The electric vehicle (EV) landscape has hit a rough patch recently, with sales momentum in the U.S. slowing down, Chinese EVs seeking global market penetration, and a lackluster charging infrastructure in various regions. Unquestionably, Tesla (NASDAQ: TSLA) has been grappling with its fair share of challenges. However, amidst this cloud of adversity, some rays of hope have started to shine for the company’s shareholders, as indicated by the latest registration data for July.

EV Surge Sparks Optimism

Signaling a positive turn for the industry as a whole, new EV registrations soared by 18% in July compared to the previous year, driven in part by Tesla’s Cybertruck, according to U.S. data from S&P Global Mobility. Furthermore, electric vehicles’ share of the U.S. light-vehicle market climbed to 8.5% from 7.6% the prior year. The substantial 18% spike in registrations during the month outpaced the overall growth from January to July, where EV registrations rose by 8.7% year-over-year.

After experiencing a decline in sales for two consecutive quarters in Q2, Tesla managed to break its losing streak in July, with registrations edging up by a modest 1.2% compared to the previous year. Notably, a significant portion of this growth was attributed to the Cybertruck, a commendable achievement considering Tesla delivered 5,175 Cybertrucks, surpassing the combined delivery figure of 5,546 units for all other electric pickups.

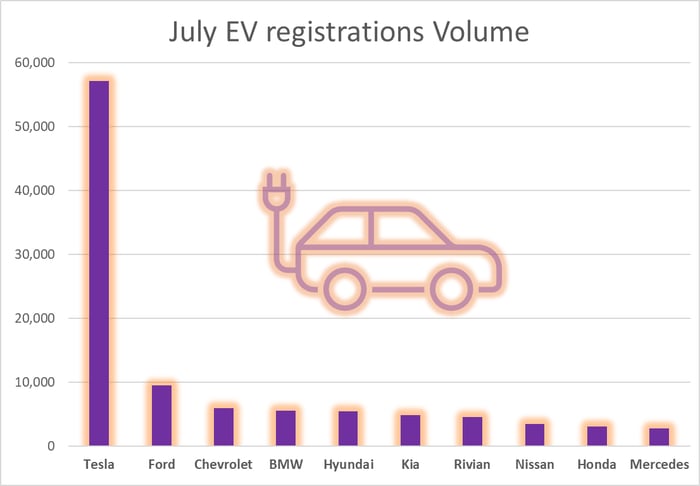

Despite the modest increase, Tesla’s stronghold in the domestic EV market remains formidable, evident from its leading position in July EV registrations as depicted in the graph below:

Graphic by author. Data source: S&P Global Mobility

Challenges on the Horizon

While July’s 18% surge is an encouraging development, it comes with a caveat. Currently, EVs are not moving off the shelves at their full manufacturer’s suggested retail prices, as manufacturers are heavily relying on incentives to bring their prices down to match gasoline-powered vehicles.

Specifically for Tesla, registrations for its Model 3 sedan took a hit in July, dropping by 31%. This downward trend has persisted throughout the year after the base Model 3 lost federal EV tax incentives at the beginning of the year due to regulatory changes affecting cars with battery components sourced from specific overseas entities.

Interpreting the Trends

As Tesla embarks on the third quarter with improved registration figures, it is undeniable that the EV competition landscape is intensifying. The emergence of new rival offerings in the EV segment poses challenges for Tesla as its existing models mature. Nonetheless, Tesla’s resilience shines through, reassuring investors of the durability of its investment thesis despite a temporary sales setback experienced over the past two quarters.

Considering the shifting tides in the EV industry, investors are advised to navigate cautiously when contemplating investing in Tesla. Though recent data offers a reassuring outlook for the company, the dynamic market conditions demand a strategic and informed approach from potential investors.