Amidst the financial tumult that unfurls in markets, a curious narrative enfolds within the realms of ETFs. ProShares Online Retail ETF (ONLN) has emerged, glimmering, catching the fancy of analysts. The shimmer of optimism surrounding ONLN stems from a surprising find – an optimistic 12-month forward target price set by analysts. As analysts wield their calculative tools and estimations dance through the air, a fascinating figure emerges – $53.18 per unit.

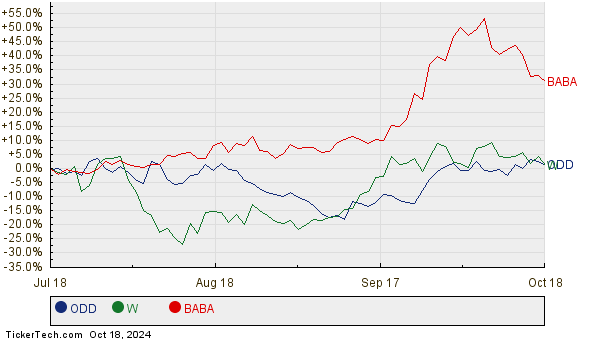

ONLN, now bobbing around $45.07 per unit, holds the promise of a 17.99% hike according to the perceptive gaze of analysts. This allure extends further to ONLN’s bedrock – three stalwart underlings – ODDITY Tech Ltd (ODD), Wayfair Inc (W), and Alibaba Group Holding Ltd (BABA). These three juggernauts, despite their recent prices, are foreseen to ascend to greater heights in the eyes of analysts. ODD boasts a target 28.46% above its recent figure, W stands at a promised 22.83% growth, and the grand BABA anticipates a captivating 18.42% leap. Behold the twelve-month price history chart depicting the bravado of ODD, W, and BABA in their stock performances!

The trio of ODD, W, and BABA cast a significant shadow over the ProShares Online Retail ETF, comprising a collective 10.68% of its being. A summary table is presented below, showcasing the analyst target prices that illuminate the optimistic landscape.

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| ProShares Online Retail ETF | ONLN | $45.07 | $53.18 | 17.99% |

| ODDITY Tech Ltd | ODD | $40.70 | $52.28 | 28.46% |

| Wayfair Inc | W | $52.57 | $64.57 | 22.83% |

| Alibaba Group Holding Ltd | BABA | $100.07 | $118.50 | 18.42% |

As the analysts paint their tapestry of predictions, the looming question is – are these targets grounded in reality, or do they soar excessively above the clouds of mere optimism? The analyst’s gaze, a beacon in the sea of unpredictability, may illuminate hidden paths or becloud true horizons. A high target, while a sign of optimism, may as well serve as a prelude to a sagging reality – a relic of a bygone era. In the intricate dance of stocks and numbers, investors must waltz cautiously, treading the fine line between hope and realism.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Funds Holding ILPT

Camden Property Trust MACD

Funds Holding FEBO