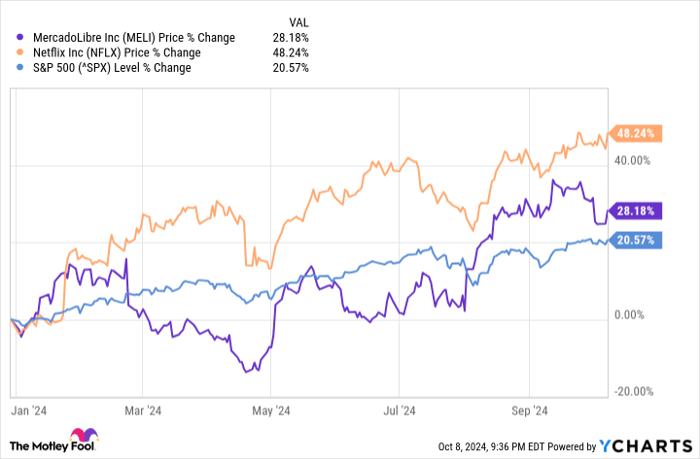

When it comes to investing, the S&P 500 is often touted as a safe bet for long-term investors. The index consistently delivers reliable returns, making it a staple for many investment portfolios. But what if there are equities that can do even better? Enter MercadoLibre and Netflix, two companies that have been dominating the market this year. While past performance is not indicative of future results, the reasons behind their success point towards continued growth and potential.

Unrivaled Dominance: MercadoLibre

As the largest e-commerce player in Latin America, MercadoLibre’s stronghold in the market is undeniable. Even powerhouse Amazon has struggled to compete with its dominance in the region. What sets MercadoLibre apart is its diverse business segments, including fintech, logistics, and a robust online storefront service for merchants. This comprehensive suite of services gives MercadoLibre a significant competitive edge in the e-commerce landscape.

Benefiting from network effects and switching costs, MercadoLibre’s moat is fortified, ensuring above-average returns for the company. Its recent financial performance speaks volumes – with revenue climbing 42% year over year to $5.1 billion in the second quarter and net income soaring by nearly 103%. The company’s solid financial standing is a testament to its position as a key player in the e-commerce industry.

With the continued growth of e-commerce globally, MercadoLibre is primed to capitalize on this trend, making it an attractive investment option for those looking to ride the wave of online retail expansion.

Streaming Supremacy: Netflix

Netflix revolutionized the streaming industry, paving the way for a new era of entertainment consumption. Despite facing stiff competition, the company has managed to stay ahead of the curve by adapting to changing dynamics. Introducing new subscription options and cracking down on password sharing has helped Netflix maintain its market dominance.

Financially, Netflix has rebounded from a dip two years ago, with revenue growing by 17% to $9.6 billion in the second quarter. Net income also saw a significant uptick of 44%, reflecting the company’s ability to innovate and evolve. With over 277 million paid memberships globally, Netflix’s ecosystem benefits from the network effect, ensuring continued growth and subscriber loyalty.

As streaming continues to gain ground as the preferred mode of TV consumption, Netflix stands to gain significantly from this trend. With ambitions to replace traditional cable services, the company has a vast addressable market waiting to be tapped, promising substantial returns for investors.

The Future Looks Bright: Investment Opportunities Ahead

Although past performance is not a guarantee of future success, the trajectories of MercadoLibre and Netflix suggest that both companies are well-positioned for sustained growth. As e-commerce and streaming services continue to reshape consumer behavior, investing in these market leaders could yield substantial returns over the long term.

Considering the market dynamics and the innovative strategies employed by MercadoLibre and Netflix, these companies present compelling investment opportunities for those seeking to capitalize on the digital revolution.