Datadog DDOG reported third-quarter 2024 non-GAAP earnings of 46 cents, which increased 27.8% from the year-ago quarter and beat the Zacks Consensus Estimate by 17.95%.

Revenues of $690 million rose 26% year over year and beat the consensus estimate by 4.15%.

Following the results, DDOG shares rose 1.12% in the pre-market trading. Datadog’s stock has gained 6.9% against the Zacks Computer and Technology sector’s rise of 28.5% in the year-to-date period.

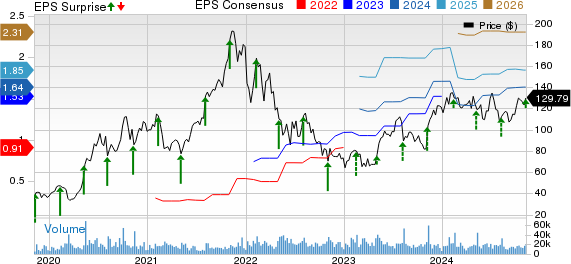

Datadog, Inc. Price, Consensus and EPS Surprise

Datadog, Inc. price-consensus-eps-surprise-chart | Datadog, Inc. Quote

DDOG’s Quarterly Details

Datadog ended the third quarter with 29,216 customers, up from 26,800 in the prior-year period.

In the third quarter of 2024, the company had 3,490 customers with an annual run rate (ARR) of $100,000 or more, which increased 12% year over year. These customers generated about 88% of the total ARR.

At the end of the third quarter, 83% of customers used two or more products, up from 82% in the year-ago quarter. Additionally, 49% of customers utilized four or more products, up from 46% in the year-ago quarter.

Datadog’s net revenue retention was in the mid-110s in the third quarter as customers increased their usage and adopted more products.

Datadog’s Operating Results

In the third quarter, DDOG’s adjusted gross margin decreased 120 basis points (bps) on a year-over-year basis to 81.1%.

Research and development expenses grew 25.2% on a year-over-year basis to $195 million, led by increased investments. Research and development, as a percentage of revenues, decreased 20 bps to 28.3%.

Sales and marketing expenses rose 22.1% year over year to $155.8 million. Sales and marketing expenses, as a percentage of revenues, contracted 70 bps to 22.6%.

General and administrative expenses decreased 1.9% year over year, reaching $36.1 million in the reported quarter. As a percentage of revenues, these expenses contracted 150 basis points to 5.2%.

Datadog reported a non-GAAP operating income of $173 million compared with $130.8 million in the year-ago quarter. The company’s operating margin improved 120 bps to 25.1%.

DDOG’s Balance Sheet & Cash Flow

As of Sept. 30, 2024, Datadog had cash, cash equivalents and marketable securities of $3.2 billion compared with $3.0 billion as of June 30, 2024.

The operating cash flow was $228.7 million in the reported quarter, up from $164.4 million in the previous quarter.

The free cash flow was $203.6 million in the quarter compared with $143.8 million in the prior quarter.

Datadog’s Q4 & 2024 Guidance

For the fourth quarter of 2024, DDOG anticipates revenues between $709 million and $713 million. Non-GAAP operating income is expected to be $163-$167 million. Non-GAAP earnings are anticipated to be 42-44 cents per share.

For 2024, Datadog expects revenues between $2.656 billion and $2.660 billion. Non-GAAP operating income is likely to be $658-$662 million. Non-GAAP earnings per share are projected between $1.75 and $1.77.

Zacks Rank & Stocks to Consider

Currently, Datadog carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader Zacks Computer & Technology sector are StoneCo STNE, NVIDIA NVDA and Bilibili BILI. StoneCo sports a Zacks Rank #1 (Strong Buy), and NVIDIA and Bilibili carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

StoneCo shares have lost 37% in the year-to-date period. STNE is set to report third-quarter fiscal 2025 results on Nov. 12.

NVIDIA shares have jumped 200.3% year to date. NVDA is set to report third-quarter fiscal 2025 results on Nov. 20.

Bilibili shares have gained 98.3% year to date. BILI is set to report third-quarter 2024 results on Nov. 14.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Bilibili Inc. Sponsored ADR (BILI) : Free Stock Analysis Report

StoneCo Ltd. (STNE) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report