Tesla Inc. TSLA is no longer viewed as a car company by most investors, The Future Fund Managing Partner Gary Black said on Tuesday, reflecting on the company’s high price-earnings ratio.

What Happened: “With future expected EPS growth of 25-30%, TSLA trades at 84x FY’25 Adj EPS vs 5-6x for legacy auto companies,” Black said in a post on social media platform X.

A company’s price-earnings ratio, he noted, is based on future expected growth rate and not the company’s current business and Tesla has its feet into EVs and autonomous driving – two of the highest growth aspects of the auto business.

Once Tesla’s profits from its auto business fall below 50% of its overall profit, Wall Street will no longer compare it to other car companies, Black said, while also noting that in the last quarter, the company’s auto business profit accounted for just 80% of its overall profit.

Black on Monday raised his 6-12 month price target on Tesla from $270 to $300 citing improved earnings projections and market indicators. Black’s adjusted earnings per share estimates now stand at $2.40 for FY’24 and $3.60 for FY’25, slightly above Wall Street consensus.

See Also: Cathie Wood’s Ark Invest Sees Tesla Unlocking $11 Trillion Revenue Potential With Robotaxi Fleet, Eclipsing Uber And Lyft

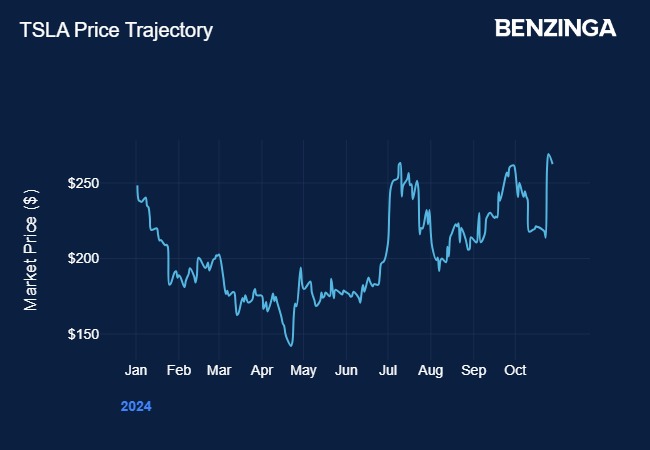

Why It Matters: Tesla’s stock was on a more-or-less downward trajectory since the start of the year until the company reported its third-quarter earnings last week on Oct. 23 and gave upbeat forecasts.

The company reported third-quarter earnings per share of 72 cents, beating a Street consensus estimate of 58 cents per share.

Musk also said that he expects vehicle sales to grow 20% to 30% next year, addressing investor concerns of falling EV demand. For 2024 too, the company is looking to exceed its delivery numbers from last year.

Price Action: Tesla shares closed down 2.5% at $262.51 on Monday. The stock is up 5.7% year-to-date and up by nearly 21% over the past five days, according to data from Benzinga Pro.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Tesla

Market News and Data brought to you by Benzinga APIs