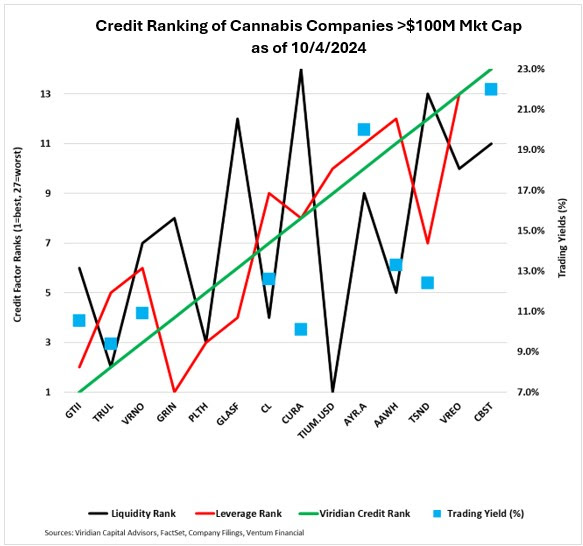

As the shadow of Florida’s impending vote on recreational cannabis lengthens, investors are casting wary eyes towards pivotal opportunities in the market. The Viridian Credit Tracker looms large, heralding AYR Wellness as a robust contender, sporting a commendable 20% yield bolstered by its commanding foothold in Florida’s lucrative cannabis realm. With Florida potentially primed to green-light recreational usage, AYR emerges as a ripe plum, dangling resplendent before investors on the eve of the ballot.

- The walls reverberate with whispers of Benzinga’s hush-hush analysis and freshest tidings concerning the cannabis domain – delivered straight to your inbox gratis. Subscribe to our newsletter – a savvy move for the serious players.

AYR Wellness Offers 20% Yield: Capitalize on Florida’s Potential Vote

The heralded Viridian Credit Tracker, under the aegis of Viridian Capital Advisors, unfurls a tale in which AYR, through its entwinement with Florida’s verdant markets, wields a mighty advantage in the face of the state’s possible nod to recreational cannabis.

Touting a 20% trading yield, AYR gallops ahead of many contemporaries. Should Florida grant the boon of recreational cannabis, AYR’s valuation could witness a meteoric surge, rendering this stock a strategic gem for investors as the vote looms large.

Cresco Labs vs. Curaleaf: A 250 Basis Point Difference

The hallowed report advocates for a strategic tango: embrace Cresco Labs with a 12.6% yield and bid adieu to Curaleaf at 10.1%. This gambit proffers investors a 250 basis point ascendancy, buttressed by Cresco’s solid fiscal foundation and credit fortification. Those in quest of sterling returns and credit robustness would do well to ponder this proposition.

Read Also: EXCLUSIVE: 80% Growth Despite The Chaos: How Dutchie, C3 Defy 2024’s Cannabis Slump

TerrAscend: Why 12% Yield Might Not Be Enough

In stark counterpoint, TerrAscend, with its proffered 12% yield, finds itself earmarked as a grand “sell.” While TerrAscend retains a firm grip on the cannabis coliseum, its humbler yield and slender exposure to Florida’s burgeoning fortunes render it a less tantalizing treat compared to AYR.

Cannabist Faces Liquidity Challenges

Despite tempting spreads festooning the celestial swath of top-tier stocks, the visage of Cannabist peers out as the weakest link in the chain, predominantly due to liquidity jitters following recent asset offloads. Investors take heed: Cannabist’s drooping credit ranking might act as a brake on its near-term rise, despite prospective meliorations down the road.

Take Action Now: Florida’s Vote Could Change the Game

With the prospect of Florida’s cannabis fiefdom blossoming, those solons of investment yearning for bloated coffers should meditate on this strategic ballet: snatch up AYR at 20%, bid adieu to TerrAscend at 12%, and cast a glance towards Cresco Labs at 12.6% vis-à-vis Curaleaf at 10.1%. The vote, akin to tectonic plates shifting, could transmogrify the panorama for cannabis stakeholders, and seizing the day ere this critical juncture unfurls could bestow rich dividends.

Read Next: SEC Charges ‘Magic Mushroom’ Co. Minerco In $8M Pump-And-Dump Scheme

Market News and Data brought to you by Benzinga APIs