Artificial intelligence (AI) evangelists hail its transformative influence on society and the economy. The impact of AI is already substantial, with predictions suggesting a $15.7 trillion boost to the global economy by 2030, according to PwC. At the forefront of this AI evolution is Nvidia (NASDAQ: NVDA), the leader in AI technology, soaring to all-time highs with its groundbreaking chips.

Nvidia’s forthcoming Grace Blackwell chip has sparked fervent interest, described as “insane” and “crazy” by industry leaders. The anticipation for its release begs the question: is it time to invest?

Nvidia’s Ongoing Innovations and Struggles

Nvidia remains committed to a rapid chip update cycle to maintain its dominance in the market. Each iteration promises exponential improvements, with Blackwell expected to be 400% more powerful than its predecessor, Hopper. This strategy creates a formidable barrier to entry for competitors like AMD, trailing in R&D expenditure.

Despite a slight setback in Blackwell’s production timeline due to a fabrication issue, Nvidia swiftly addressed the problem. The delayed release did not dent Nvidia’s strong position, with imminent Blackwell rollout indicating a bright future for the company.

The Business Impact of Blackwell and Assessment of Valuation

Nvidia’s collaboration with Foxconn to establish a cutting-edge production facility in Mexico for Blackwell chips signifies a strategic move to diversify its manufacturing operations. The surge in demand has led to pre-sold Blackwell chips for a year, underscoring strong market confidence in Nvidia’s products.

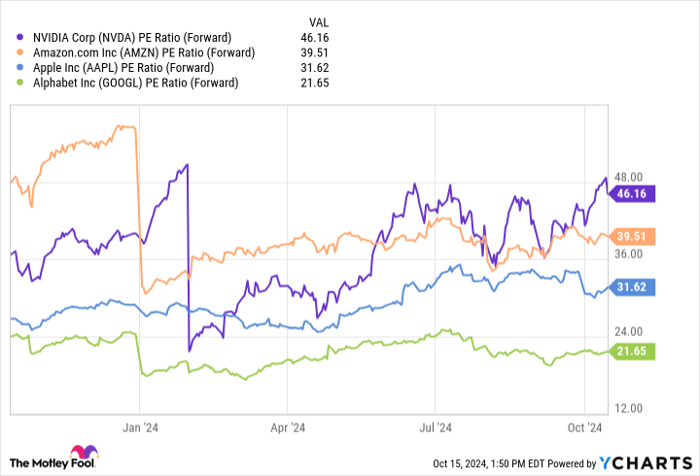

While the stock price reflects this optimism, potential investors must tread cautiously. Despite Nvidia’s promising trajectory, its high forward price-to-earnings ratio of 46 warrants scrutiny. Balancing enthusiasm with prudent evaluation is crucial in making investment decisions.

Considerations for Potential Investors

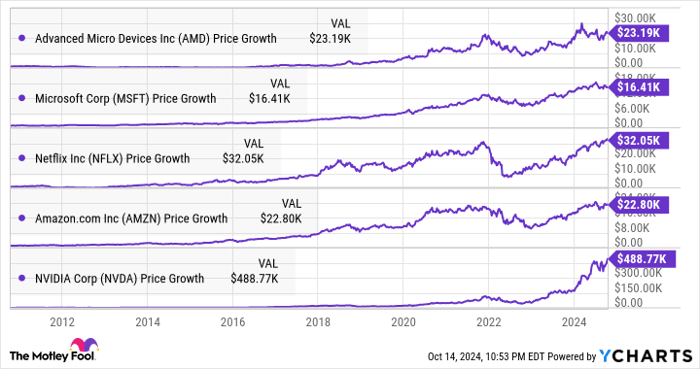

Before diving into Nvidia stock, ponder the insights from the Motley Fool’s Stock Advisor team, who identify the top stocks for future growth. Though Nvidia may not make the list, historically, its potential for substantial returns is evident. For instance, an investment of $1,000 in Nvidia in 2005 could have yielded an impressive $839,122.

Stock Advisor empowers investors with expert guidance and track record, outperforming the S&P 500 by a significant margin since 2002. While Nvidia’s prospects seem bright, careful monitoring of market dynamics and valuation metrics is essential for prudent investment decisions.

*Stock Advisor returns as of October 14, 2024