Advanced Micro Devices AMD reported third-quarter 2024 non-GAAP earnings of 92 cents per share, beating the Zacks Consensus Estimate by 1.10%. The figure surged 31.4% year over year.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Revenues of $6.82 billion beat the Zacks Consensus Estimate by 1.59% and increased 17.6% year over year, as well as 17% sequentially.

The top-line growth benefited from robust Data Center and Client revenues, partially offset by sluggishness in the Gaming and Embedded segments.

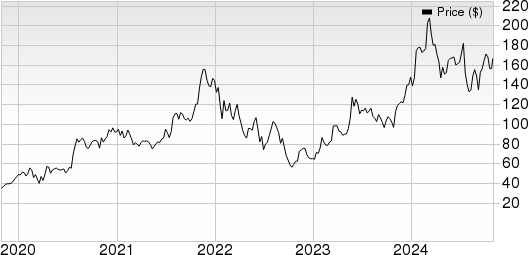

Advanced Micro Devices, Inc. Price, Consensus and EPS Surprise

Advanced Micro Devices, Inc. price-consensus-eps-surprise-chart | Advanced Micro Devices, Inc. Quote

AMD shares were down roughly 8.45% in pre-market trading, given the unimpressive fourth-quarter 2024 guidance.

AMD shares have underperformed the Zacks Computer & Technology sector year to date. Shares have appreciated 12.8%, while the broader sector has returned 26.4%.

AMD Q3 Top Line Rides on Data Center Growth

Data Center revenues surged 122.1% year over year to $3.55 billion and accounted for 52% of total revenues. Sequentially, revenues increased 25%.

AMD’s top line benefited from the well-grounded Instinct product portfolio and strong growth in the fourth-gen EPYC CPU sales.

Exiting third-quarter 2024, AMD’s public cloud instances increased 20% year over year to more than 950, with Microsoft, AWS, Uber and Netflix deploying it at scale.

Meta Platforms alone employed more than 1.5 million EPYC CPUs globally to power its social media platforms. EPYC instance adoption by enterprise customers also expanded, with notable wins from Adobe, Boeing, Tata, among others.

The chipmaker has diversified its enterprise customer portfolio in the third quarter of 2024 with wins from energy, large technology and automotive companies, including Airbus, FedEx, HSBC, Walgreens and others.

Microsoft expanded its usage of MI300X accelerators to power GPT-4 and multiple co-pilot services, including Microsoft 365 Chat, Word and Teams.

AMD remains acquisitive with the announcement of its agreement to acquire ZT Systems, which provides AI infrastructure to large hyperscale computing companies. This will enable AMD to simultaneously design and validate its next-gen AI silicon and systems, speeding up large-scale deployment of data center accelerators.

The Client segment’s revenues soared 29.5% year over year to $1.88 billion and accounted for 27.6% of total revenues. Sequentially, revenues increased 26%.

The Gaming segment’s revenues fell 69.3% year over year to $462 million and accounted for 6.8% of total revenues. Sequentially, revenues declined 29%.

The Embedded segment’s revenues were $927 million, down 25.4% year over year, but up 8% sequentially. The segment accounted for 13.6% of total revenues.

AMD’s Margins Expand Y/Y in Q3

Non-GAAP gross margin expanded 300 basis points (bps) on a year-over-year basis to 54% driven by growth in the Data Center and Client segment.

Non-GAAP operating expenses increased 15.3% year over year to $1.72 billion.

Non-GAAP operating margin expanded 300 bps on a year-over-year basis to 25% in the third quarter.

AMD’s Balance Sheet & Cash Flow Remains Strong

As of Sept. 28, 2024, AMD had cash and cash equivalents of $3.89 billion compared with $4.11 billion as of June 29, 2024.

As of Sept. 28, 2024, total debt was $1.72 billion, unchanged from the figure reported as of June 29, 2024.

Operating cash flow was reported at $628 million compared with $593 million in the second quarter of 2024.

Free cash flow was $496 million in the first quarter of 2024 compared with $439 million in the second quarter of 2024.

AMD’s Q4 Guidance Unimpressive

AMD expects fourth-quarter 2024 revenues to be $7.5 billion (+/-$300 million). At the mid-point of the revenue range, this represents year-over-year growth of approximately 22% and sequential growth of approximately 10%.

Sequentially, AMD expects strong growth in the Data Center, Client and Gaming segment.

Year over year, AMD expects Data Center and Client segment revenues to be up significantly, driven by the strong product portfolio. The Embedded and the Gaming segment revenues are expected to decline.

For the fourth quarter, AMD expects non-GAAP gross margin to be roughly 54%. Non-GAAP operating expenses are expected to be nearly $2.05 billion.

AMD’s Zacks Rank & Stocks to Consider

Currently, AMD carries a Zacks Rank #4 (Sell).

AudioEye AEYE, Astera Labs ALAB and Angi ANGI are some better-ranked stocks in the broader sector. Each of the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AudioEye shares have gained 319.4% year to date. AEYE is set to report its third-quarter 2024 results on Nov. 7.

Astera Labs shares have gained 19.4% year to date. ALAB is set to report its third-quarter 2024 results on Nov. 4.

Angi shares have lost 3.6% year to date. Angi is set to report its third-quarter 2024 earnings on Nov. 11.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Angi Inc. (ANGI) : Free Stock Analysis Report

Audioeye, Inc. (AEYE) : Free Stock Analysis Report

Astera Labs, Inc. (ALAB) : Free Stock Analysis Report