Home to over 90 snacking and restaurant brands spanning various dining sectors, MTY Food Group (OTC: MTYF.F) operates in the shadows of public recognition despite its widespread consumer engagement. The company boasts a notable array of well-known brands such as Papa Murphy’s, Cold Stone Creamery, Famous Dave’s, Village Inn, Wetzel’s Pretzels, Thai Express, and TacoTime, with a total of 7,100 locations worldwide.

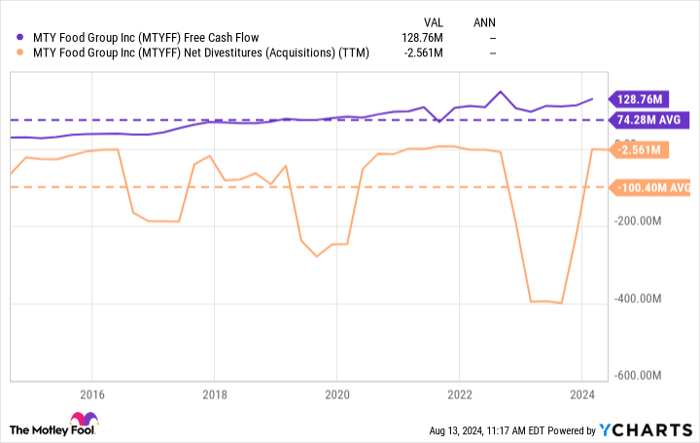

Adopting a franchise model for the majority of its operations, MTY Food Group’s asset-light profile has translated into consistently positive free cash flow (FCF) over the years. This financial stability has yielded remarkable total returns of 3,600% since the beginning of the century, outshining the S&P 500 index by a factor of seven.

A Strategic Path of Expansion: MTY Food Group’s Acquisitive Nature

MTY Food Group’s history of 50 acquisitions, 27 of which occurred in the last decade, underscores its strategic growth trajectory. Unlike companies reliant on large one-time mergers for expansion, serial acquirers like MTY tend to outperform in the long run.

By focusing their free cash flow on disciplined acquisitions, companies like MTY have historically demonstrated the ability to beat the broader market’s performance. With an average return on invested capital (ROIC) of 15% and a consistent creation of value for investors over its weighted average cost of capital (WACC) of 7%, MTY Food Group exemplifies prudent investment in growth.

Nurturing Growth Through Dividends: Steady Free Cash Flow

Noteworthy growth of 251% in free cash flow per share over the last decade has paved the way for MTY Food Group to increase dividends consistently. Despite a brief pause during the height of the pandemic, the company’s dividend payout ratio remains a mere 14%, leaving ample room for future increases.

With a current dividend yield standing at 2.5% and a commitment to share buybacks, management’s dedication to enhancing shareholder returns is evident. Owning 16% of outstanding shares, the board and management are aligned with investors in driving long-term value.

A Unique Valuation Proposition: MTY’s Market Position

Beyond its robust brand portfolio, stellar FCF growth, and strategic acquisitions, MTY Food Group presents a compelling once-in-a-decade valuation opportunity. Currently trading near 10-year lows in enterprise-value-to-EBITDA and enterprise-value-to-FCF ratios, the company offers investors a rare chance for potential growth.

Unveiling the Investment Picture at MTY Food Group

In the realm of investing, MTY Food Group stands as a beacon of consistency. The company, with its 2.5% dividend yield surpassing its 10-year average, exudes stability and reliability. A dive into the historical narrative of MTY unveils peaks of dividend yields in exceptional periods, akin to the dazzling fireworks of a celebration or the fleeting drop of a market during unforeseen circumstances.

Unlocking Investment Brilliance in MTY Food Group

When exploring the investment landscape, the question arises: Is MTY Food Group the golden ticket? Though MTY may not be a star in terms of rapid growth, its forte in strategic acquisitions, robust Free Cash Flow (FCF) generation, and consistent return of cash to shareholders paint a portrait of a spectacular dividend stock. Envision it as a gem waiting to be unearthed in the current once-in-a-decade valuation.

Insights into MTY’s Investment Appeal

Before plunging into MTY’s stocks, it’s prudent to evaluate the bigger picture. The leading analysts at Motley Fool Stock Advisor might not have placed MTY Food Group in their top 10 stocks recently, but their selections are like a treasure map promising colossal returns in the years ahead.

Reflect on the time when Nvidia entered the spotlight in April 2005. A mere $1,000 investment back then could have blossomed into a staggering $763,374 following the recommendation. This historical anecdote underlines the potential fruits of strategic investment decisions.

Stock Advisor acts as a beacon for investors, offering a roadmap to success. It provides a scaffold for crafting a diverse portfolio, regular insights from industry experts, and bi-monthly stock recommendations. The service’s track record speaks volumes – it has outperformed the S&P 500 fourfold since its inception in 2002.

For those seeking guidance on top-notch investment opportunities, take a gander at the 10 stocks highlighted by Stock Advisor. Tapping into these recommendations might just be the key to unlocking remarkable returns.

*Stock Advisor returns as of August 12, 2024