Unusual Activity in Precious Metals

SPDR Gold Trust (GLD), a barometer for precious metals, caught market attention with unusual options activity signaling a “bearish” sentiment, despite its recent upward trajectory.

Options Activity Analysis

Notably, a significant trade involved 125 contracts of the $193 call option expiring in January 2027, with a premium of $73.60, indicating a skeptical outlook on GLD’s potential to reach profitability.

Contrarian Perspective

While GLD has exhibited resilience, some traders may be betting on cooling inflation trends, which could dampen the outlook for gold that typically thrives in inflationary environments.

Insights on Direxion ETFs

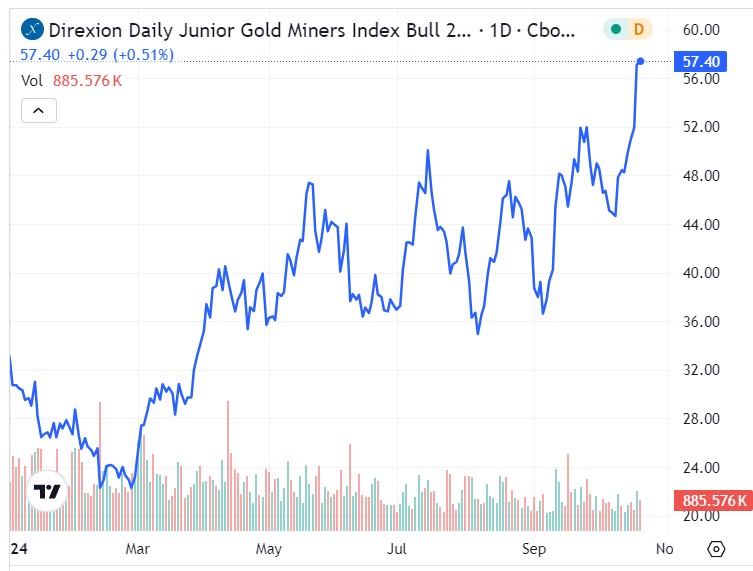

Direxion’s leveraged gold ETFs, JNUG and JDST, offer investors exposure to the underlying mining industry, with JNUG providing 2X daily results of the MVIS Global Junior Gold Miners Index and JDST doing the same but in the opposite direction.

Considerations for Investors

Investors should be mindful that these ETFs are designed for short-term exposure due to daily compounding effects that may impact long-term performance.

Performance Review: JNUG and JDST

Concerning performance, JNUG has seen substantial gains this year, supported by technical indicators such as its 200-day moving average, suggesting a bullish trend.

- JNUG’s recent surge above the 50-day moving average signals further potential in the gold market.

- Conversely, JDST has faced headwinds due to inflation challenges, resulting in a significant decline, with the 200-day moving average acting as a resistance level.

- Despite recent losses, a decline in selling volume may hint at a possible reversal for JDST.

All in all, the juxtaposition of the GLD options activity with the performance of JNUG and JDST ETFs paints a complex picture of the sentiment surrounding gold and leveraged funds. Investors should tread carefully amidst these shifting market dynamics.

Market News and Data brought to you by Benzinga APIs