Alibaba (NYSE:BABA) experienced a significant upswing in trading as it successfully concluded a three-year regulatory “rectification” process, marking the end of a tumultuous period following an antitrust fine imposed in 2021. Shares of the Chinese e-commerce giant soared following this positive development.

Antitrust Violations Unraveled

Chinese regulator, the State Administration for Market Regulation (SAMR), had been closely monitoring Alibaba for several years due to antitrust concerns. An antitrust fine of RMB18.23 billion ($2.6 billion) was levied in 2021 after discovering anti-competitive practices, including pressuring merchants to exclusively engage with Alibaba’s platforms, thwarting them from connectivity elsewhere. SAMR deemed this “choose one” policy as an unfair maneuver that bolstered Alibaba’s market stronghold.

Post the fine, SAMR diligently supervised Alibaba’s adherence to necessary regulations. On Friday, SAMR announced Alibaba’s full compliance and cessation of the prejudiced policy. Additionally, the regulator committed to guiding Alibaba in enhancing compliance, efficiency, and innovation.

Outlook Brightens for BABA

With the conclusion of the regulatory probe, Alibaba witnesses a silver lining as it resolves a substantial conflict with Beijing that severely impacted its stock. Despite a harrowing 70% drop from its peak in 2020, Alibaba still grapples with challenges such as a languid growth trajectory amidst escalated competition in China’s e-commerce landscape and cautious consumer spending.

Investing Perspective on BABA

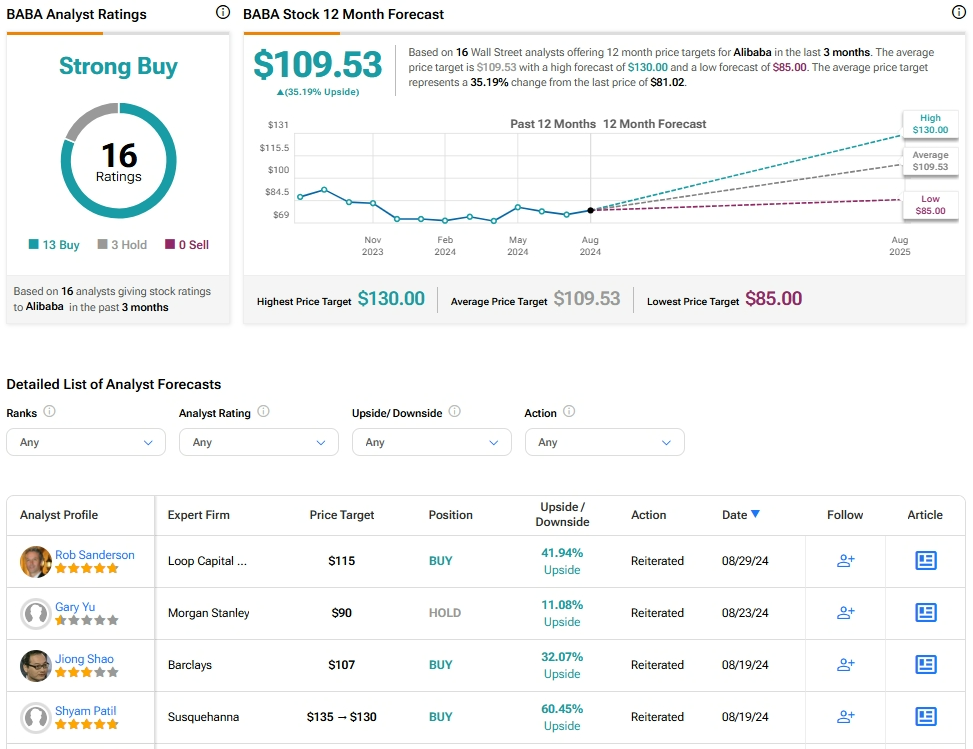

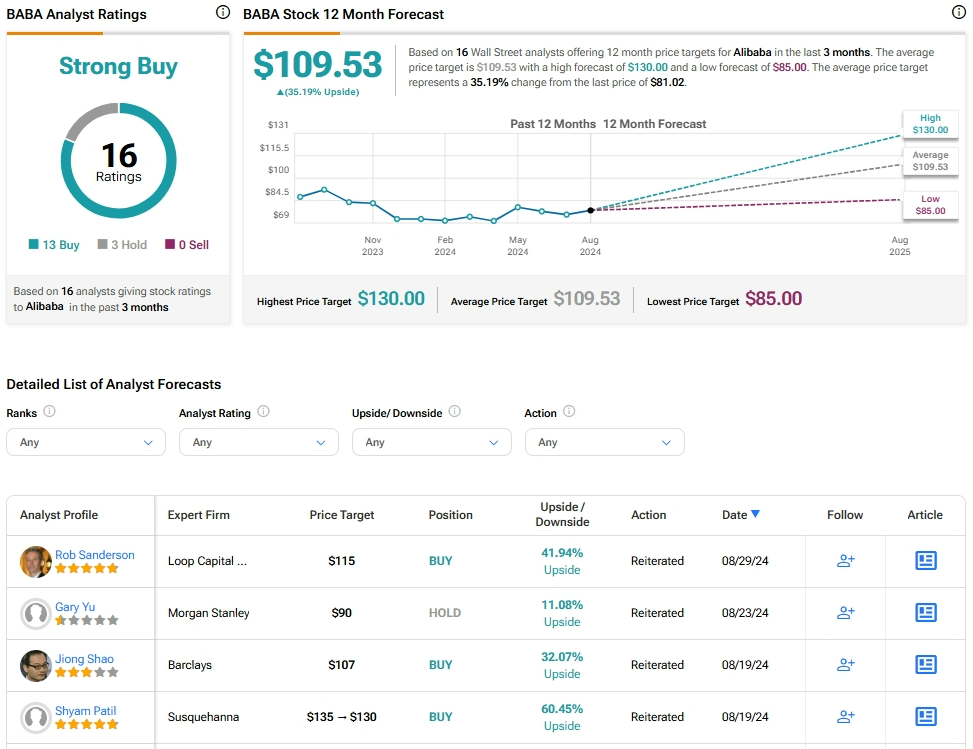

Market analysts maintain an optimistic stance on BABA stock, reflecting a Strong Buy consensus based on 13 Buy ratings and three Holds. Over the past year, BABA has observed a decline exceeding 10%, yet the average price target of $109.53 forecasts a promising 35.2% upside potential from current levels.

For more insights on BABA analyst ratings, click here.