GE Vernova Inc. stock, with the ticker symbol GEV, has become the darling of Wall Street and investors alike, experiencing a meteoric surge since its inception in April. The company represents a pure-play opportunity in the energy transition landscape, particularly appealing to those backing the synergy between nuclear power and artificial intelligence initiatives driven by tech giants like Microsoft. As the company gears up to unveil its Q3 earnings results on October 23, the time might be ripe for investors to consider a long-term position in GEV stock.

Nuclear and Energy Transition: A Driving Force in the Economy and AI Space

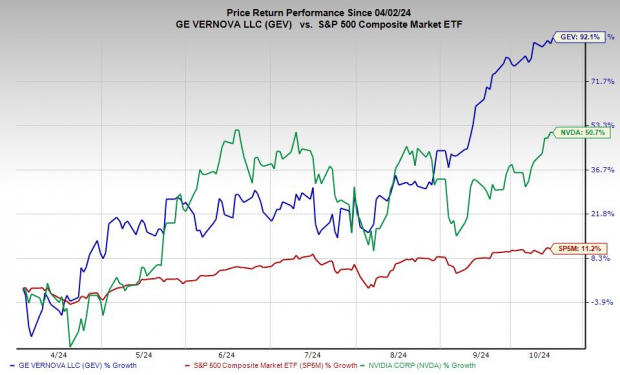

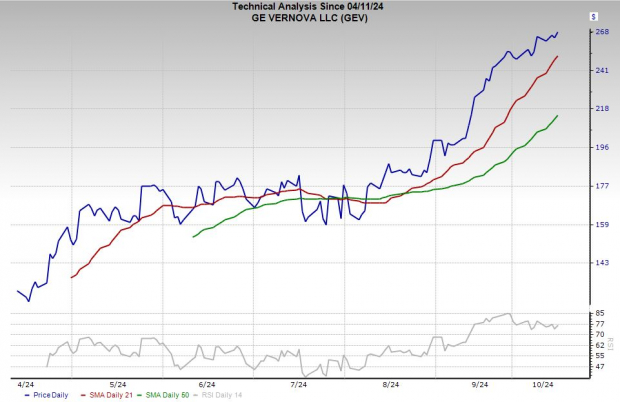

Three of the top five performing companies on the S&P 500, namely Vistra, Constellation Energy, and GE Vernova, are nuclear energy entities and key players in the broader electrification sphere. The rise of nuclear power within the investment landscape can be attributed to the increasing energy demands of the AI revolution. Partnerships such as the one between Constellation Energy and Microsoft have solidified the pivotal role nuclear energy is set to play in fueling the AI revolution, prompting major tech corporations like Amazon to secure their power supply from non-fossil fuel sources.

Image Source: Zacks Investment Research

Data from Citi analysts suggest that data centers could drive up to 10.9% of U.S. electricity demand by 2030, significantly up from the current 4.5%. This data underscores the ongoing revamp and expansion of the U.S. power grid to support various initiatives such as the energy transition, electrification, reshoring, and the AI revolution, positioning nuclear energy firms as central players in the global shift towards sustainable energy sources.

Why GEV Stock Presents an Appealing Investment Opportunity in Nuclear Energy and AI

GE Vernova entered the public domain following General Electric’s division into three separate entities – GE Aerospace, GE Healthcare, and GE Vernova. CEO Scott Strazik describes GEV as singularly committed to expediting the energy transition across electrification, nuclear energy, and beyond. Through its three primary business segments – Power, Wind, and Electrification – GE Vernova contributes to a substantial portion of the world’s electricity generation, emphasizing its role in the energy sector.

Image Source: Zacks Investment Research

GEV’s steam power division specializes in nuclear turbine solutions across various reactor types. Its Hitachi Nuclear Energy branch holds a prominent position in providing advanced nuclear reactors, fuel, and relevant services. The recent collaboration between GE Vernova and the U.S. Department of Energy underscores the company’s crucial role in advancing the next-gen nuclear and uranium industries, reinforcing America’s leadership in nuclear energy innovation.

As the demand for High-Assay Low-Enriched Uranium (HALEU) intensifies for next-gen small modular reactors (SMRs), nuclear energy firms like GE Vernova stand to play a pivotal role in supplying the requisite fuel for these advanced systems.

Further Reasons to Consider Investing in GEV Stock

GEV’s Electrification backlog demonstrated a robust 35% Year-on-Year growth to $4.8 billion in Q2, with the Power segment also recording a substantial 30% increase amounting to $5.0 billion. These positive figures have instilled confidence in GE Vernova’s outlook, with plans to restructure its offshore wind segment amid challenges posed by inflation and supply chain constraints.

Investor’s Insight into GE Vernova Inc.

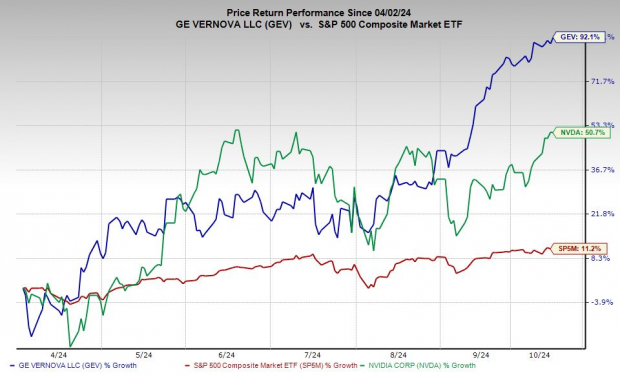

GE Vernova Inc. is expected to witness a promising increase of 5% in 2024 followed by a 6% surge in the subsequent year. The company’s adjusted earnings for 2025 are projected to nearly double from $3.19 per share in FY24 to $6.19 per share.

Looking ahead to FY25 and FY26, GE Vernova’s earnings outlook has taken a sharp upturn. This positive trajectory has attracted more attention from Wall Street analysts, with the number of brokerage recommendations at Zacks increasing from 14 to 22 in the past three months. Notably, 70% of these recommendations classify as “Strong Buys.”

Image Source: Zacks Investment Research

Strong Performance and Market Position

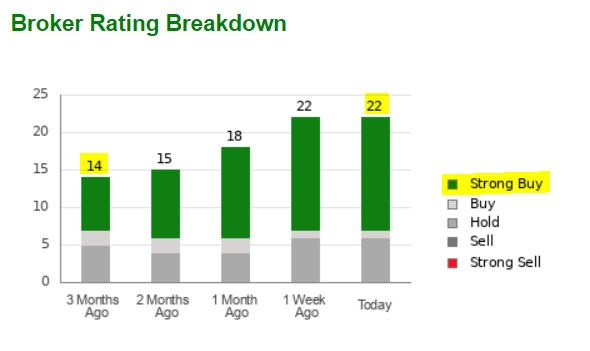

GE Vernova Inc. stands out as the fifth-best performing stock in the S&P 500 market for 2024, boasting a remarkable 90% increase since its introduction. Trailing behind GE Vernova are industry giants like Nvidia and Vistra (VST), with GEV’s stock soaring by 50% in the last three months alone.

Given its recent momentum, GE Vernova stock has reached new heights, leading to speculation that it may be slightly overvalued. However, market watchers suggest that any potential pullback, especially around the company’s 21-day moving average or the 50-day mark, could present a lucrative buying opportunity. It’s worth noting that timing the market precisely might not be the best strategy for long-term investors.

Investors keen on GE Vernova should mark their calendars for the company’s Q3 earnings announcement scheduled for October 23.

Explore Zacks’ Expert Insights

Some years ago, Zacks offered a ground-breaking deal to its members – access to all stock picks for a mere $1, without any further obligations. This move surprised many, leading to a significant number of members seizing the opportunity while others hesitated, assuming a catch.

Thousands took advantage of this generous offer, delving into Zacks’ portfolio services like Surprise Trader, Stocks Under $10, and Technology Innovators, which delivered impressive gains with 228 positions posting double- and triple-digit profits in 2023 alone.

If you’re interested in exploring more stock opportunities, Zacks’ latest recommendations, such as Microsoft Corporation (MSFT), Constellation Energy Corporation (CEG), Vistra Corp. (VST), and GE Vernova Inc. (GEV) are readily available for analysis.

To get further insights, you can refer to Zacks Investment Research.