Nvidia’s Market Surge and the Bullish Projections

Nvidia Corp NVDA shares closed up 0.8% at $138 on Friday, pushing its market capitalization over $3 trillion. Market experts believe the stock has even more room to grow, with some projecting its valuation to reach $4 trillion.

CEO of Lumida Wealth Management, Ram Ahluwalia, expressed optimism about the company’s trajectory, affirming a bullish outlook of a $4 trillion market cap. Similarly, T. Rowe Price portfolio manager Tony Wang and Dan Niles of Niles Investment Management foresee significant growth, with Niles stating, “You’ll see Nvidia’s revenues double over the next several years, and I think you’ll see the stock double over the next several years.”

Goldman Sachs backs this sentiment, highlighting Nvidia’s potential in the Inference compute sector. The investment firm believes Nvidia is well-positioned to seize growth opportunities, with a price target of $150 for the stock.

Bofa Securities recently revised Nvidia’s price target from $165 to $190 while maintaining a ‘Buy’ rating on the stock. The overall analyst consensus places Nvidia’s price target at $234.49 based on ratings from 38 analysts.

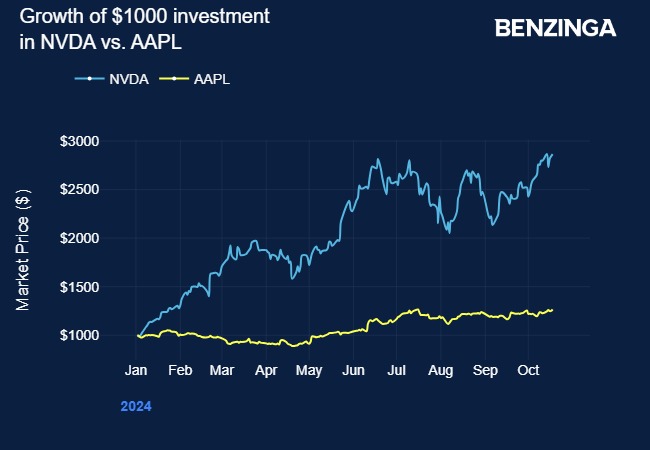

The Impact of Nvidia’s Ascension Nvidia’s stock has witnessed a staggering 233% surge in the past year, soaring from $41 to $138. This uptrend has outpaced even ETFs tracking Nvidia, such as GraniteShares 2x Long NVDA Daily ETF (NVDL) and Direxion Daily NVDA Bull 2X Shares (NVDU), which have recorded gains of at least 440% during the same period. The company now boasts a market cap of about $3.39 trillion, positioning it just behind Apple in market capitalization.

Despite Apple’s market cap of $3.57 trillion, Nvidia’s remarkable growth trajectory has caught the attention of investors worldwide. The stock’s year-to-date increase of nearly 186.5% signifies its robust performance in the volatile tech market landscape, cementing its position as a leading player in the sector.

Image Source: Shutterstock