Amid a landscape often overshadowed by the allure of electric vehicle giants, the venerable Ford has been undergoing its own tumultuous odyssey in the realm of EVs. Nevertheless, a newfound strategy aimed at dealerships seems to have injected a much-needed dose of adrenaline. A novel pilot program is on the horizon, offering dealerships a handsome reward for ordering the coveted F-150 Lightning pickups, and lo and behold, Ford’s shares experienced a modest uptick in response.

The gist of this fresh scheme involves dealers placing orders for F-150 Lightning through Ford’s Retail Replenishment Centers, with potential bonuses amounting to a substantial $1,500 as per insights from Electrek. Over the forthcoming month, Ford’s dealers have the lucrative opportunity to rake in as much as $22,500 in incentives for embracing these new electric marvels.

Every order of an F-150 Lightning, whether XLT, Lariat, Flash, or Platinum, fetches an additional $1,000 from Ford. Impressively, those opting for a minimum of nine vehicles witness this base amount gracefully beefed up to $1,500 per unit. This window of profitability remains open until November 15, the expiration date of this tantalizing offer, allowing astute dealers to amass a grand total of $22,500 for ordering a fleet of 15 vehicles. Although the appetite for more is permissible, the incentives cap off at an enticing $22,500 figure.

Roadblocks and Workarounds: Ford’s Stance on Tesla Adapters

The buzz surrounding Tesla’s strategic move to establish its charging system as the North American standard was nothing short of a masterstroke, yet it hasn’t unfolded smoothly. Recently, Ford deemed it necessary to caution its customers against using the Tesla Supercharger system, along with the accompanying adapters, until revamped chargers hit the shelves.

A cautionary tale presented by Inside EVs hinted at a lurking “potential issue” related to these adapters. While the exact nature of this potential conundrum remains shrouded in mystery, its repercussions are startlingly clear – ranging from prolonged recharge times to potential damage to the charging port. Fortunately, replacements are being expedited, bringing a sigh of relief to all Ford EV owners grappling with the widespread presence of the Tesla Supercharger network.

Analysts’ Verdict: Is Now the Time to Invest in Ford Stock?

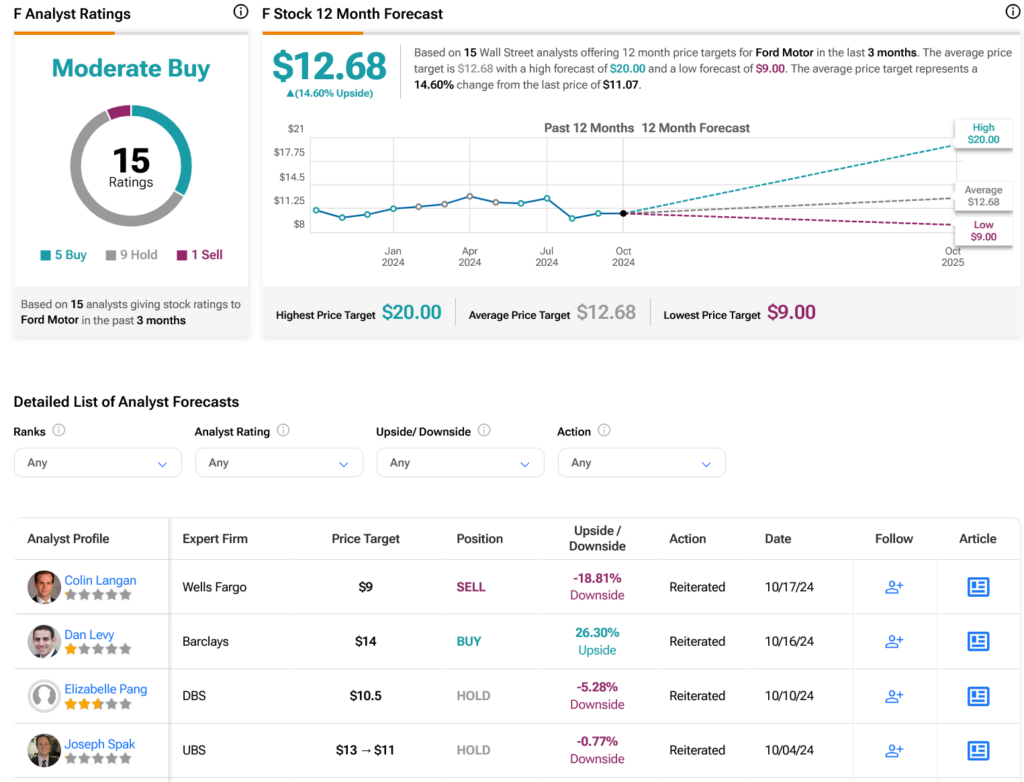

Shifting attention to the financial arena, experts on Wall Street have reached a consensus rating of Moderate Buy for Ford’s stock, with a tally of five Buys, nine Holds, and one Sell over the past quarter, as depicted by the graph below. Following a 3.12% surge in its share price over the last year, the average price target for F stands at a promising $12.68 per share, suggesting an enticing 14.6% growth potential.