-powered trucks and SUVs, GM strategically positions itself to leverage the demand in this segment while advancing towards electrification.

Challenges in the Chinese Market and Sparse Revamp Strategy Insights

GM’s performance in China, once a significant profit hub, has been lackluster in recent years, with GM reporting a $210 million loss in the region during the first two quarters of this year, primarily attributed to intense competition from both local and global automakers. CEO Mary Barra forewarned of persisting challenges throughout the year, citing unyielding headwinds.

While reassuring investors of imminent restructuring moves in China, GM’s restructuring details remain scant. Efforts to diminish inventories and amplify sales are underway, yet hurdles loom large, particularly amid local rivals’ endeavors to boost production of budget-friendly EVs.

Analyzing GM’s Stock Performance and Valuation

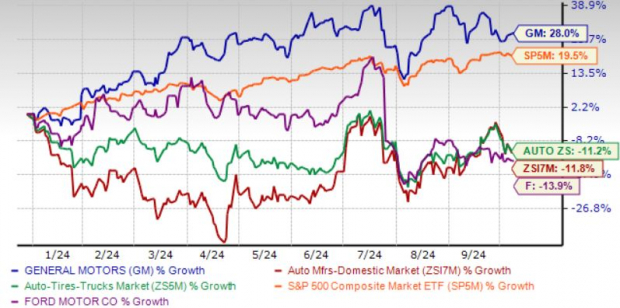

Year to date, GM stock has soared by 28%, surpassing both the broader market and industry counterparts like Ford, which witnessed a 14% decline in its stock value over the same period. GM stock hovers near its 52-week peak of $50.50, presently trading at around $46.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

From a valuation perspective, GM appears marginally pricier than Ford, trading at a forward sales multiple of 0.29X, compared to F’s 0.25X forward sales multiple.

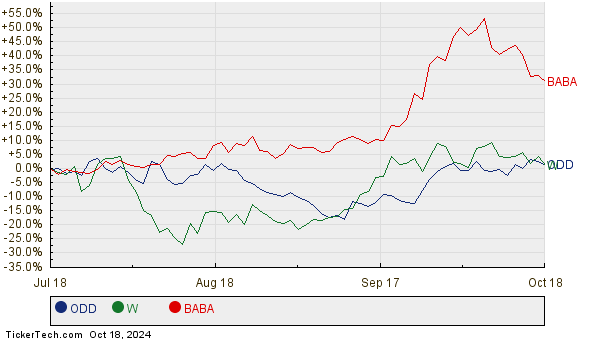

Image Source: Zacks Investment Research

The Struggles and Strengths Amid GM’s Long-Term Promise

GM has succeeded in delivering robust financial outcomes, surpassing earnings projections in the previous four quarters.

Image Source: Zacks Investment Research

Explore the latest earnings estimations and surprises on ZacksEarnings Calendar.

While GM’s long-term potential shines bright, near-term predicaments loom. GM anticipates a 1-1.5% year-over-year pricing challenge in the latter half of 2024, potentially undermining profitability. Additionally, GM foresees approximately $1 billion in costs for the rest of the year.

The Bumpy Road Ahead for General Motors

General Motors (GM) is facing a tumultuous year, buffeted by increased marketing spending and soaring commodity prices, notably for copper and aluminum. The company’s autonomous driving division, Cruise, is bleeding money, with GM’s chief financial officer Paul Jacobson predicting potential losses of up to $2 billion by 2025. These headwinds, compounded by operational difficulties in China, may exert pressure on GM’s shares in the immediate future.

Seizing Opportunities or Managing Risks?

For investors with a short-term investment horizon, the current scenario might present a chance to cash out gains, especially as GM’s stock approaches recent peaks.

Riding the Long-Term Growth Trajectory

Despite short-term challenges, GM remains a sturdy choice for long-term investors. The company’s robust portfolio of traditional vehicles, alongside a maturing electric vehicle (EV) strategy, places it favorably for sustained expansion. By slashing expenses and ramping up EV output, GM is poised to drive enduring value over the distant horizon.

However, for investors eyeing near-time returns, GM’s stock has already posted substantial gains this year. With imminent perils such as escalating expenses, pricing constraints, and slower-than-projected EV adoption, those seeking rapid profits might contemplate securing gains now, preceding the firm’s third-quarter earnings disclosure on October 22.

General Motors presently holds a Zacks Rank #4 (Sell).

Conclusion

General Motors, an icon of the American auto industry, finds itself at a crossroads as it navigates through a challenging terrain marked by cost escalations, market uncertainties, and technological transitions. The journey ahead is fraught with obstacles, yet opportunities abound for astute investors willing to weather the storm and embrace the company’s long-term vision.