Investors will be keeping a close eye on the financial sector with the major US banks set to report their third quarter results over the next week.

While JPMorgan Chase JPM and other big banks will be at the forefront of attention, The Bank of New York Mellon BK and The Progressive Corporation PGR are two finance stocks that shouldn’t be overlooked.

Set to release their Q3 reports on Friday, October 11, let’s see why now is a good time to invest in BNY Mellon and Progressive.

BNY Mellon’s Consistency

Zacks Rank #2 (Buy)

Having operations in over 35 countries, BNY Mellon’s expansion as a wealth and asset manager is very intriguing with Q3 sales expected to be up 3% to $4.52 billion. On the bottom line, Q3 earnings are thought to have increased 10% to $1.40 per share.

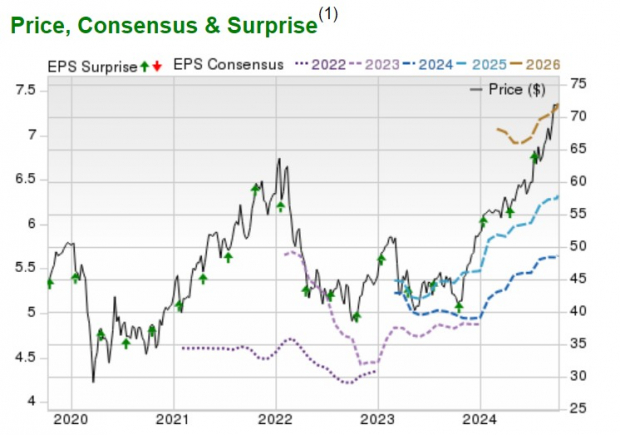

More impressive, BNY Mellon has reached or exceeded the Zacks EPS Consensus for 21 consecutive quarters dating back to July of 2019 and has posted an average EPS surprise of 9.92% in its last four quarterly reports. Expecting 12% EPS growth in fiscal 2024 and FY25, BNY Mellon’s stock has soared over +70% year to date and still trades at an attractive 12.9X forward earnings multiple. BK also offers a generous 2.57% annual dividend yield which should keep investors engaged.

Image Source: Zacks Investment Research

Progressive’s Insurance Premiums

Zacks Rank #1 (Strong Buy)

Progressive’s stock has also soared more than +70% year to date but retains a strong buy rating as many insurance companies are expected to benefit from a deflationary environment. To that point, Progressive’s Zacks Insurance-Property and Casualty Industry is currently in the top 10% of over 250 Zacks industries.

Insurance premiums should continue to boost Progressive’s profitability as one of the major domestic auto insurers. Notably, Progressive’s net premiums earned during Q3 are expected to spike 22% to $17.94 billion versus $14.89 billion in the comparative quarter.

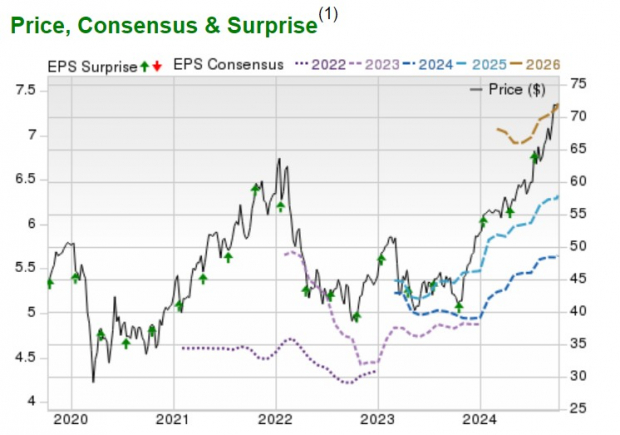

Even better, Progressive’s Q3 EPS is projected to soar 59% to $3.33 (Current QTR below) compared to $2.09 per share a year ago. Seeing steady top line expansion, Progressive’s Q3 sales are slated to spike 20% to $18.94 billion with double-digit revenue growth in the forecast for FY24 and FY25.

Image Source: Zacks Investment Research

Furthermore, Progressive has widely surpassed earnings expectations in each of its last four quarterly reports posting an average EPS surprise of 24.08%.

Largely suggesting more upside in Progressive’s stock is that earnings estimate revisions for Q3, FY24, and FY25 have soared over the last 60 days. Plus, PGR still trades at a reasonable 19.1X forward earnings multiple.

Image Source: Zacks Investment Research

Bottom Line

The Bank of New York Mellon and The Progressive Corporation should be standouts in regards to the Q3 earnings season. Now may be a good time to buy as their impressive stock performances could certainly continue if they can reach or exceed earnings expectations.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report