Acting as the financial market’s behind-the-scenes directors, activist investors wield substantial influence by either making bullish investments or advocating for structural change that can inject dynamism into stock activities.

The impact of these investor interventions may vary in terms of duration, but the recent strategic moves made by activists in the stock market have had a profound effect on certain equities, aligning with fundamental market trends.

Thriving amidst Global Oil Demand: Talos Energy, Inc.

In light of the latest revelations from the International Energy Agency’s (IEA) October Oil Market Report (OMR), the surge in global oil demand projected to arise from the existing 102.8 million barrels per day (mb/d) supply portends a favorable outlook for the market. Despite a marginal rise from the previous yearly low in September, oil prices at $74 per barrel remain depressed, marking an 11% decline over the past three months.

Against a backdrop of heightened geopolitical tensions between Iran and Israel, the specter of oil supply disruptions continues to loom large, particularly consolidating the Gulf of Mexico’s critical position in the global oil supply chain. Talos Energy, ranked as the 5th largest operator in the Gulf of Mexico, has strategically positioned itself to capitalize on this advantageous scenario. The company specializes in offshore oil and gas acquisition and development, focusing on deepwater and shallow water fields.

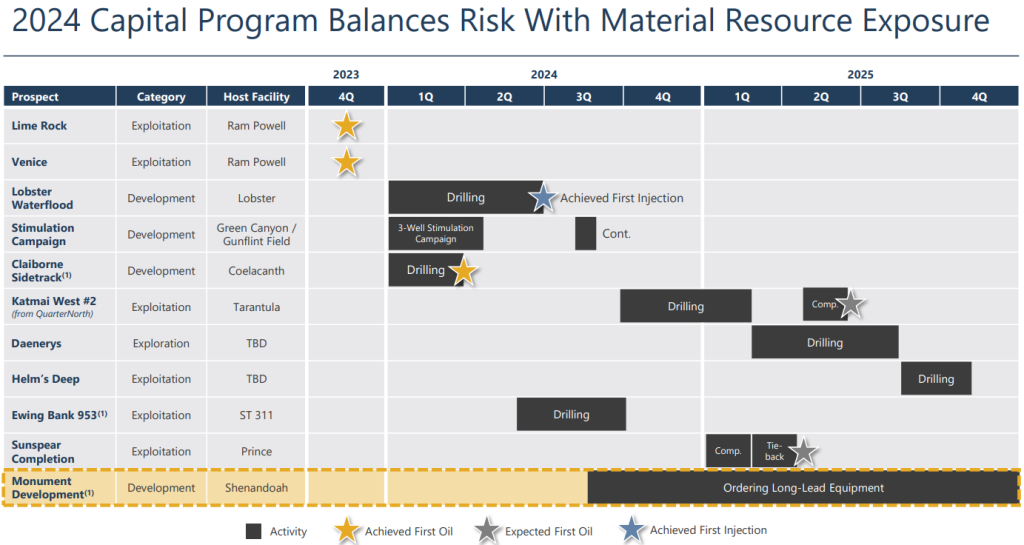

In its Q2 2024 financial report, Talos Energy demonstrated resilience by reducing its debt burden by $100 million, surpassing the estimated free cash flow of $119.6 million with an actual figure of $148 million. With a strategic emphasis on low leverage and high-margin oil production, Talos is actively expanding its asset base across various exploration ventures, including Katmai, Helms Deep, Ewing Bank, and Daenerys.

Renowned Mexican tycoon Carlos Slim recently bolstered his investment in Talos Energy by acquiring 2,166,000 TALO shares at an average price of $10.76, progressively raising his stake to 22% of the company’s outstanding shares. Despite TALO shares currently trading at $9.67, reflecting a 26% decline year-to-date, analysts project an optimistic price target range, with the average estimate standing at $15.93 per share, well above the current market value.

Flight Path to Reinvention: Southwest Airlines Company

Headquartered in the heart of Texas, Southwest Airlines has carved a niche for itself through its customer-centric approach, offering point-to-point service, flexible flight change policies, and complimentary baggage allowances. In response to mounting pressure from activist investors, the company’s COO hinted at the inevitability of ‘tough decisions’ aimed at enhancing profitability.

Embracing a transformation agenda, Southwest Airlines is set to introduce fare adjustments for seats with enhanced legroom, transition from open to assigned seating arrangements, and introduce red-eye flights – overnight journeys that span across the night and culminate the following morning. The company also bolstered investor confidence by unveiling a $2.5 billion stock repurchase program in September.

During the Q2 2024 financial disclosure, Southwest Airlines reported a net income of $367 million, a significant decrease from the $683 million recorded in the corresponding quarter of the previous year. Operating expenses surged from $6.2 billion to $6.9 billion over the same period, signaling the operational challenges facing the airline.

Distinguished activist investor Elliott Management flexed its muscle by upping its stake in Southwest Airlines, acquiring 7 million LUV shares in early August within the price range of $24.48 to $25.55 per share. This move elevated Elliot Management’s ownership to 8.2% of the total outstanding shares, prompting calls for the removal of current CEO Robert E. Jordan, who assumed office in February 2022. Despite trading at $30.23 presently, LUV stock has witnessed a 6.2% uptick year-to-date with an average price target of $29.25 per share, slightly below the 52-week average of $28.38.

The Crypto Minefield: Bitdeer Technologies Group

Celebrated for its superior profitability relative to industry behemoth BlackRock, Tether Holdings intensified its stake in Bitdeer Technologies Group during early August, acquiring 2 million BTDR shares within the price range of $7.19 to $8.30 per share. This move propelled Tether’s ownership to 27% of Bitdeer’s total shares outstanding.

Operating as a key player in cloud hash rate services and boasting its proprietary mining infrastructure, Bitdeer stands out with its cutting-edge ASIC chip development, exemplified by the Sealminer Seal02 released in Q3 2024. This innovative chip boasts an impressive energy efficiency rating of 13.5 J/TH and is poised for mass production by the close of 2024.

Bolstered by substantial financial resources, Tether Holdings unveiled plans to inject approximately $500 million across various Bitcoin mining ventures throughout 2024, spanning strategic investments in Uruguay, El Salvador’s Volcano Energy, ZettaHash, German firm Northern Data AG, and Swan Mining. Notably, Bitdeer stands to benefit from Tether’s strategic Bitcoin portfolio commitment, encompassing a $100 million stake.

Despite a slight downturn in Bitdeer’s stock performance, currently priced at $8.22 and down 7.4% year-to-date, the median price target stands at $14 per share, indicating a positive trajectory. With a robust Bitcoin mining capacity pipeline slated for completion by 2026 and Bitcoin prices up by 51% year-to-date at $66.8k, even the Federal Reserve has expressed concerns over the potential disruptive impact of Bitcoin on traditional financial frameworks.

Animed with strategic foresight and financial acumen, activists investors play a pivotal role in reshaping the stock landscape, steering companies toward renewed growth trajectories amidst a volatile market equilibrium.

***

Neither the author, nor this website, provide financial advice. Please make informed decisions based on your own research and due diligence.