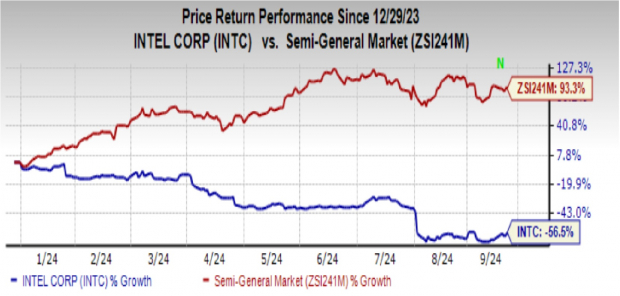

Market Dip for Nvidia Corp:

Nvidia Corp NVDA has recently experienced a slight downturn in its stock performance, with shares losing about 2% in the past five business days and 8% over the last month. This shift follows a decline in quarter-to-quarter revenue growth from 22% to 15%, indicating a potential slow-down.

Partnership Potential:

Despite this, Nvidia’s collaboration with Alibaba Group Holding’s BABA cloud-computing services unit for autonomous driving technology signals new opportunities in the global automotive AI market, which is valued at $2.99 billion.

Options and Derivatives Market:

The options market has adjusted to the slowdown in Nvidia stock, with implied volatility lower than historical levels. This presents an interesting scenario for traders looking to invest in call and put options.

Exploring Direxion ETFs:

Direxion’s leveraged ETFs, including the NVDU and NVDD funds, offer unique opportunities for investors looking to capitalize on Nvidia’s performance.

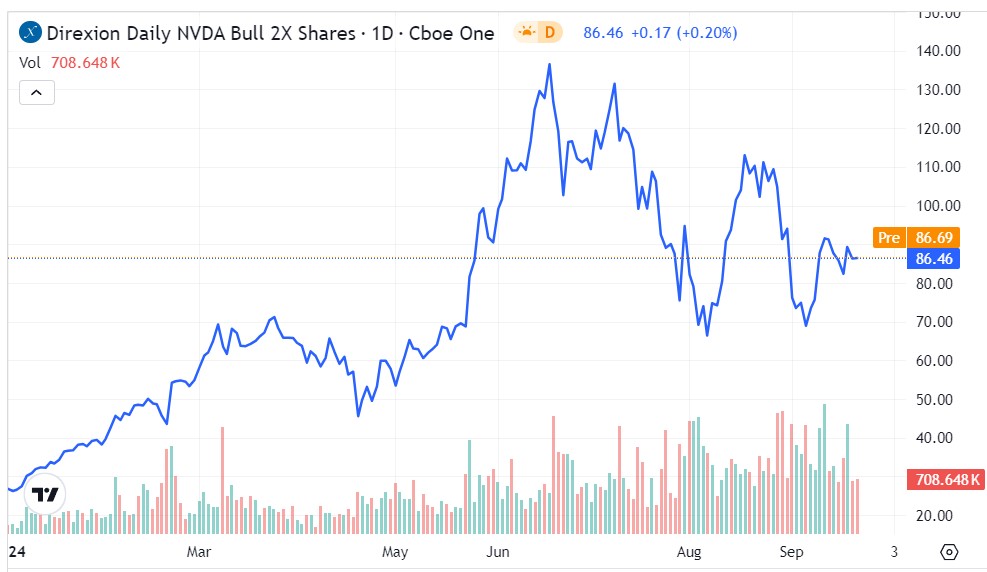

The NVDU ETF:

The NVDU ETF has shown significant gains, outperforming traditional stocks with a 220% increase since the beginning of the year. However, recent momentum has slowed, making it a point of interest for potential investors.

The NVDD ETF:

In contrast, the NVDD fund has struggled, losing 66% since January. Despite this, recent small gains present an intriguing opportunity for bearish investors, especially with consistent support levels.

Note: Both ETFs are designed for short-term exposure, and investors need to be aware of potential volatility drag.