The Rise of NVIDIA and Advanced Micro Devices

In a midweek session, NVIDIA Corp. (NVDA) and Advanced Micro Devices, Inc. (AMD) witnessed significant market value growth, with NVDA stocks surging over 8% and AMD not far behind at nearly 5% up. These tech giants are pivotal players in the artificial intelligence landscape, with their advanced graphics processors powering various AI platforms.

The Impact of U.S. Government Decisions

Recent considerations by the U.S. government to allow Nvidia to export its cutting-edge chips to Saudi Arabia, in opposition to previous restrictions aimed at countering China, could potentially invigorate NVDA and similar companies. Despite recent sluggishness in their forward momentum, positive news, such as potential equity financing by OpenAI, involving Nvidia, Microsoft Corp. (MSFT), and Apple Inc. (AAPL), hints at growth, especially with the rising popularity of large language models.

Challenges Amidst the AI Boom

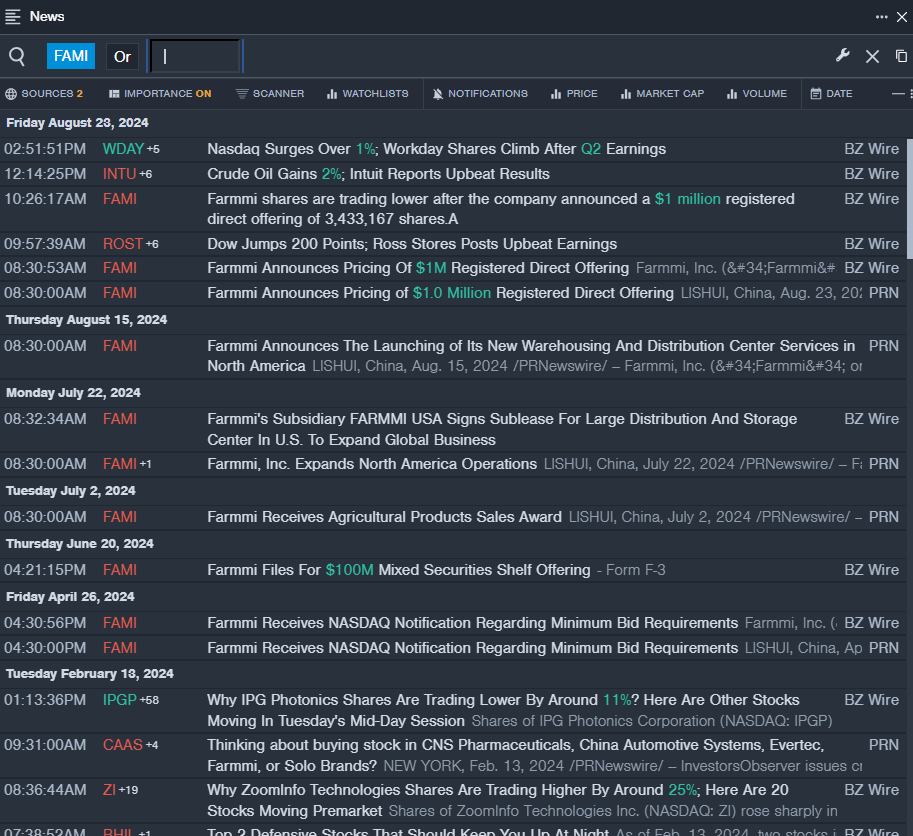

While AI-centric companies are thriving, those with focuses outside AI, like traditional software firms, are facing hurdles. This contrasts starkly with companies that leverage AI and big data, such as Asana Inc. (ASAN), which admitted to overexpansion during the pandemic, prompting market adjustments that could endanger inflated valuations.

The Direxion ETFs Opportunity

For traders seeking to capitalize on AI trends, the Direxion Daily AI and Big Data Bull 2X Shares (AIBU) and the Direxion Daily AI and Big Data Bear 2X Shares (AIBD) from Direxion present enticing options. These ETFs align with the Solactive US AI & Big Data Index, allowing investors to potentially profit from daily movements in the sector.

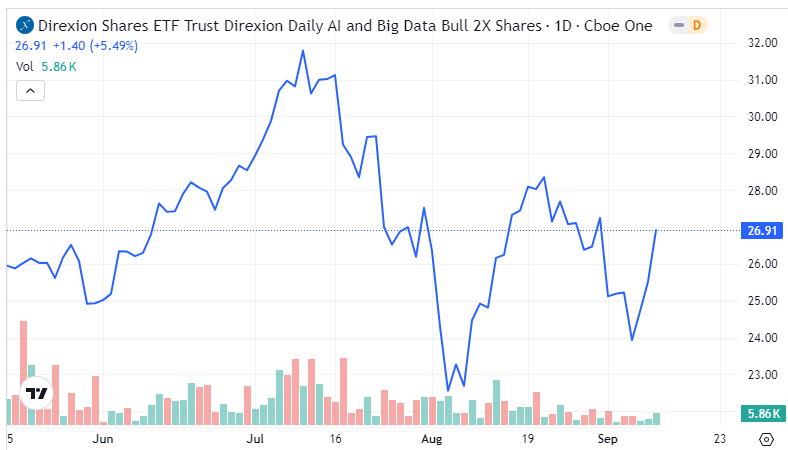

The AIBU ETF Performance

Despite an optimistic start, the AIBU ETF has faced resistance lately, struggling to surpass key resistance levels. Overcoming these hurdles, especially the $27 and $29 marks, is crucial for sustained growth, reminiscent of the challenges NVDA stock is currently grappling with.

The AIBD ETF Performance

Contrary to AIBU, the AIBD ETF struggled initially in 2024 but has shown signs of stabilizing in the latter part of the year. While facing challenges in Wednesday’s session, AIBD has found support around the $22 mark, indicating significant interest in betting against the prevailing AI narrative.

Featured photo by Brian Penny on Pixabay.

This post contains sponsored content. This content is for informational purposes only and not intended to be investing advice.