Cryptocurrency investors have endured a frustrating seven months, with the market seemingly stuck in a rut since Bitcoin’s peak in March 2024. Despite several failed attempts to break out of this downtrend, hope is stirring as recent movements hint at a potential resurgence in the crypto market.

The Long-Awaited Rally in Crypto

For months, cryptocurrencies have struggled to surpass resistance levels, prompting doubts about any possible recovery. However, a silver lining emerges as these assets have managed to hold steady without a significant crash.

Remarkably, Bitcoin has maintained a pattern of minimal monthly fluctuations below 20% since February, a rare occurrence for the typically volatile cryptocurrency. The current trend mirrors a similar period in 2015 when Bitcoin stagnated for eight consecutive months before skyrocketing by nearly 40% in October, paving the way for a substantial rally in the following year.

History suggests that prolonged periods of stagnation often precede significant price movements, offering a glimmer of hope for investors expecting a breakout in the crypto space.

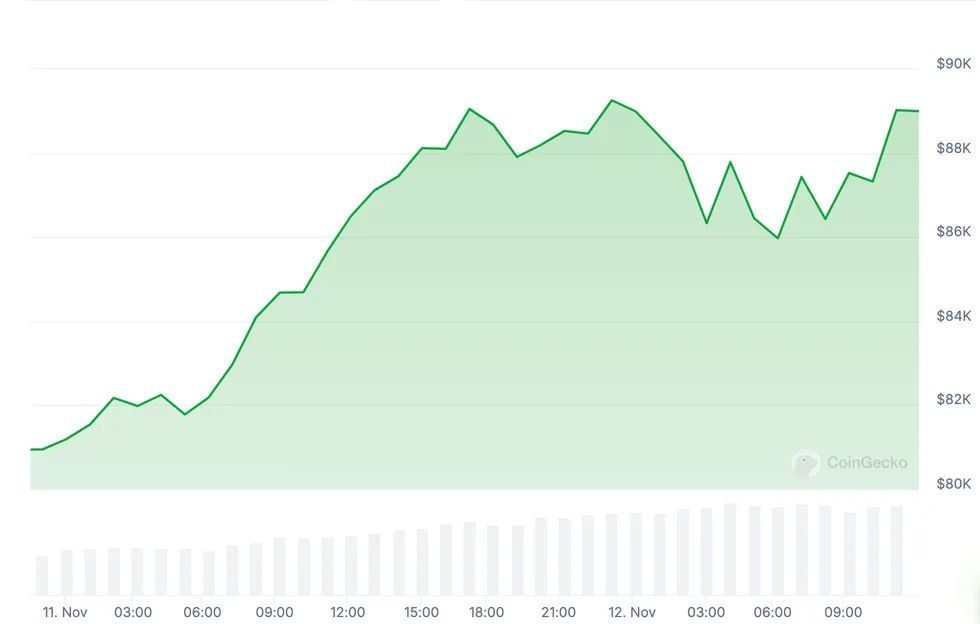

The Telling Surge in Bitcoin

Bitcoin’s recent rally paints an optimistic picture, with the cryptocurrency surging approximately 25% from its early September lows, marking the most substantial intraday gain since the market peak earlier this year.

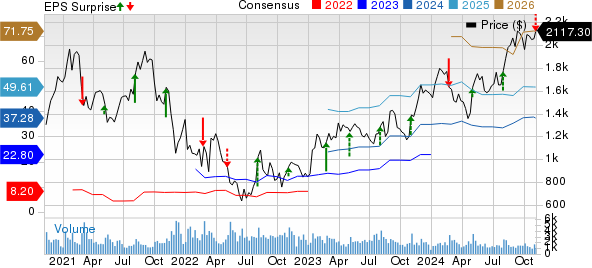

What sets this rally apart is Bitcoin’s ability to reclaim key moving averages, including the 50-, 100-, and 200-day metrics, indicating a potential shift in market sentiment. Unlike previous failed breakout attempts in May, July, and August, where Bitcoin struggled to maintain these levels, the current rally shows resilience in holding above these important thresholds.

This consistent ability to retake and sustain key moving averages points towards a more robust and sustained rally than seen earlier in 2024, potentially signaling a favorable time for investors to consider entering the market and diversifying their portfolios.

The simultaneous positive movements in both the stock and crypto markets suggest a broader sentiment shift towards risk-on assets, paving the way for a potential year-end rally in November and December. Investors are advised to keep a close watch on these developments for possible market opportunities.