1. National Security Concerns Spark US Government to Contemplate AI Chip Export Limits

A recent report from Bloomberg highlighted the potential implementation of sales restrictions on advanced artificial intelligence (AI) chips from American firms to specific nations by the US government. The main focus seems to be countries in the Persian Gulf, notably the United Arab Emirates and Saudi Arabia, as detailed by sources familiar with the situation.

Both these nations have deeply delved into AI investments, with notable contributions from the United Arab Emirates’ Mubadala Investment Firm to Anthropic, and Saudi Arabia’s reported US$40 billion investment fund established in collaboration with Andreessen Horowitz.

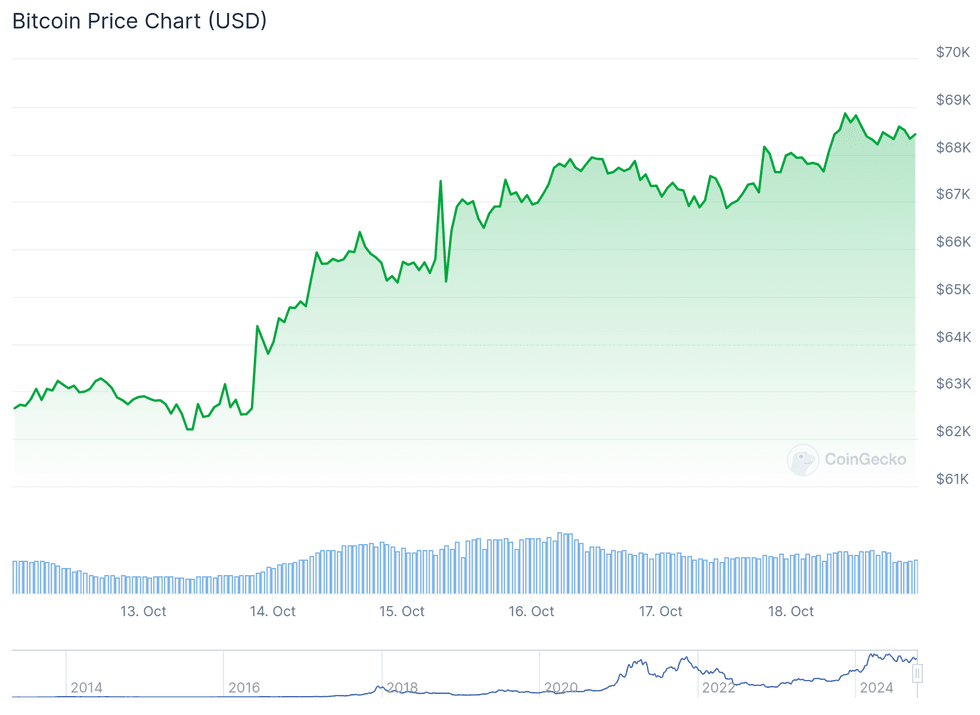

Chart via Google Finance.

NVIDIA and AMD performance, October 14 to 18, 2024.

Following this revelation, NVIDIA (NASDAQ:NVDA) shares depreciated by over 4% the day after the report circulated, despite recording its highest closing value since June just a day earlier. Similarly, AMD (NASDAQ:AMD), a prominent competitor of NVIDIA, saw its shares plummet by over 4% on Tuesday morning.

According to Bloomberg, major stakeholders such as Intel, AMD, and NVIDIA, alongside representatives from the Bureau of Industry and Security and the White House National Security Council, have refrained from commenting on the issue.

2. ASML’s Q3 Performance Disappoints, Sending Ripples Across Semiconductor Industry

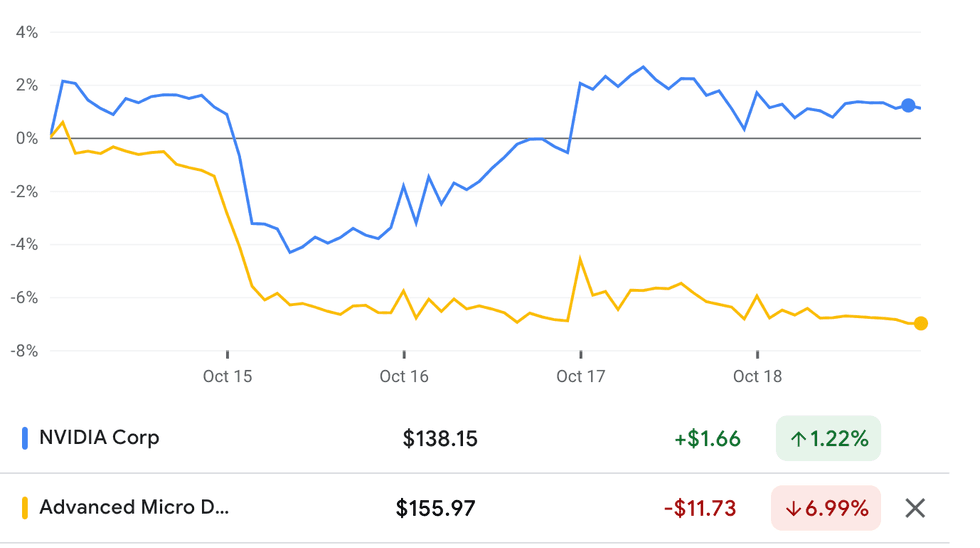

In another turn of events on Tuesday, ASML (NASDAQ:ASML) mistakenly released its Q3 results ahead of the intended schedule, unveiling a downward revision in sales expectations from 40 billion euros to 35 billion for the year 2025.

The Q3 results also failed to meet revenue projections by more than half, leading to a nearly 16% plunge in the company’s stock value, wiping out approximately 50 billion euros from its market capitalization.

ASML CEO Christophe Fouquet addressed the situation in a press release, stating, “While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover. It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, which is leading to customer cautiousness.”

Chart via Google Finance.

ASML performance, October 14 to 18, 2024.

The repercussions of ASML’s underwhelming performance reverberated throughout the semiconductor industry, given ASML’s pivotal role as a primary supplier to numerous leading chipmakers globally. Consequently, TSMC, a key client of ASML, witnessed a 3.3% dip in its share value in early Tuesday trading, before its own Q3 results release two days later. Intel (NASDAQ:INTC) and Samsung (KS:5930) observed decreases exceeding 2% each, contributing to a 5.1% decline in the Philadelphia Semiconductor Index.

Silicon Valley Giants Ride Strong Earnings Wave Amid Semiconductor Market Fluctuations

TSMC Delivers Upbeat Financials, Raises Revenue Forecast

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) unveiled robust third-quarter results, surpassing expectations and boosting its revenue growth target to approximately US$26 billion. This positive shift marks a significant uptick from the previous forecast range of US$22.4 billion to US$23.2 billion declared in Q2. The latest earnings report showcases a staggering 39 percent year-on-year increase to nearly US$23.5 billion, representing a remarkable 13 percent growth from the previous quarter. Furthermore, net income soared by an impressive 31.2 percent, enticing investors to drive the stock price above US$200 for the first time this year ahead of the financial release.

Amidst Chipmaker Woes, TSMC Sees Bright Future

In a contrast to ASML’s woes due to sluggish chip demands and export restrictions, TSMC’s stellar performance illuminates a more sanguine picture. TSMC’s Senior VP and Chief Financial Officer, Wendell Huang, attributed the solid third-quarter showing to the robust demand from smartphone and AI sectors for the company’s cutting-edge 3nm and 5nm technologies. Anticipating this momentum to continue into the fourth quarter of 2024, Huang foresees sustained strength in their business driven by the thriving demand for their leading-edge process technologies. The optimistic outlook has not only reinforced investor confidence but also propelled shares of TSMC’s key customers, NVIDIA and Apple, to an upward trajectory.

Google and Amazon Transition Towards Sustainable Nuclear Energy

Following Microsoft’s recent foray into nuclear-powered data centers, Big Tech titans Google and Amazon have now pivoted towards embracing nuclear energy to meet their escalating power requirements sustainably. Google inked an agreement with Kairos Power to procure nuclear energy generated from small modular reactors (SMRs) with an eye on achieving its ambitious net-zero objectives. The agreement entails the deployment of several SMRs, the first of which is slated to start operation by 2030, followed by subsequent roll-outs until 2035. On the other hand, Amazon sealed agreements with Energy Northwest, X-Energy, and Dominion Energy (NYSE:D), signaling a tangible commitment to support the development of SMRs in Virginia and Washington.

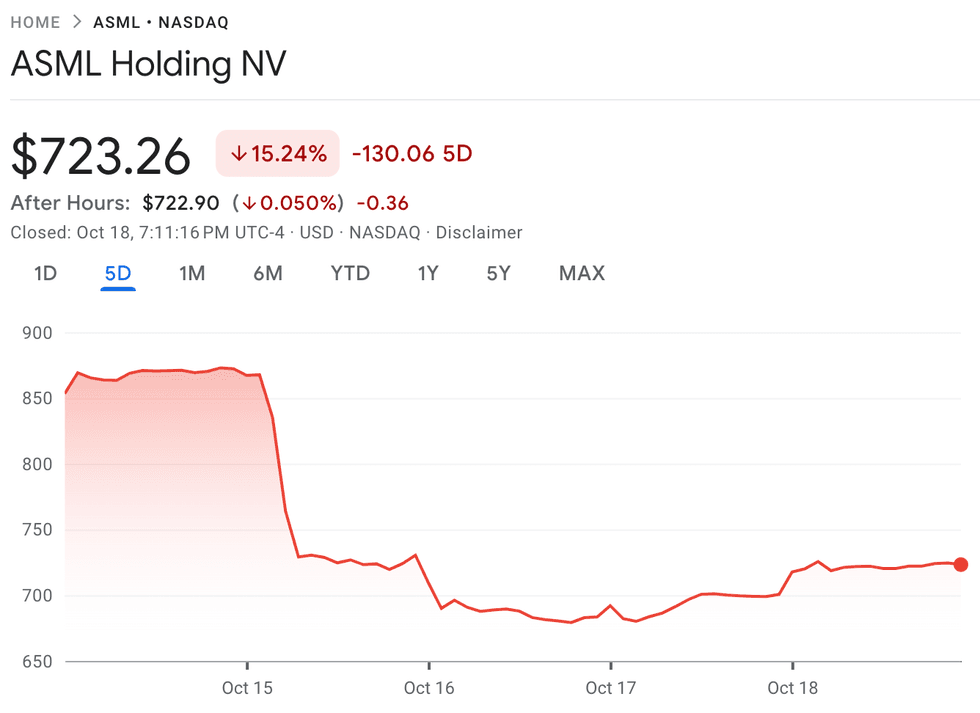

Chart via Google Finance.

TSMC and ASML performance, October 14 to 18, 2024.

Don’t forget to follow us @INN_Technology for real-time news updates!