Unveiling PTC’s Financial Landscape

PTC Inc., with a market capitalization of $22.1 billion, spearheads the provision of software solutions and services for manufacturing entities. Operating out of the industrious hub of Boston, Massachusetts, the company’s software arsenal encompasses a diverse range of tools. From computer-aided design modeling to product lifecycle management and data orchestration, PTC’s suite of products is geared towards aiding companies in product design, operation, and management. The company’s fiscal prowess will be under the microscope as it gears up to unveil its fiscal Q4 earnings following market closure on November 6.

Analyst Prognoses and Financial Projections

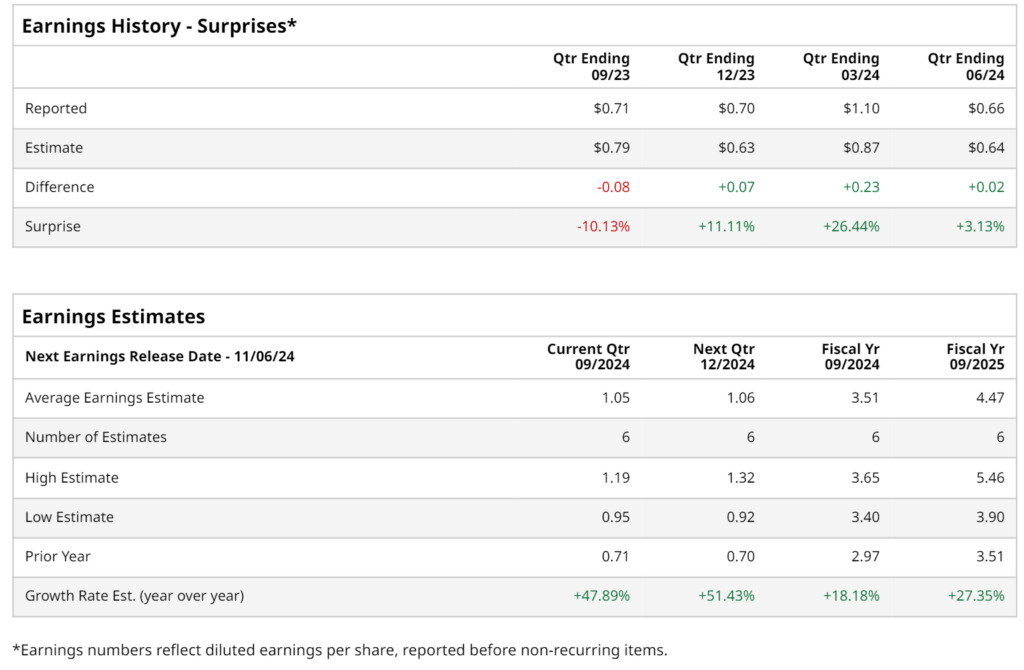

Financial soothsayers have forecasted PTC to reveal a profit of $1.05 per share for the imminent quarter, a robust 47.9% climb compared to the $0.71 per share figure from the corresponding period last year. Over the last quartet of quarters, PTC has surpassed the expectations of Wall Street pundits three out of four times. In its Q3 disclosure, the company’s adjusted earnings per share of $0.98 aligned with consensus estimates.

Looking beyond the immediate future, analysts foresee a fiscal 2024 earnings per share of $3.51, marking an 18.2% upswing from the prior fiscal year. Additionally, the EPS trajectory is expected to ascend by 27.4% year-on-year, breaching the $4.47 mark in fiscal 2025.

Market Performance and Investor Sentiment

On a year-to-date basis, PTC’s share price has experienced a 5.4% uptick, trailing both the S&P 500 Index’s nearly 23% rally and the Technology Select Sector SPDR Fund’s 20% return over the same period. Following its Q3 earnings disclosure, despite aligning with earnings projections, PTC’s stock witnessed a 1.1% decline. The revenue figure of $518.6 million fell short of the $533 million consensus estimate and recorded a 4% dip compared to the previous year. Notably, the decrease stemmed from a drop in license and professional services revenues, while an uptick of 8.2% in support and cloud services revenues offered some respite. The company’s 1% year-over-year decline in adjusted EPS, coupled with a 240-bps drop in non-GAAP operating margin to 31.7%, might have chipped away at investor confidence.

Closing Thoughts and Investor Outlook

Despite the recent setbacks, the consensus among analysts remains bullish on PTC’s stock, denoting a steadfast “Strong Buy” recommendation. Out of the 18 analysts covering the stock, 14 signal a “Strong Buy,” one leans towards a “Moderate Buy,” while three advocate a “Hold.” The average analyst price target for PTC stands at $203.61, pointing towards a potential 10.4% upside from current levels.